Laggard Or Loser? ( DocuSign Q1 FY1/25 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Its All Over For Software, Season III, Episode 2

by Alex King

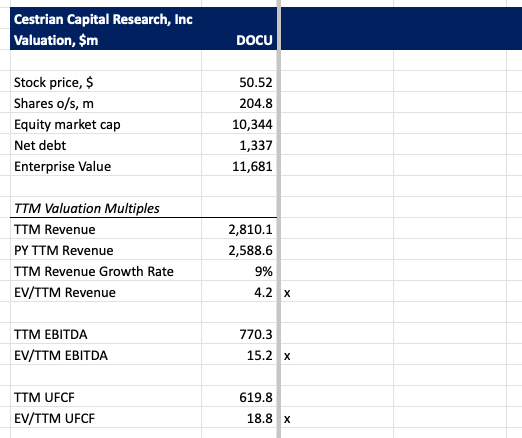

DocuSign is neither as good of a business as its 2020-21 stock price would suggest, nor as bad of a business as its present dismal trend would suggest. It’s a perfectly reasonable business. It’s just that nobody wants to buy the stock, as can be seen from the valuation:

At a time when a lot of software names with ho-hum fundamentals are trading at >50-100x cashflow, here’s DocuSign at 19x. Yep, there’s only 9% TTM revenue growth, it’s nobody’s idea of an exciting company, but there’s some comfort in the multiples, whether you are thinking of buying the stock at present (because the entry price looks OK) or because you already hold it (because those multiples look like they could trend up over time).

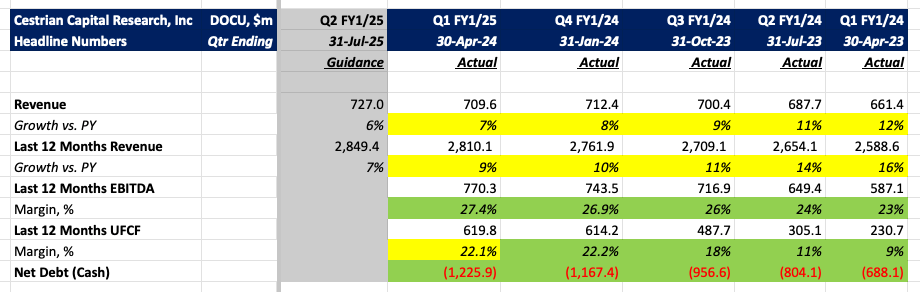

Headline Numbers

Cashflow margins remain strong, dropped a touch this quarter but still good. Balance sheet record high levels of net cash at $1.3bn; the company has authorized a large ($1bn) buyback facility. The revenue line is key now. It looks like the company might arrest the decline in its growth rate in 1-2 quarters’ time. That will be a watershed moment if so.

For our paying subscribers we now dig into the full fundamentals, the stock price performance and our rating.