Lockheed Martin Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitationof an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Stalled Out, For Now

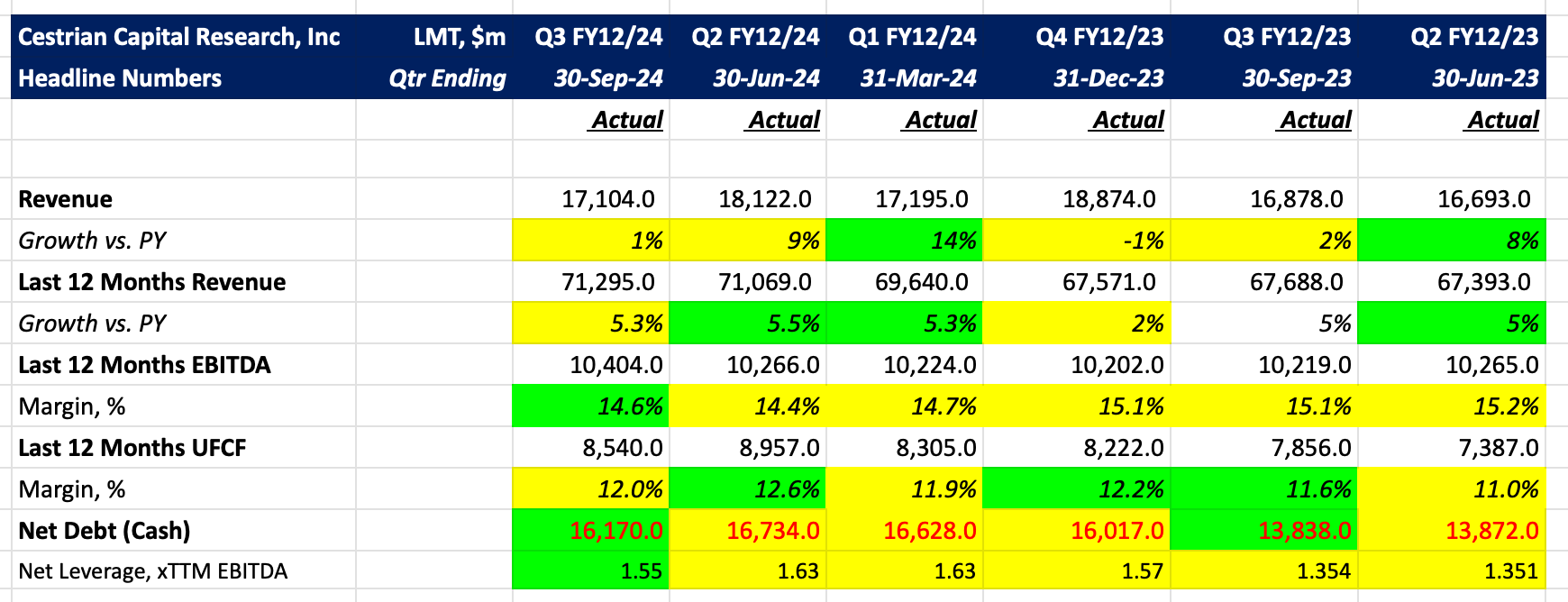

Lockheed Martin ($LMT) has been on a tear lately. The threat of the Middle East blowing up whilst there is an ongoing land war in Europe will do that to defense stocks. Whilst the stock price has been running hot, the fundamentals have been decidedly lukewarm. There was a modest improvement this quarter, with backlog at record highs of $165bn, up 6% on a year ago. Revenue growth slowed, EBITDA and cashflow margins fell somewhat, but the company closed the quarter with an improved balance sheet, now carrying net debt equivalent to something like 1.55x TTM EBITDA (down from 1.63x a quarter ago).

The stock promptly cooled off on the print today. Let’s take a look at the fundamentals in detail, plus valuation analysis, the stock chart and our rating.