Inner Circle Model Portfolio Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It's That Time Again

by Alex King, CEO, Cestrian Capital Research, Inc

Righto, been awhile since we did this but let's check in on how our Inner Circle service model portfolios are doing. This is a no-paywall post so that anyone who has yet to join up to our Inner Circle service can get a look-see of how we're doing.

If you're reading this as a free subscriber, and you'd like to join, you can do so right from this button:

If you're a paying subscriber to the Market Insight tier of this service, you can upgrade to Inner Circle using this button:

If you hit snags or snafus of any kind, you can reach us using this contact form and we'll get right back to you.

Anyway. Model portfolios. Here goes.

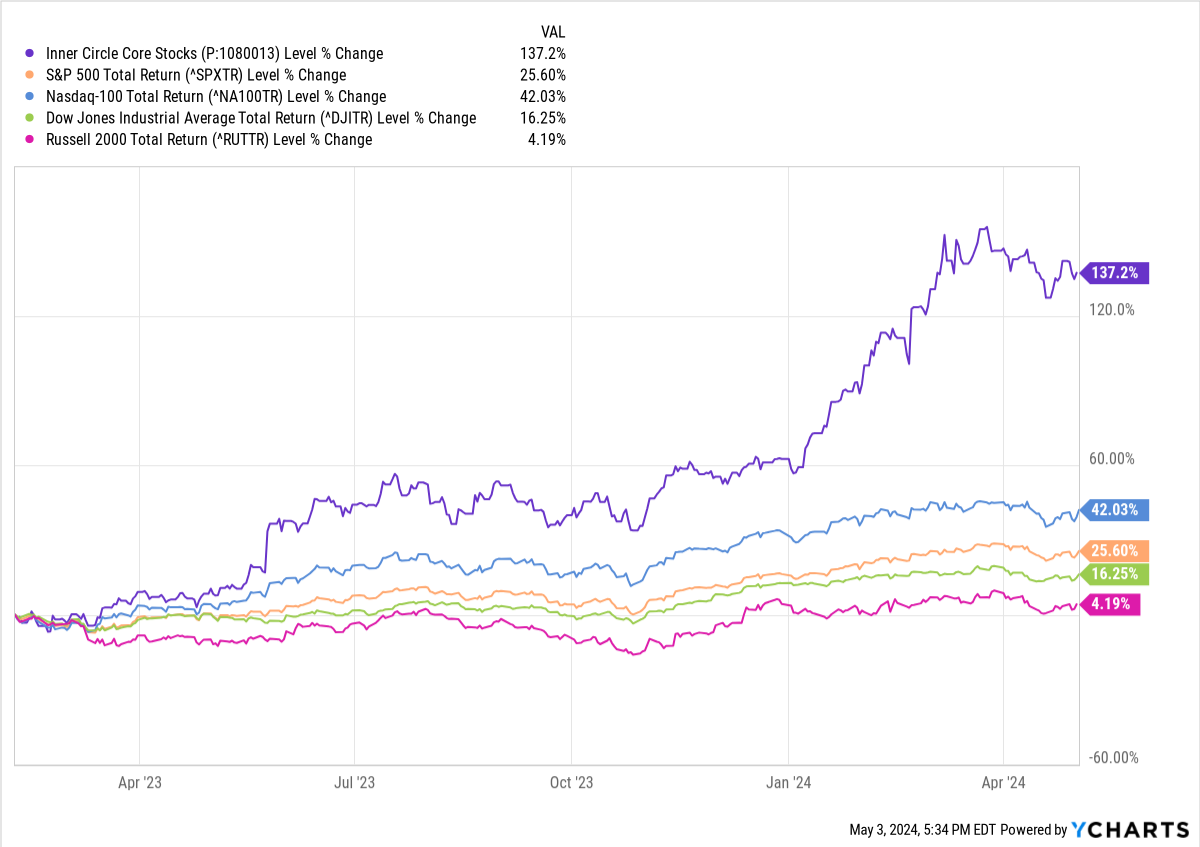

Inner Circle Core Stocks

This portfolio was established on 7 February 2023; we've made no changes, just let it run. 5 stocks, equally allocated at inception, no cash left over. The model assumes dividends re-invested, no rebalancing, and no fees (since we assume this to be a self-invested model). The index comparables are all on a total return basis, which is to say, again, all dividends re-invested.

