L3Harris Q2 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Now For The De-Leverage

by Alex King, CEO, Cestrian Capital Research, Inc.

L3Harris ($LHX) is a defense and space sector contractor whose chosen method in life is to acquire their way into sectors they deem attractive, and dispose of business units they deem unattractive. This means that it's almost impossible to get a clean read on the financials as an outsider. For any company engaged in serial M&A, what you really need to do is to model the "pro forma" numbers, which means to be able to recreate the business as it looks today and project that back in time over a few quarters and a few years, to look at how the business as it is today has performed. Of course that is also just a proxy measure, because the units were run by different management teams and different capital allocation rules in the past vs. today, but you get the point. For me then, what I look at with an M&A machine like $LHX is:

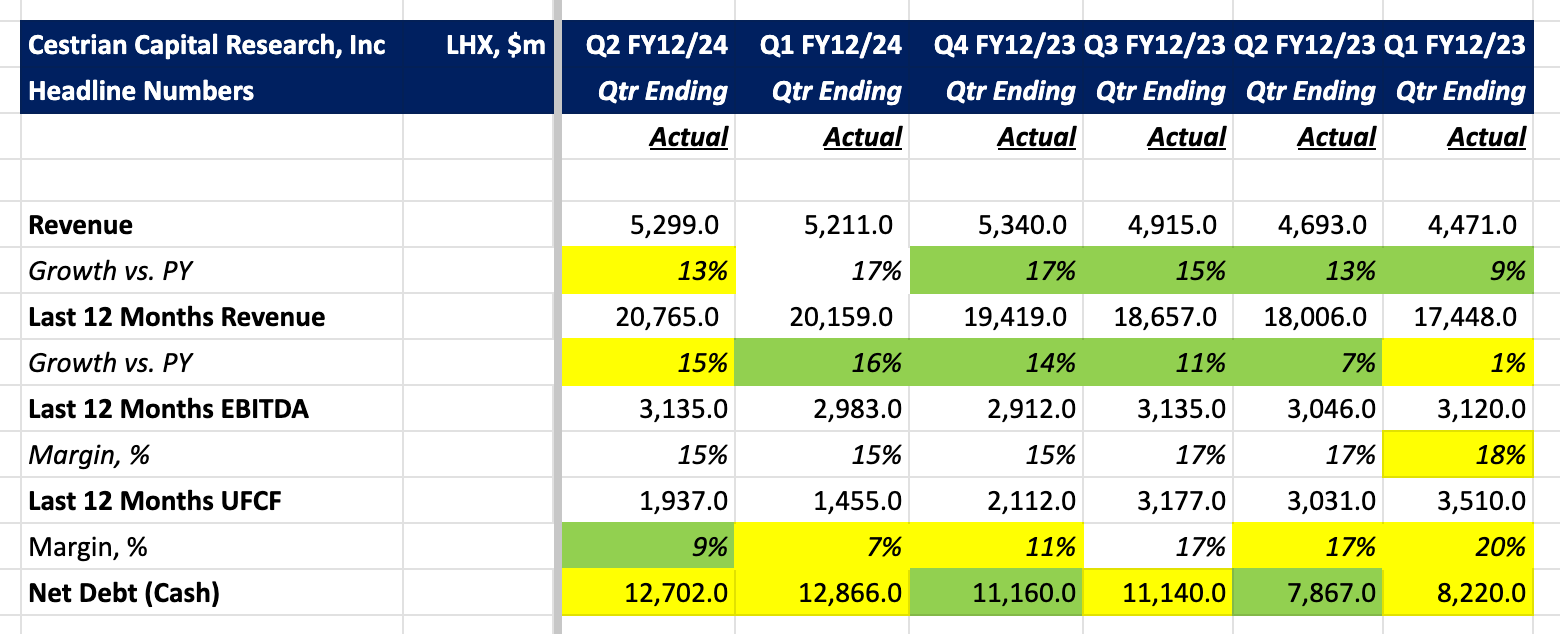

- Overall direction of revenue, TTM EBITDA, TTM UFCF (should be up obviously)

- Net debt and net leverage numbers - specifically you want to see the net leverage number coming down over time as acquisition debt is redeemed or at least eclipsed by a growing cash pile.

- The share count not get out of hand (if it is, it means the acquisitions are likely being paid for with stock - doesn't show up in net leverage but is dilutive to shareholders).

So, let's get to work on LHX Q2.

Here's the headline numbers. Below, for our paying subscribers here of all tiers, we dive into more detail on numbers, charts, price targets and stop levels.