Many Ways To Make Bank

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

We Use Sector Rotation To Target Above-Market Equity Returns

Our single-stock investing method at Cestrian Capital Research is built on four pillars.

- Overall assessment of where the equity indices stand. (Read up on our equity index trading method, here).

- Sector rotation analysis to follow the path of large account capital as it moves in and out of sectors (eg. tech, energy, consumer staples, industrials, and so on). We expanded on this method recently here.

- Fundamental analysis of company financials (is it a stock one should own at all?)

- Technical analysis of each individual stock (what are compelling entry and exit points for the stock, over multiple timeframes)?

We then use this work to develop ratings and stock price targets on individual named stocks and ETFs. You can read all about our single-stock and ETF strategy, here.

We want to take a moment to tell you all about our best work.

That’s our Inner Circle service.

You can read our reviews, and sign up for free, here.

Inner Circle Portfolio Construction

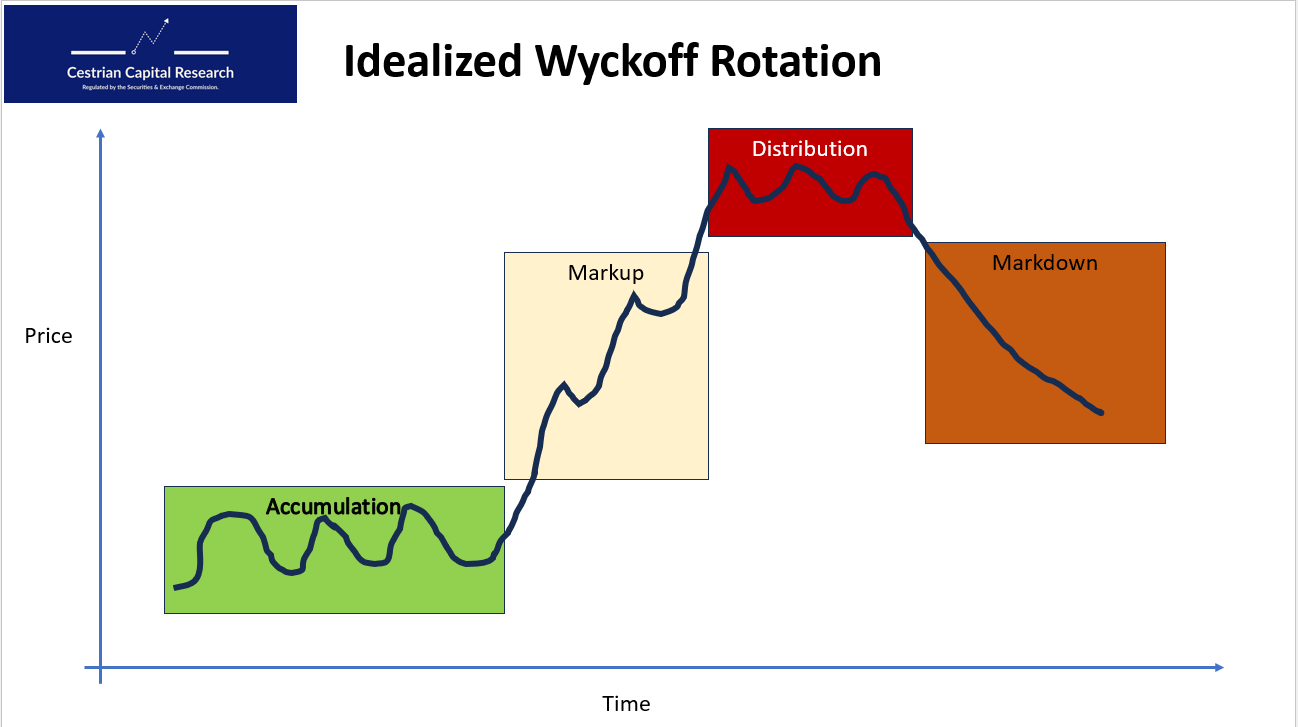

Within our Inner Circle service we combine the above methods to construct baskets of stocks which can be used in a Wyckoff rotation strategy.