+137% to date vs. +26% for the S&P500 vs. +42% for the Nasdaq-100 vs. +16% for the Dow vs. +4% (!) for the Russell 2000.

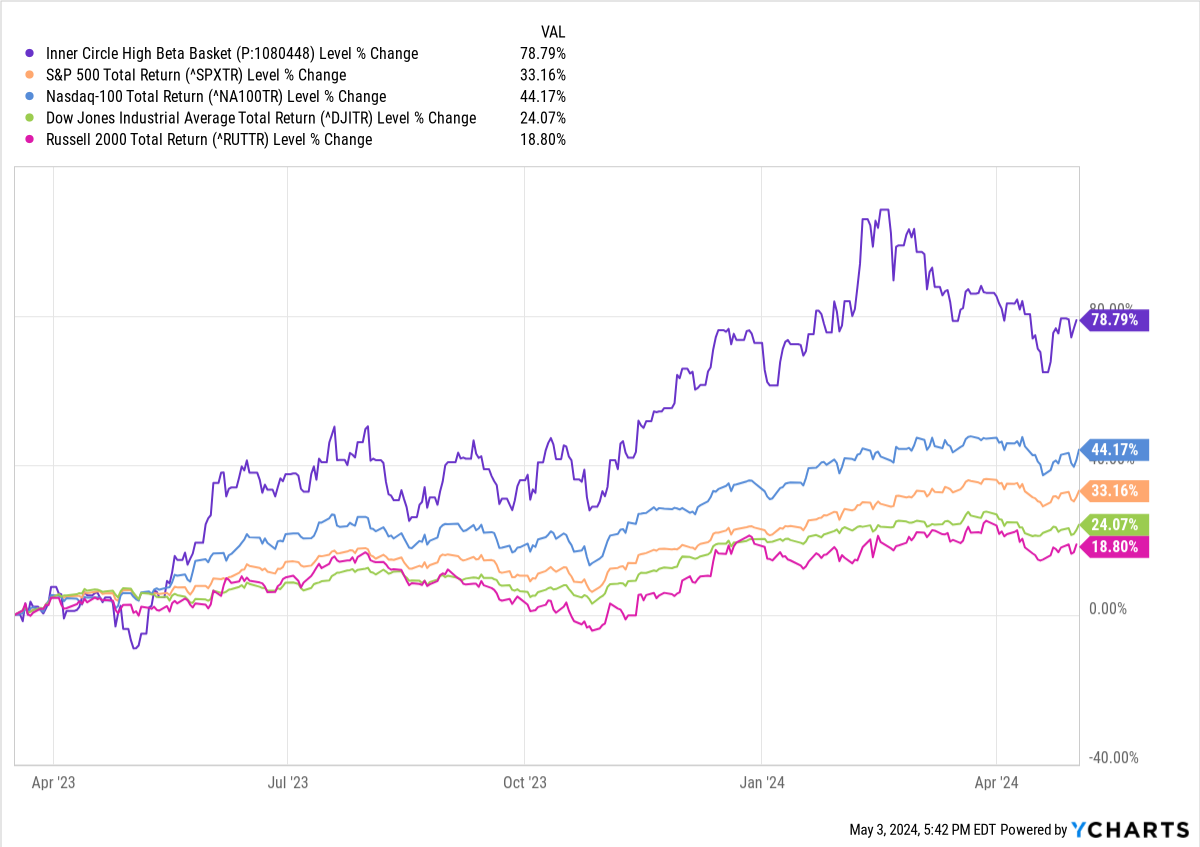

Inner Circle High Beta Stocks

This was established 17 March 2023. Again, 5 stocks, no rebalancing since day one, 100% allocated, no cash left over, no fees since self-invested model is the assumption.

