ExxonMobil Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

If Inflation, Then Oil; If Oil, Then $XOM

As the Fed has now declared tariff inflation to be transitory in nature, we now know we don’t have to worry about that too much. Just like Covid stimulus inflation was transitory in nature. Phew! Glad this is going to be a nothingburger.

That said, on the offchance that tariffs do lead to a spike in inflation, one could be forgiven for looking for some ways to benefit from that. We can assume that bonds and high-beta stocks will get hurt, and we can assume that the equity indices won’t love it either. But energy? Energy should do just fine.

Plenty of energy sector names look like they are preparing to put in a bull move at present. Here’s $USO for instance. (You can open a full page version of this chart, here).

Anything can happen of course, but it looks like USO has a chance of exiting that range compression to the upside.

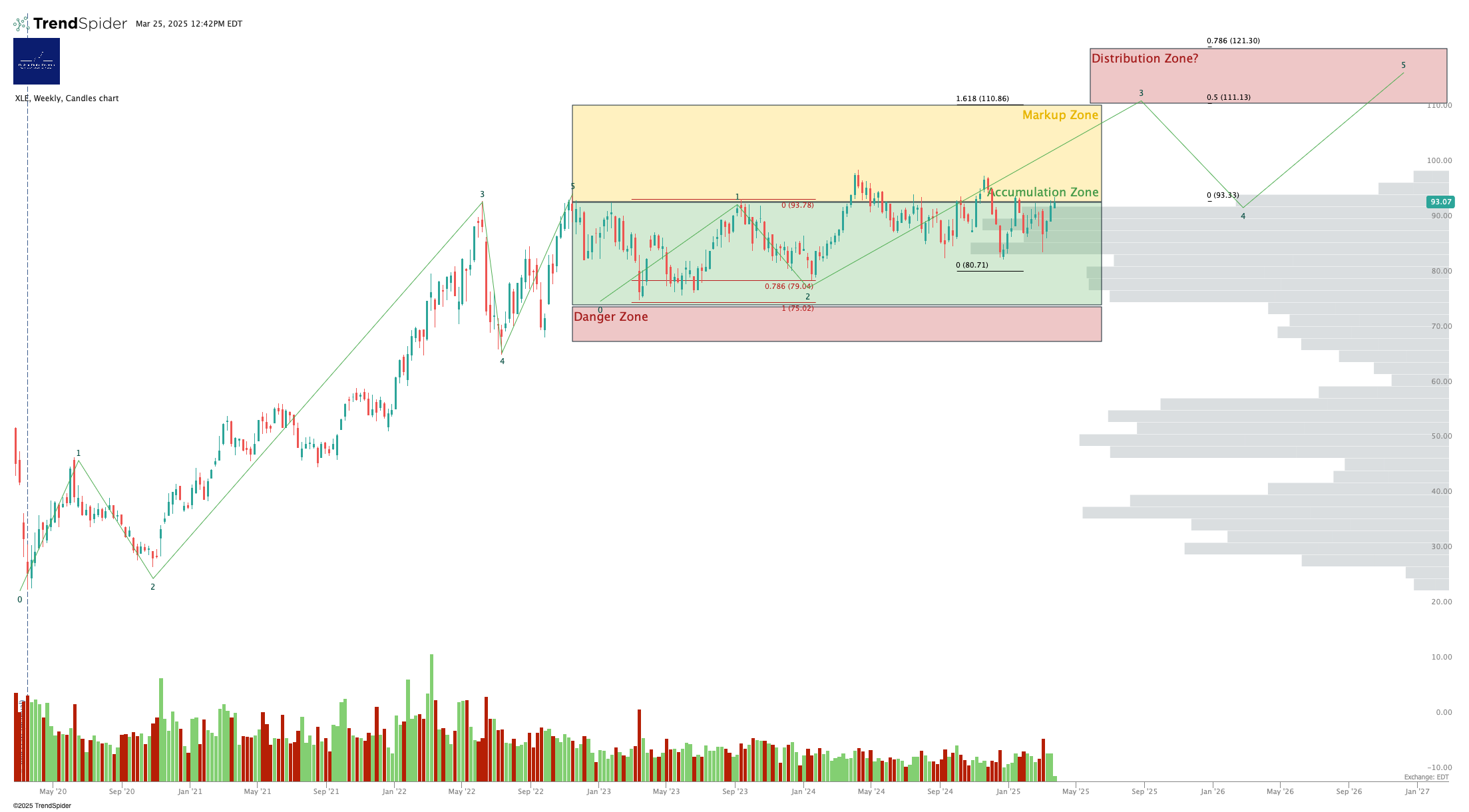

Here’s $XLE. (Full page version, here).

Stocks tend to move with their sectors, all other things being equal, so it is in this context that I think one should consider $XOM.

Let’s take a look.