Intel Q2 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

You Can't Say The Worst Is Over Until The Worst Is Over

by Alex King, CEO, Cestrian Capital Research, Inc

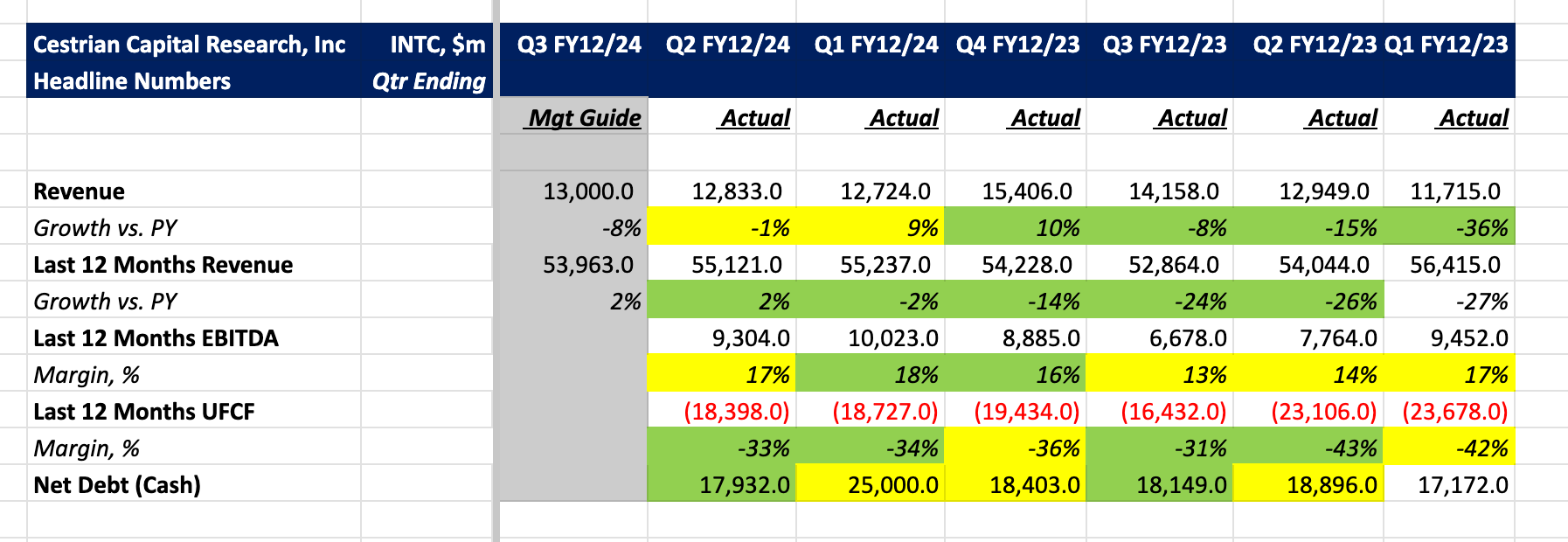

As everyone knows, it's all over for Intel. Even the kid on the bus stop knows. The company missed mobile, missed a series of small-feature-size transitions, missed AI, missed everything. It's on the back foot in manufacturing vs. TSMC and on the back foot in CPU vs. AMD and on the back foot in GPU vs. NVDA and, oh, also, AMD. And it burned nearly $19bn in unlevered pretax free cashflow losses in the last twelve months, whereas Nvidia generated over $48bn in unlevered pretax FCF in the same time period. Apart from this, all is just peachy at Intel.

The company just printed a quarter in which they threw (probably) everything in the kitchen sink. They cancelled the dividend and announced a giant restructuring designed to remove a lot of operating costs from the business; this ought to coincide with capex not getting worse. This wouldn't have been received well on any day, but the print and earnings call came at a time when investors are feeling decidedly queasy about equities overall and in particular those in the semiconductor sector. The aforementioned and on-fire $NVDA is down 25% from its peak; no surprise therefore that INTC stock was routed after it delivered the good news.

I think the two mistakes one can make here as an actual or potential Intel shareholder are:

- Assuming the worst is over, and that it's all recovery from here, or

- Assuming that the stock will continue to drop through the floor as investors flee.

Generally speaking it's true to say that in investing, extremes aren't the most likely path. The most likely paths are messy and meandering and slowly move in one direction overall whilst confusing folks with shorter-term moves en route to the final destination.

I hold a modest allocation of Intel stock which is now handsomely underwater; I made money on it during 2023, selling in the low $40s, and had hoped to repeat the trick this time around. I have a cost base of around $34 right now; the stock closed Friday at $21 and change. Urgh. So, what now?

Read on folks.