+79% to date vs. +33% for the S&P500 vs. +44% for the Nasdaq-100 vs. +24% for the Dow and +19% for the Russell 2000.

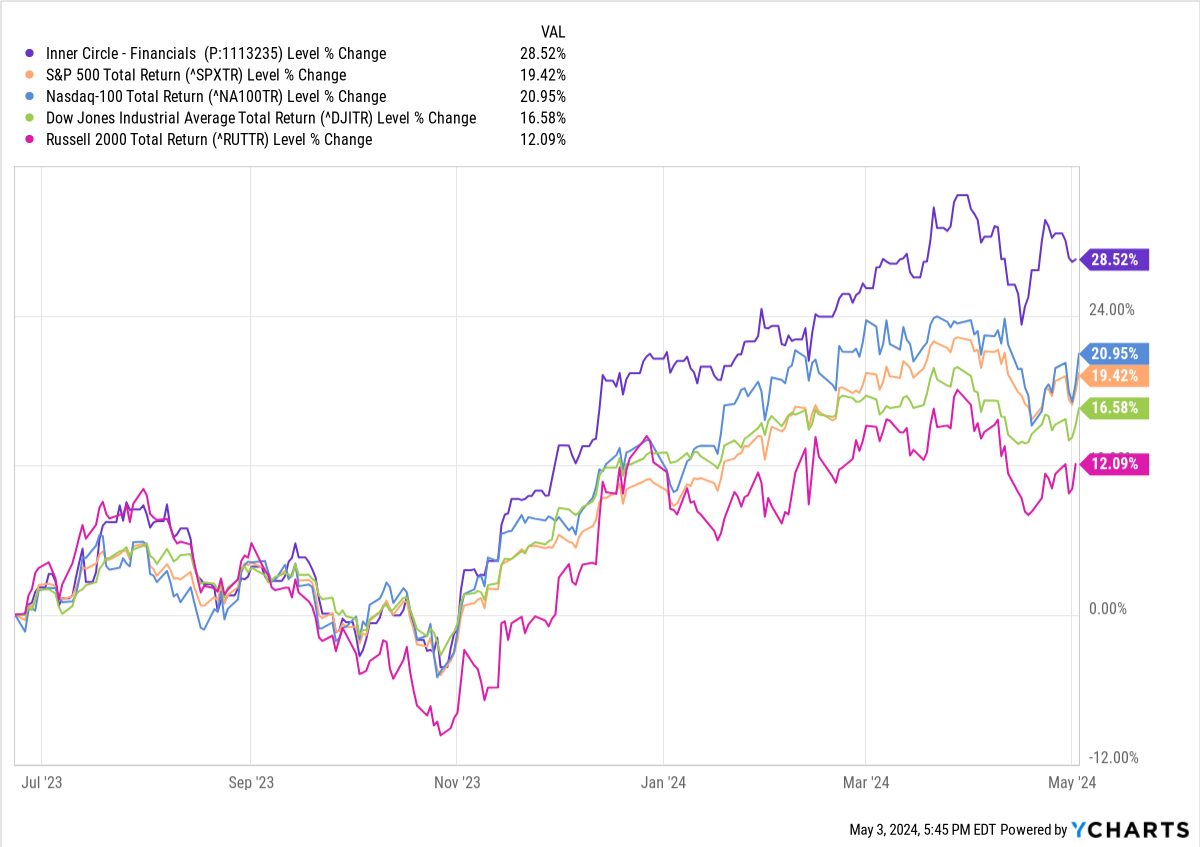

Inner Circle Financial Stocks

Set up on 23 June 2023. You know the drill - 5 stocks, no rebalancing, no fees assumed, all dividends re-invested.

+29% to date vs. +19% for the S&P500, +21% for the Nasdaq-100, +17% for the Dow and +12% for the Russell 2000.

