Rotation Update

How It Started ... How It's Going

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Spin Me Right Round, Right Round

About a month back we posted the first of two (so far) baskets of rotation opportunities. By 'rotation' we mean that we expect some institutional money to be taking profits in tech after the monster run-up in the Nasdaq in 2023 year to date, and then deploying the capital into stocks that have yet to participate in this year's rally.

The first basket came from the financial sector. Paying subscribers can read the original post, here:

It's worth us checking in on these names to see how this idea is going. We'll focus on charts alone at this stage rather than earnings analysis.

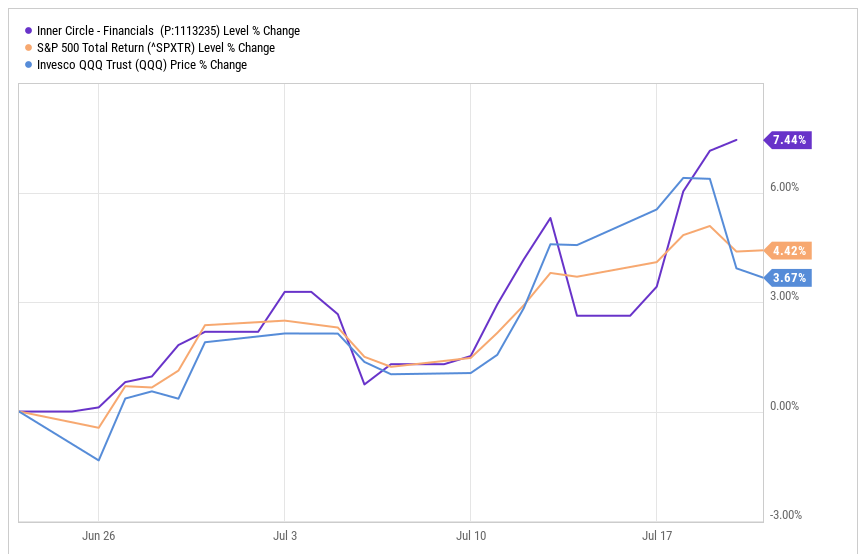

First up, here's the basket of stocks, equal-weighted, since its 23 June inception.

Now let's go stock by stock.