Flash Crash

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Market On Open, Friday 24 May

by Alex King

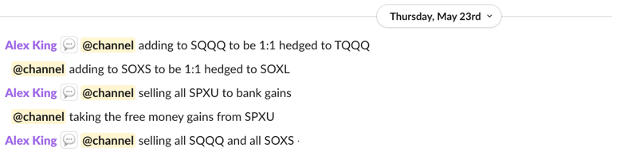

If you are an Inner Circle member here, you may have caught a very nice short-term short opportunity we posted in chat and in trade disclosures yesterday. An opportunity to hedge longs and then take short profits in the S&P500 and the Nasdaq-100 and also in the levered semiconductor sector pairing of SOXL / SOXS.

Equities are up a little in pre-market right now; we’ll see if that holds. Personally I am now un-hedged long in the S&P500 and the Nasdaq, may hedge into the long weekend, haven’t decided yet. As always, Inner Circle members will get a trade disclosure alert before any such trades are placed.

If you’d like to become an Inner Circle member, either as a step up from free or from Market Insight here, you can use the links below; any problems, reach out using this contact form and we’ll get right back to you.

Anyway, back to the task at hand. As always in these notes, today we cover all four primary US equity indices (the S&P500, Nasdaq-100, Dow Jones-30 and Russell 2000); bonds (TLT), volatility (the Vix), oil (USO) and sector-specific ETFs. We provide long- and short-term insight daily and we include coverage of leveraged ETFs which - if you have gotten sharp at the rotation and hedging methods we teach - can be used to very good effect. All of this features daily in the pay version of this newsletter.

Yet to sign up?

Monthly and annual subscriptions available - right here. Market Insight gets you the entry-level stuff, Inner Circle gets you our best work.