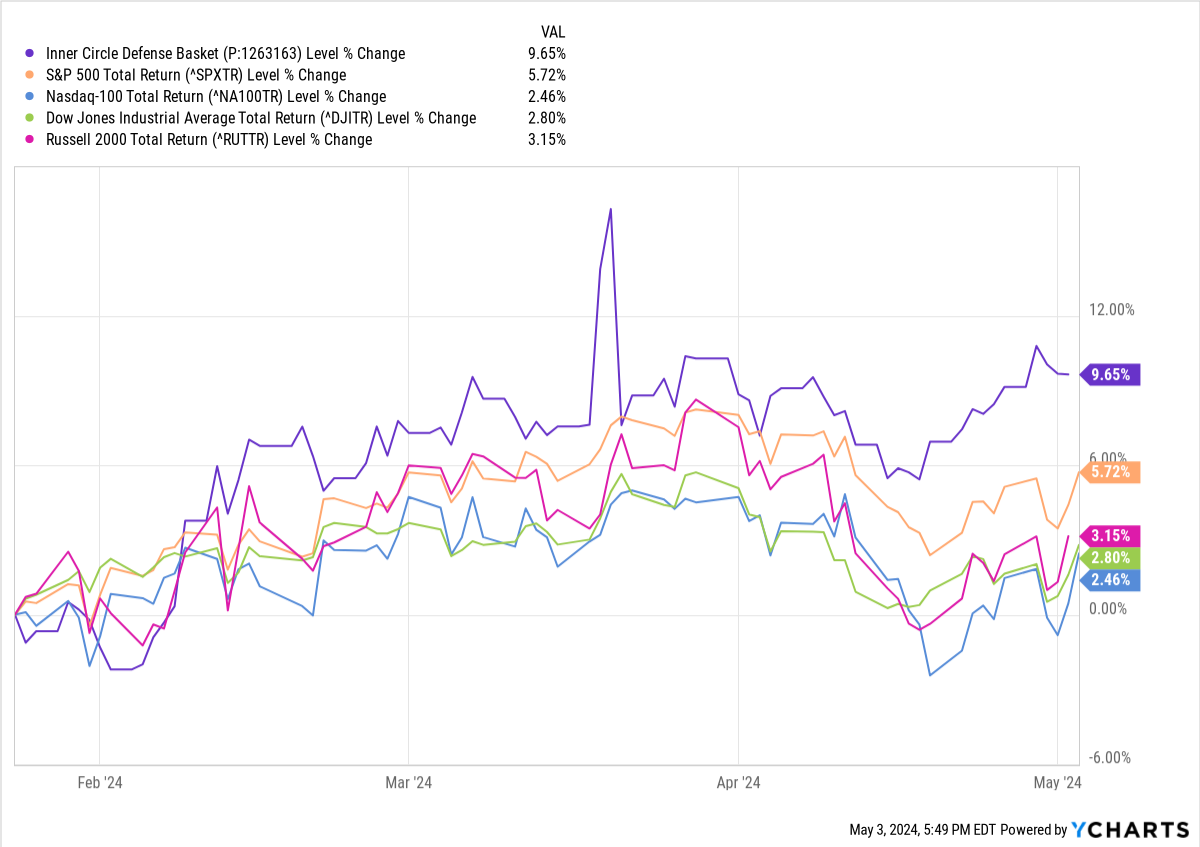

Inner Circle Defense Stocks

Now, this one was set up not to outperform particularly, but with an eye to capital protection and something of a hedge in case the world got ugly. We opened this on 24 January 2024. Slightly different construction - six defense-sector stocks, of which four had a sizeable allocation and two a smaller allocation reflecting their higher risk profile. Otherwise, again, all dividends re-invested, no reallocation since inception, and no fees assumed.

Rather surprisingly, to me at least! - +10% to date vs. +6% for the S&P500, +2% for the Nasdaq, +3% for the Dow and +3% for the Russell 2000. If the markets rip to the upside in the coming months, I would expect this portfolio to underperform, but for now, it has served its purpose.

OK folks, thanks for reading our stuff. Have a great weekend, and if you'd like to be in on the ground floor when we open the next model portfolio - which will be soon - don't forget to join our Inner Circle service!

Cestrian Capital Research, Inc - 3 May 2024.