Lockheed Martin Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitationof an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Charts vs. Reality, Episode 207

by Alex King, CEO, Cestrian Capital Research, Inc.

To state the obvious, one really should avoid buying or owning Lockheed Martin ($LMT) stock. Any major recipient of Federal government contracts is at liberty to hit an air pocket in contracts at present. Whether the cause of this is small-government ideology or a looming debt ceiling crisis, I know not. What I do know is that if your revenue line is decided predominantly in DC, you should be worried about the outlook. Which obviously nixes LMT, NOC, LHX and whatnot. Right?

Well, maybe not. For one thing we will see a surge of re-armament spending across Europe, and whilst European-HQ’d defense contractors will surely benefit from that - hence the meme-stock behavior of Rheinmetall and other such names - I would expect US vendors to also enjoy the subsequent flow of European government funds.

GME Or RHM?

You don’t have to buy F-35 fighters; you can buy alternatives from Dassault. But you probably aren’t going to buy all your new fighters from Dassault, not least because they probably can’t manufacture enough of them quickly enough to suit your policy goals. Which means you are probably going to have to buy more F-35s in the next few years than you had originally planned. Which is good for LMT’s backlog, and where backlog goes in US defense contractors, revenue and earnings and cashflow usually follow.

The numbers at LMT, up to 31 December 2024, so, before the current maelstrom really took ahold, are pretty good. And the stock chart may be at a useful level, which is to say it has put in a low, bounced, fallen back again but has not made a new low, and has started to move up. That’s a pretty good entry point for any stock, because it means you can place a sell-stop-limit order a little below those recent lows (so if you are wrong about Number Go Up then it can’t hurt you that badly) but it also means you may have plenty of upside ahead of you. Technicians will describe this opportunity in various ways but in the end all technical analysis methods converge on this One Old Trick which is, if the upside looks substantially bigger than the downside, and you can protect your downside, that’s not a bad idea.

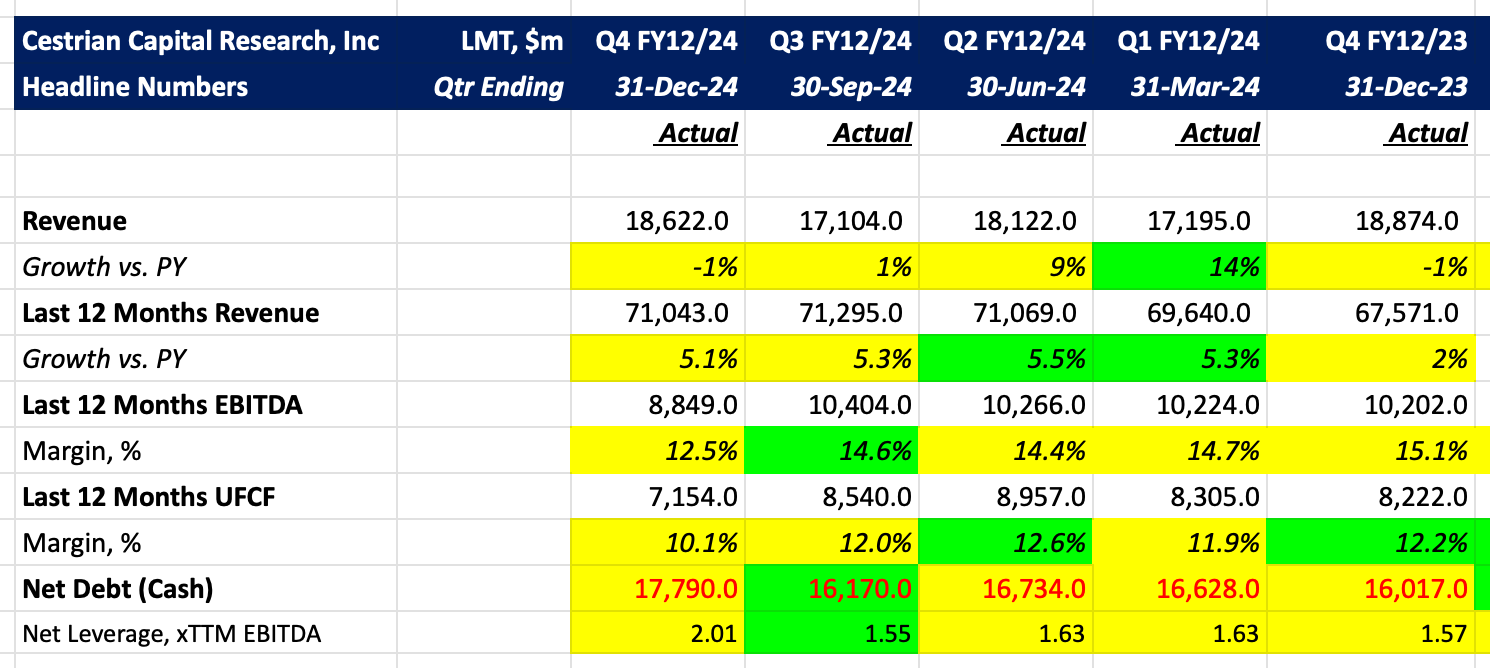

Anyway, here’s LMT numbers and then we’ll get into the weeds.

In short, 5% growth at 10% cashflow margins with 2x net leverage. That’s OK.