Inner Circle Portfolio Review

Sheesh. What A Week.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

A Word On Portfolio Construction

The portfolio construction method we follow here in the Cestrian Inner Circle service is simple at heart. We are looking for opportune moments to put together a basket of stocks with a common theme - usually a sector theme - where those stocks are (i) issued by high quality companies that would pass the Buffett "would you want to own them forever" test and (ii) look to be under institutional accumulation on their respective charts.

How do we identify these names?

- Fundamental analysis of the underlying companies. Our fundamental work is institution-grade. There probably is better fundamental analysis out there, but we've yet to see it. This gives us the would-I-own-it-forever-if-I-had-to answer.

- Technical analysis of the stock. Specifically, is the stock trending in a sideways range at the lows with high volume? And is that price zone at a level typical of a support level from which a bull run can launch? If the answer is yes to both of those questions, that's likely to be institutional accumulation you see on the chart.

So if the underlying company looks good enough to keep until the End of Days, and the stock looks like it can trend sideways long enough for a little more accumulation before a bull run, we're officially interested. And if we can find a cluster of such names in that sector - all main market US stocks, nothing from lands far away, nothing micro cap-y, just your regular American hero - then we'll create a new basket, alert our Inner Circle subscribers to the idea, and indeed commence accumulating positions in those names in staff personal accounts.

When our portfolios look like they can keep winning, we let them run. Look like they may lose or just go nowhere, we wind them up and move on. Right now we have four active portfolios:

