Intel Corp Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Best MAGA Play Of All

by Alex King, Cestrian Capital Research, Inc

Kudos to our analyst Jams O’Donnell who last year called Intel as the ultimate MAGA play. Jams, it should be said, is not even of US extraction. But she does know her semiconductor, as you will be aware from her work on the capital equipment companies and more here at Cestrian Towers. And as the Great Global Tussle gathers ultra-clean steam, centered around small-feature-size high-yield production of advanced semiconductor devices, we do indeed believe Intel stock is set to benefit. If you want to make semiconductor devices in the US then your fabrication options are limited. It is true that Intel’s fabrication abilities are as muted as TSMC’s are lauded, but that is in part just a matter of time before Intel gets good-enough at what is needed.

The stock has been punished of late as you know, and languished in the $18-20/share dead zone for quite some time. Lately there are signs of life. You wouldn’t know that from the fundamentals, but since we know stock prices are leading indicators of improving numbers, and not vice-versa, we should not be surprised by that.

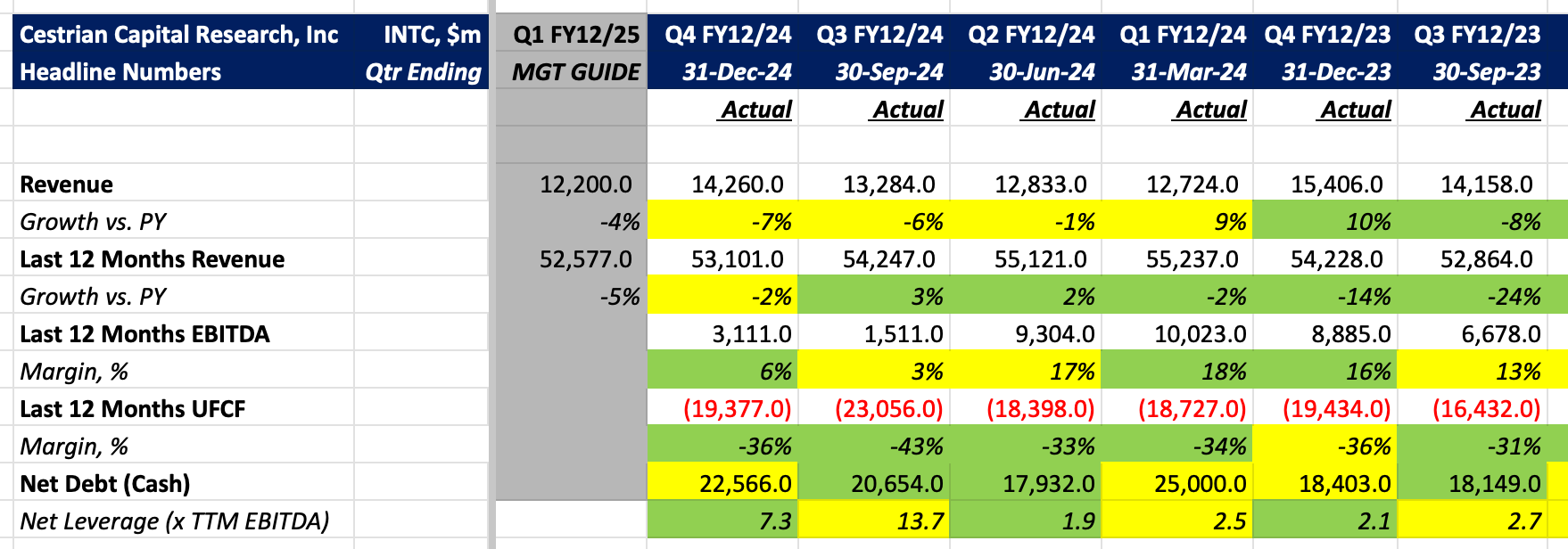

Headline numbers remain grim. But the stock is moving up and that means there is likely light at the end of the tunnel.

Now for valuation, stock charts and price targets, and full financials.