Iridium Communications Q2 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Not All That Transmits Is SpaceX

by Alex King, CEO, Cestrian Capital Research, Inc.

What follows is an example of where our work prioritizes technical analysis over fundamentals, and how we use technical patterns to identify opportunities and to manage risk.

Iridium Communications ($IRDM) is, as you likely know, not the world's most exciting business. Heck it's not even the most exciting satcomm business; that moniker goes to SpaceX's Starlink unit which now has so many birds in the sky that astronomers are complaining. IRDM is a reboot of an earlier incarnation of satcomm, funded by Motorola in prehistory before the money fizzled out, phones failed to sell, and under-utilized satellites started to contemplate entering decaying orbits just to have something to do all day. The company excels in providing low bit rate connections for voice and datacomm to users in remote locations - marine, polar, desert, etc. The fundamentals look like a satcomm business of old; high capex for a while then very little, and whilst capex is low, revenue and operating leverage work together to generate very high unlevered pretax free cashflow margins.

We had a great run with $IRDM in 2018-2023. We were bullish on the stock as the capex required to build and launch the current fleet of satellites tapered off in 2018 - this was a fundamental call. We said that we thought the stock would enter a Distribution Zone (= large account players selling) between $60-68. And yea verily did the stock dumpeth in that zone, from January-July 2023. The stock then entered free fall, dropping from $68/share - $24/share between April 2023-April 2024. There was but a brief countertrend rally.

The stock appears to have bottomed out. Is it time to buy back in?

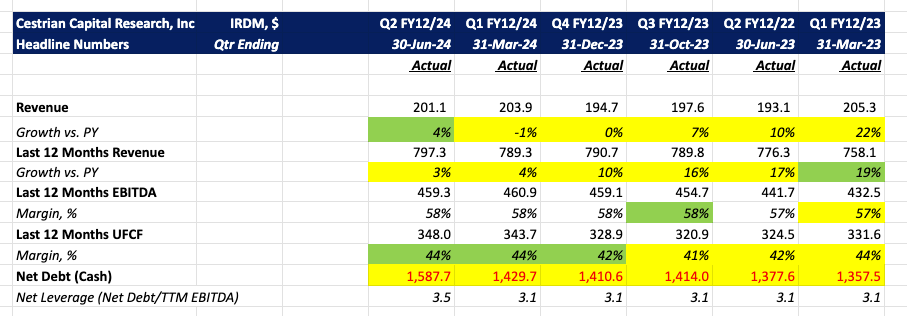

Here's the headline numbers. Below, for our paying subscribers of all tiers, we dive into more detail on numbers, charts, price targets and stop levels.