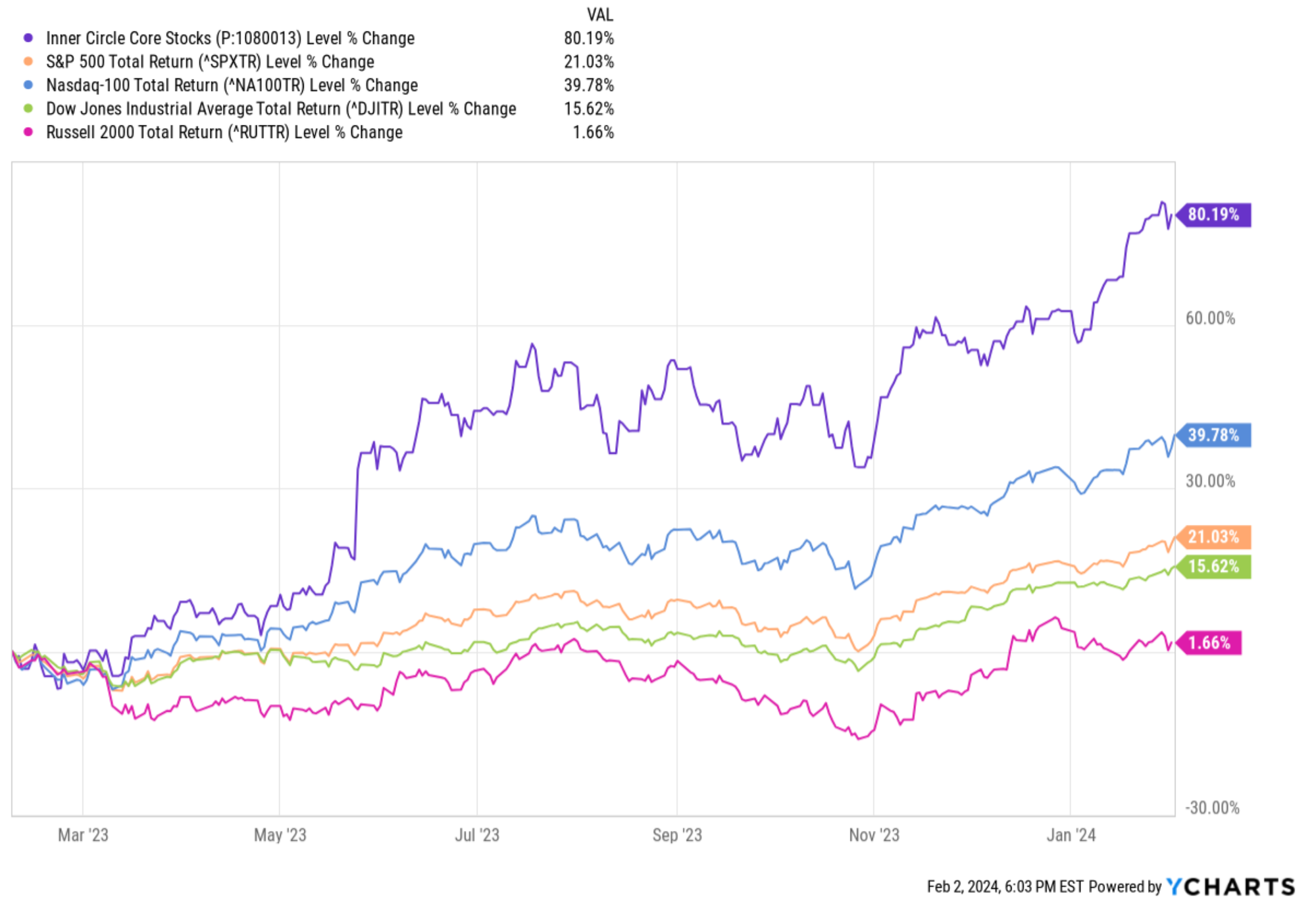

- Core Stocks, established 7 February 2023

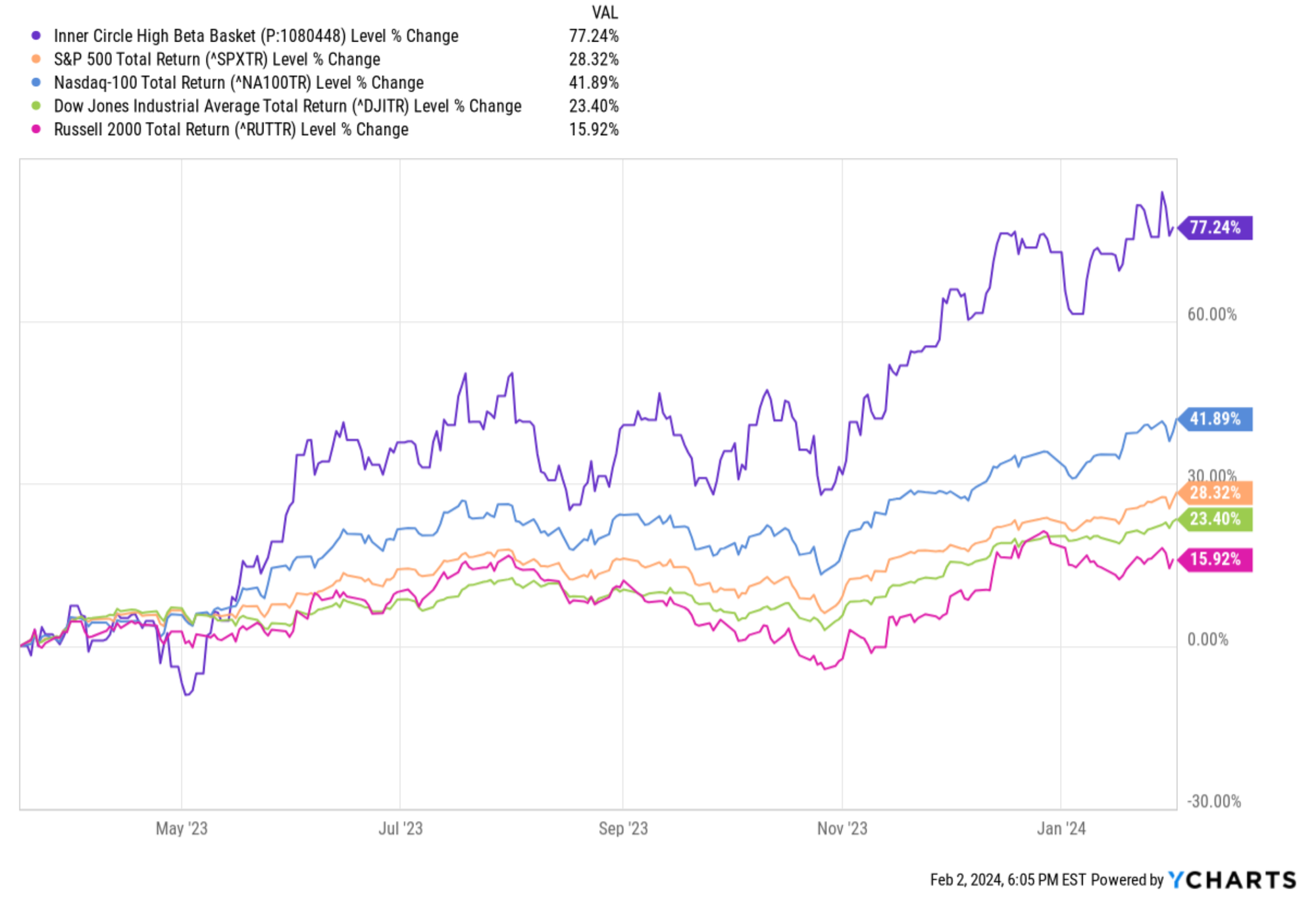

- High Beta Stocks, established 17 March 2023

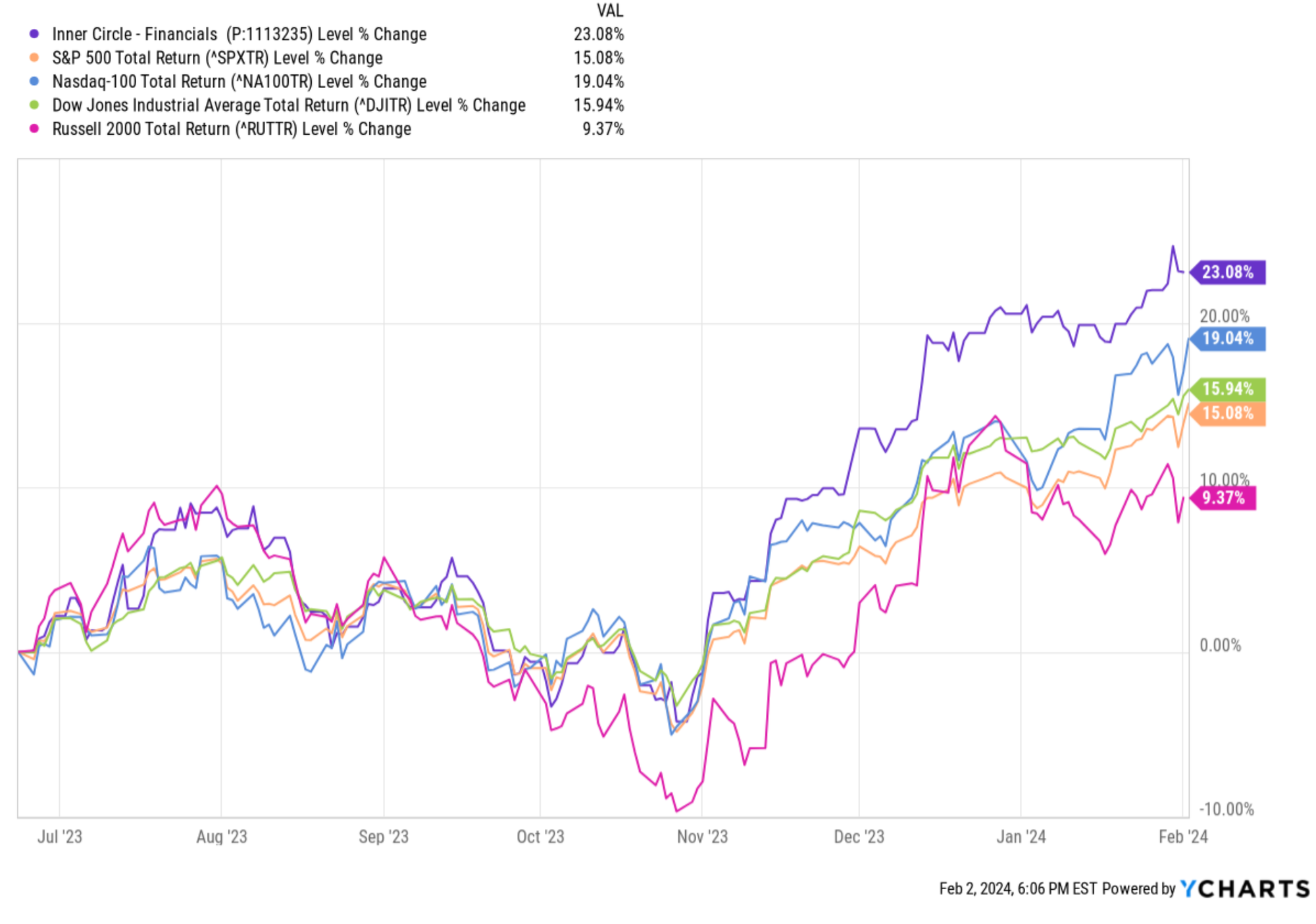

- Financial Stocks, established 23 June 2023

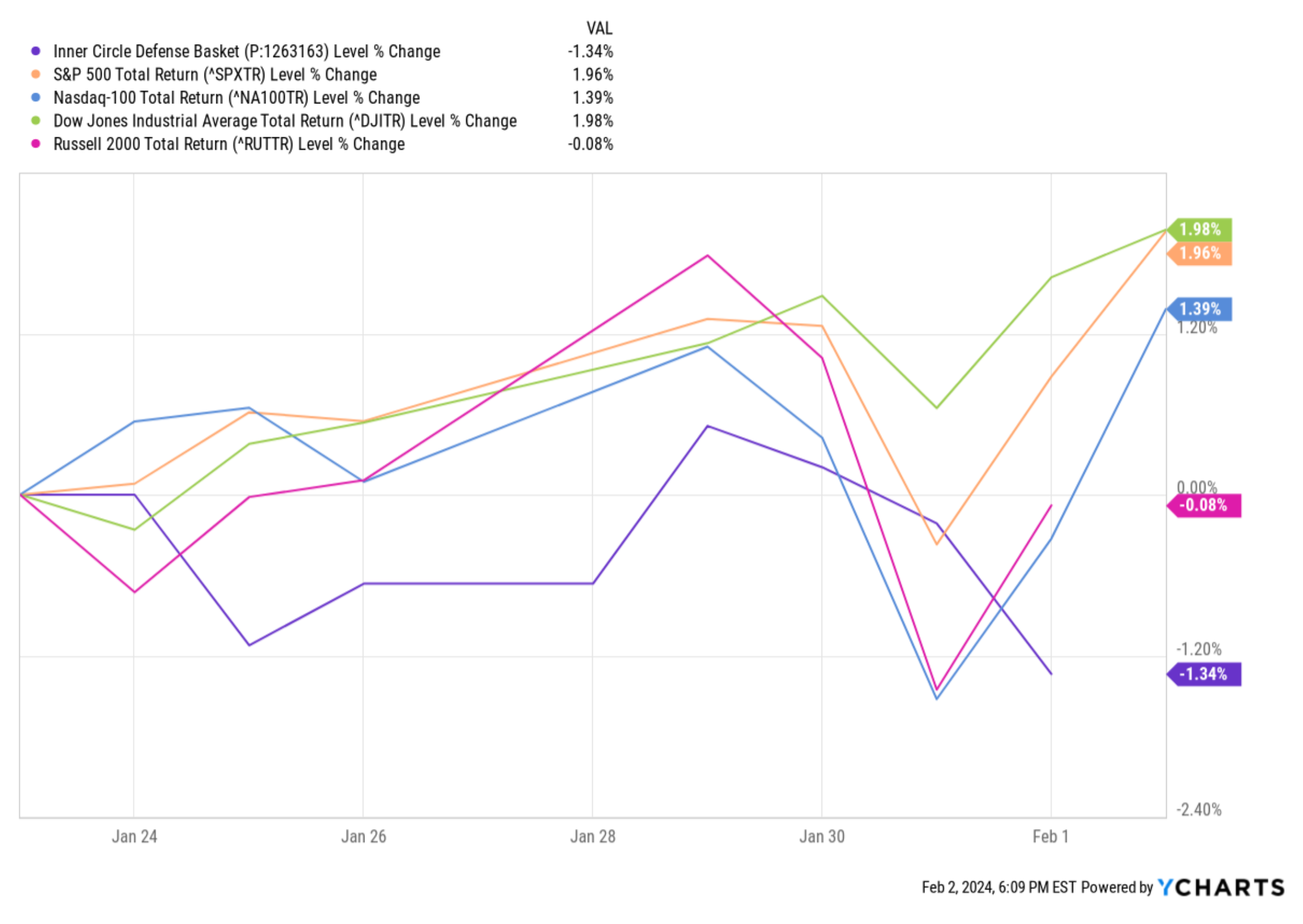

- Defense Stocks, established in January this year.

We had a basket of Dow names too, names that fit the above bill but which failed to reach escape velocity. We closed it out with a little over a 10% gain in a few months. Time to move on.

Paying members of our Inner Circle service get to see the work real time, to test and question the work to deliver a better outcome for the entire Inner Circle community. We write earnings reports on each and every name in the