As a reminder, here's an idealized form of Wyckoff rotation.

Stocks - and sectors - follow paths of this nature more often than one might think.

The Inner Circle Portfolio Strategy is intended to operate as follows:

- Create and rate at Accumulate (buy) a basket of stocks moving sideways in the Accumulation phase. Most often, the basket will be defined by sector. The stocks must be compelling long ideas in and of themselves, with suitable entry points based on fundamentals and charts each on a single-stock basis.

- Rate at Hold as that basket as it moves up through Markup.

- Rate at Distribute (sell) that basket as it moves sideways through Distribution.

The Markdown phase may provide single-stock shorting opportunities if you are looking for them - but our Inner Circle Portfolio Strategy is long-only. (For short opportunities, take a look at our Equity Index Strategy).

We intend this strategy to operate on a repeatable basis, which is to say, we will create Accumulation baskets as and when we find them. During the hold period we will report on the portfolio performance at least weekly, and we'll also be writing up earnings reports for each single stock within each basket. We don't intend to tweak and trim these baskets, nor rebalance them over time. When the basket is sold, it will be sold in its entirety. As this service progresses we may look to change this approach but for now it's a rifle-shot buy, rifle-shot sell approach.

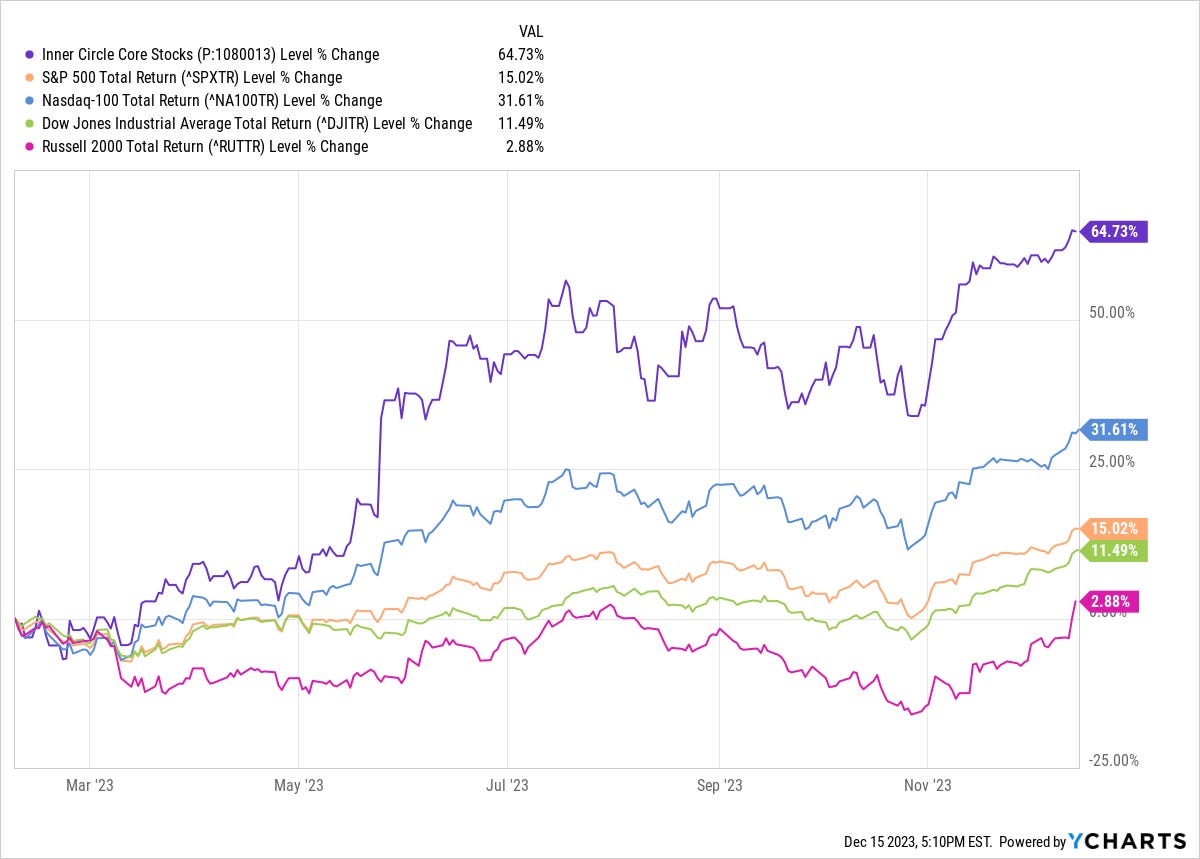

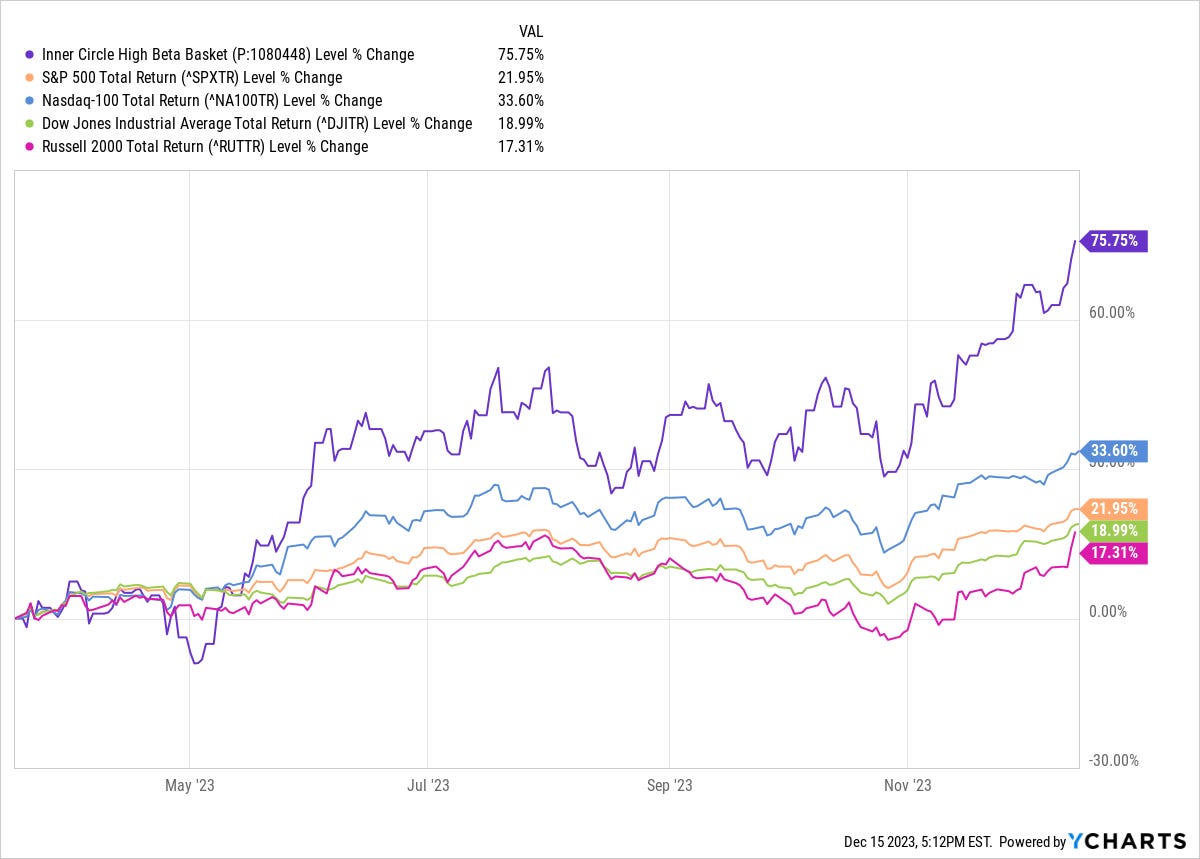

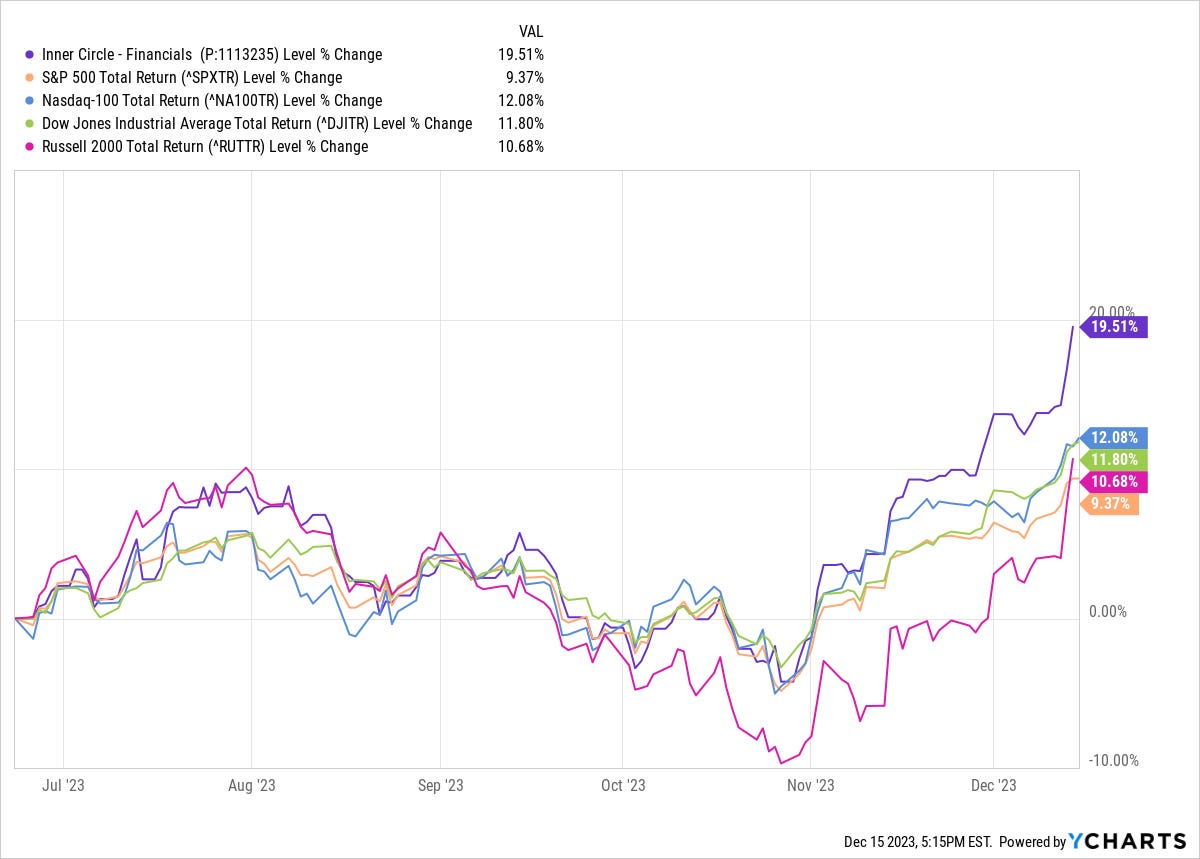

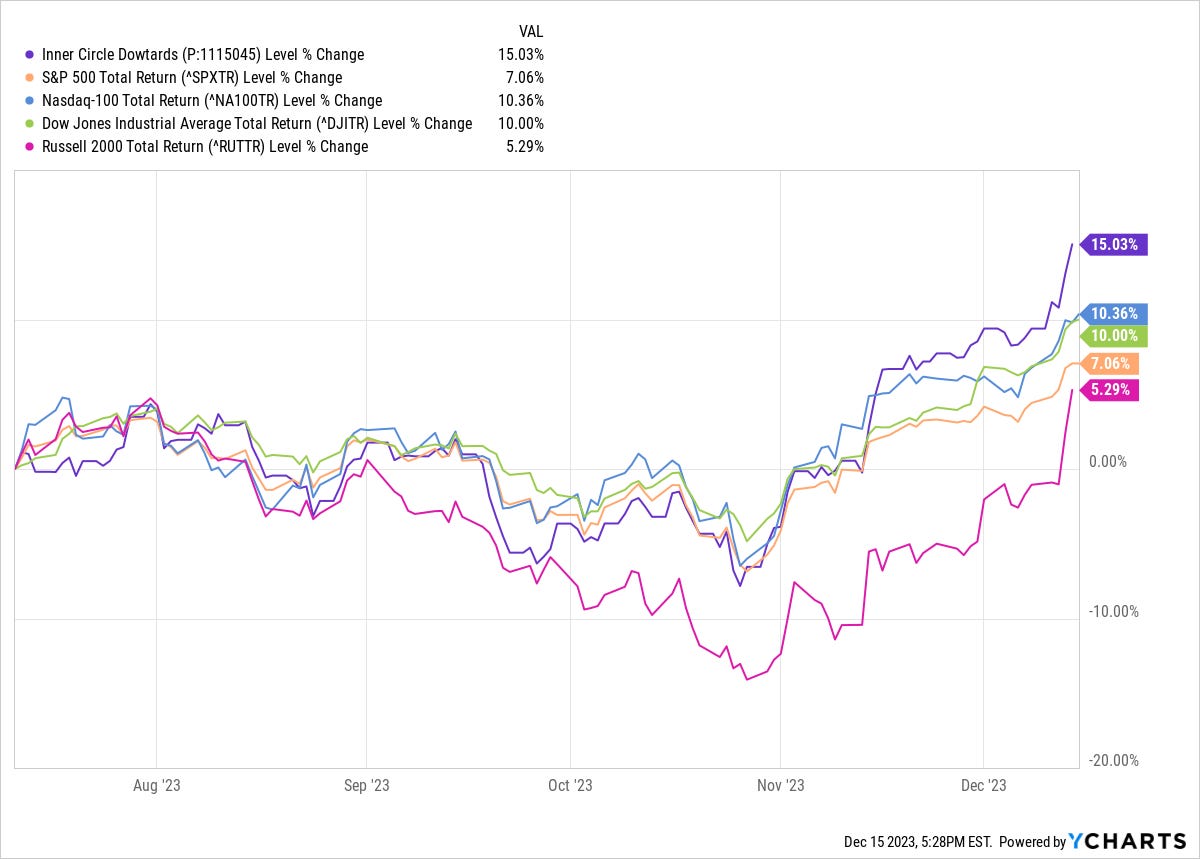

Here's the current baskets' performance as of the close on the 15th December 2023. In each case we use a total return calculation (which assumes any and all dividends were re-invested back into the stock that produced them) and we compare to the total return performance of the S&P500, the Nasdaq-100, the Dow Jones and the Russell 2000 over the same period. The charts all assume no management fee charged, since these are model portfolios intended to be used for consideration by our members; we do not, as a firm, manage any client assets nor as a result charge management fees of any kind.

1. Core Stocks - Inception (7 February 2023) To Date.

2. High Beta Stocks - Inception (17 March 2023) To Date.

3. Financial Stocks - Inception (23 June 2023) To Date.

4. Dow Stocks - Inception (11 July 2023) To Date.

Cestrian Capital Research, Inc - 15 December 2023.

NOTE: For current single-stock writeups, charts, ratings, and Cestrian Capital Research staff personal account positions within Inner Circle covered names, check Stocks & ETFs, here.

Inner Circle, by Cestrian Capital Research. © 2023