Fortinet Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Going the Distance

By HermitWarrior

We've made no secret of our view in past earnings notes that the era of legacy hardware-based security vendors is coming to an end. Not tomorrow but eventually, we believe, this category of companies will be deflated by pure software players. Fortinet ($FTNT) at least is determined to prove us wrong for now.

Yes, revenue growth is barely half that of Zscaler ($ZS), our top contender among cloud security stocks, at 13% yoy vs a projected 22% for the coming ZS earnings print. Yes, you still need a box at every location (though they offer virtual firewalls to secure cloud based infrastructure). But this is a skilled operator, with good footwork, a long reach (800K customers) and enough heft in $5.9B of TTM revenues, to give the challengers a good fight. They aim to go the distance.

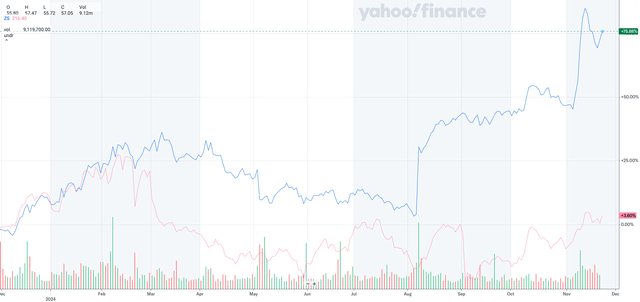

Plus, let's not forget that FTNT is deemed to be very shareholder friendly, with over $5B in stock buy-backs since 2020 driving a 35% increase in EPS. The share price over the last 12 months shows it.

FTNT vs ZS (FTNT is the blue line) 1 year performance. Source: Yahoo Finance

We now turn to the numbers, valuation, the stock chart and our rating.