Intel Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitationof an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

If Boeing Is Still Solvent So Too Is Intel

by Alex King, CEO, Cestrian Capital Research, Inc.

The reason to want to own Intel long term is simple; it’s a bet on whether the US can in fact decouple its semiconductor device demand from a supply chain dominated by Taiwan Semiconductor ($TSM). Success in doing so is a strategic imperative for the US; it’s as important today as nuclear missile stockpiling was in the 1960s. The US can get there one of two ways. One, it can hope that TSM’s Arizona and other US fabs can (1) produce in volume at high yield AND (2) remain somehow independent of the Taiwanese ownership of those fabs in the event that China decides to implement the notion that Taiwan isn’t really a country at all but more a kind of island neighborhood of the mainland. Or, Two, it can hope that Intel gets its act together and is able to produce advanced devices with modern feature sizes at volume … you get the idea.

I personally doubt Option One is a viable strategy. The TSM Arizona fab is reporting compelling yields now, which is good. But if the parent company is sequestered … then what? Occupy the Arizona plant and wrest it from parent control? Not pretty. So I think it’s all eyes on Intel. Also not pretty. But the US appears to be in a Run What Ya Brung kind of race, so I think we can expect a river of federal money and other forms of assistance to flow from DC all the way into the Santa Clara Valley.

I own Intel personally and I don’t mind holding it for a long time. I don’t suppose it will be an easy one to own, but then my allocation to it is modest and if the stock halved along the way, it wouldn’t keep me awake at night. I think Intel is a must-win for the US, and generally speaking betting against US semiconductor technology has been a losing bet for, oh, about 80 years now. So I’ll be sitting tight with my INTC stock.

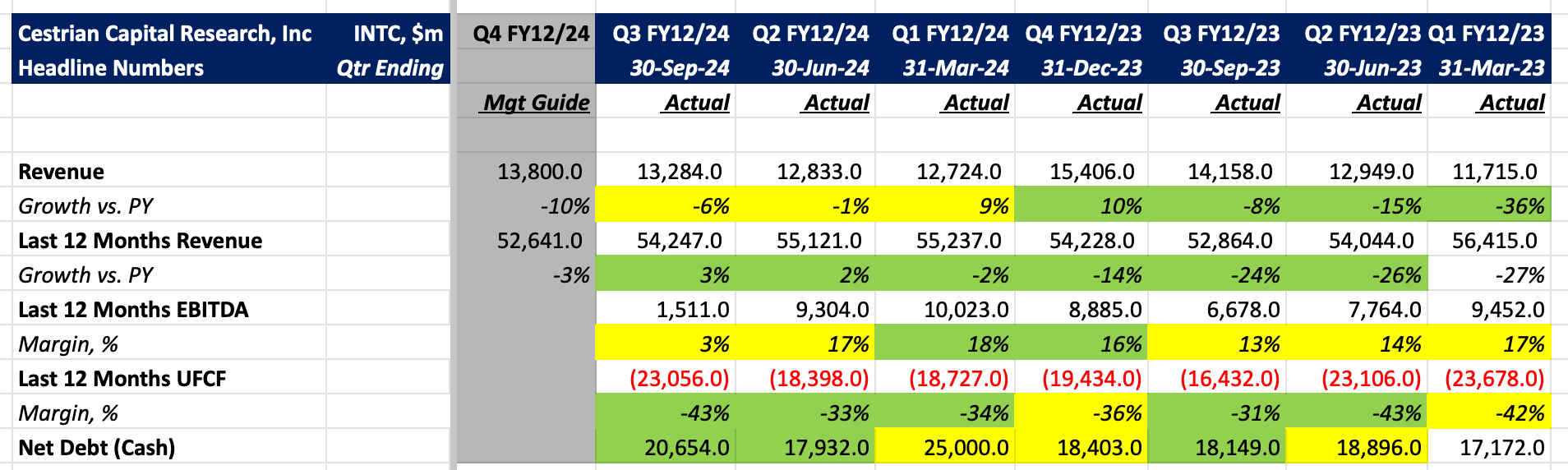

Here's the Q3 headlines, which are a mess.

Detailed numbers, valuation and chart follow for all paying subscribers regardless of service tier.