Less Than Marvell -ous, But Still OK - MRVL Q1 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Next Comes The Comm

by Alex King

If you missed it, take a look at our recent note on ARM, here. If you can't be bothered, the nub of it is: there is life in AI beyond Nvidia. Once hyperscale datacenter customers have finished the first wave of their systems upgrades to cope with AI workloads, they will have to turn their attention to other stuff. Like power, interconnect, cooling, storage, and so forth. This whole thing is like the Second Coming Of The Datacenter Revolution. Back in the early 2000s when normal people had decided the Internet was All Over And Just A Fad, and had gone back to playing cards with their friends for entertainment, the strange tech-y people were getting all excited about things called VCSELs and Fibre Channel (yup, spelt in the Olde Worlde way) and 10Gbps Ethernet and Storage Area Networks and such. And the reason the pointyheads were getting in a lather about this stuff is that whilst the normals were sleeping, the compute load and storage load in what was later to be known as The Cloud was getting ..... HUGE. And fast. Today, this is accepted by normals too. But normals, most of whom have gotten the memo about AI and are mainlining $NVDL for more than all they are worth, have yet to think about the next stages of capex in the AI datacenter. And when they do? I think there is a good chance that folks start loading up on names they haven't heard of, like $SPDY (which is what Marvell's ticker should really be, obviously).

There's others in this basket - go look for power management IC companies for instance, fibre channel component suppliers, all that - but $MRVL isn't a bad place to start. Here's the datacenter product set.

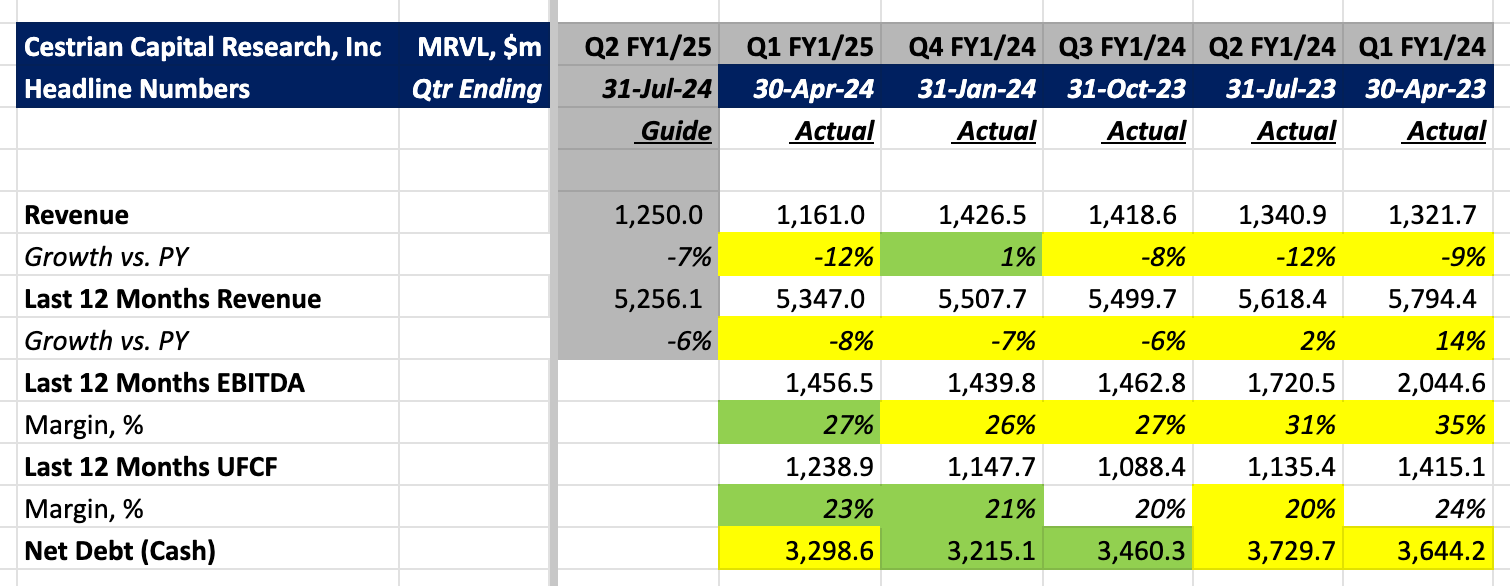

If you look at the fundamentals, it's not so hot. Growth continues to decline; although EBITDA and cashflow margins are moving up. But recall that NVDA had flat to negative revenue growth in 2022, and the stock started to move up before the fundamentals had turned around - as always.

The chart shows, I think, a gentle drift up from the December 2022 lows through our Accumulation Zone ($32-45/share) and now through our Markup Zone ($45-94/share).

Personally I made some nice gains on this one last year, as disclosed real-time in our real-time services. Kudos to one of our wise contributors, @FredFrog, for the original idea.

I don't think MRVL will ever deliver explosive NVDA-like stock price performance but I think it can continue to move up in the medium to long term.

Headline numbers follow; then after the paywall, detailed numbers, charts, stock price targets and rating.

Headline Financials