Iridium Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitationof an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Jigsaw Piece?

by Alex King, CEO, Cestrian Capital Research, Inc.

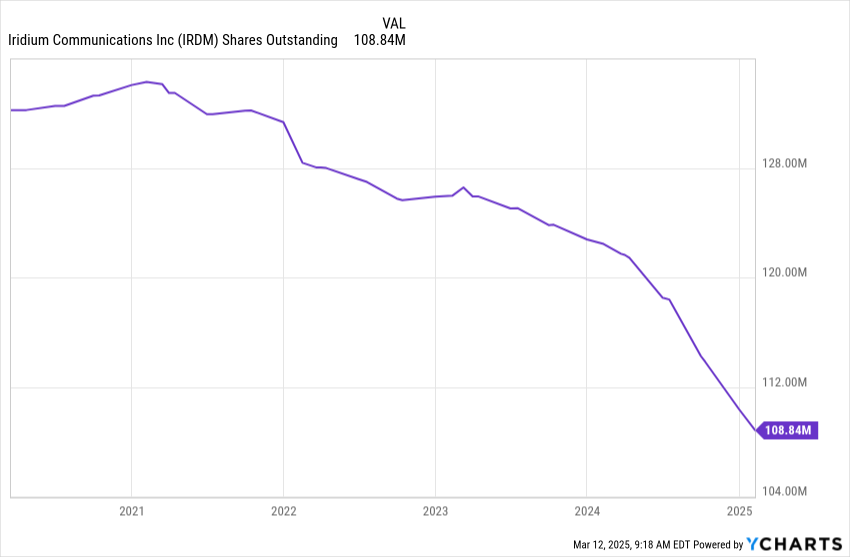

Iridium doesn’t offer the fastest satellite internet service in the world. It doesn’t offer the highest-throughput service for video broadcast. And it isn’t the next generation hero to which your cellphone will bond. But it does operate a high margin business, growing revenues at a solid clip, with a leveraged-buyback method of supporting the stock price. It’s basically a leveraged buyout with a traded ticker. And I suspect its story ends with a bigger friend buying it entirely.

Satcom I suspect is going to go through some consolidation and capex re-upping as an industry. Like it or not, Starlink is now politicized and that means opportunity for some. I would expect to see Eutelsat and others seek to capitalize on this. Perhaps Iridium features in an M&A plan somewhere in this industry flux.

It was a good quarter for Iridium.

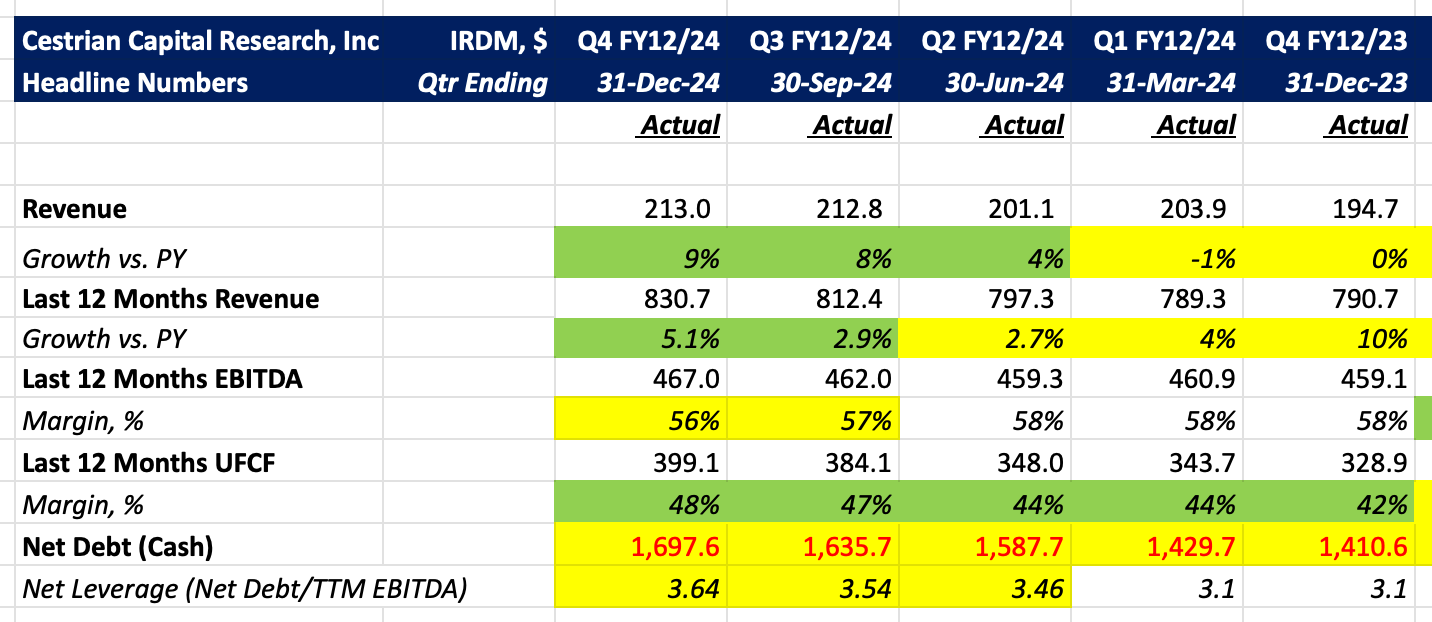

Leverage is climbing as the share count falls.

Let's take a look at the numbers, valuation, stock chart and potential price targets.