portfolios, refresh our technical analysis of the stocks regularly and generally keep a very close watch on model portfolio performance.

If you've yet to become a paying member here, you really should consider it. If you don't want to commit to a year's membership, just take the monthly for $299. If you decide to move up to annual, we'll roll the $299 in, so you won't be out of pocket. And if you hate it? You spent only $299. Less than you lost on your last bad trade!

There's a link below where you can become a paying member if you've yet to do so. But for now let's look at the model portfolio performances, inception to date.

All returns are on a total return basis, dividends reinvested, and assume no fees paid to asset managers (we assume these are self-managed portfolios, in essence).

Core Stocks, Inception 7 Feb 2023 to date.

High Beta Stocks, Inception 17 March 2023 to date.

Financial Stocks, Inception 23 June 2023 to date.

Defense Stocks, Inception 24 Jan 2024 to date.

Defense names, we should add, were explicitly explicitly as a defensive portfolio. If these names are beating the market indices, we should all be worried. We hope this portfolio just ticks along, preserving value, growing with dividend reinvestment, nothing too exciting one way or the other.

Join The Inner Circle Now!

Hit "SUBSCRIBE" at the bottom of your screen. Choose monthly or annual subscription options to get our best work.

(Want to know more about the service first? Read this).

Alex King, CEO, Cestrian Capital Research, Inc - 2 February 2024.