Iridium Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitationof an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Aging Gracefully

by Alex King, CEO, Cestrian Capital Research, Inc.

Iridium, faced with competitive threats from SpaceX / Starlink for real and AST Mobile if it ever becomes real, is doing exactly what any management team should do in that position, which is to extend the life of the company as far as they can down the road. Then to grow cashflow faster than revenue. And to use that rising pile of cash to lever up the balance sheet to either (1) pay out ginormo levered dividends or (2) conduct a sustained buyback campaign. This is helping the stock price in the short term; personally it’s not a stock I plan to own (though the name has been good to me in the past) because in the end I think this is a “burning platform”. And in tech you don’t really ever want to own a burning platform with a public ticker. (You can make very good money if you own the whole thing, leverage it sky-high and live off the cashflows; but that’s not what’s on offer with public tickers).

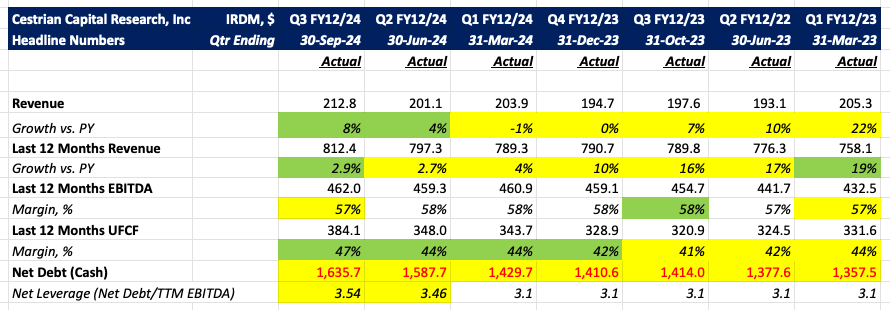

Here’s the headlines.

Numbers, valuation and chart follow for all paying subscribers regardless of service tier.