ExxonMobil Q3 FY12/2024 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Wen Breakout?

By Alex King, CEO, Cestrian Capital Research, Inc.

As everyone knows, inflation is coming back, because tariffs. And if inflation comes back, we can kiss goodbye to rate cuts. And if no rate cuts, then high beta stocks are going to get a kicking. Which "should" (ha!) cause rotation into more boring sectors like energy, which generally have some price-setting power so can benefit from an inflationary environment.

In the alternative, inflation is in fact quelled, the Fed continues to hack away at the funds rate, but demand for energy moons because AI. See for instance this note from Bloomberg recently.

So I can think of at least two high-level reasons why capital ought to rotate into the energy sector. One commensurate with a bear market in general equities, and one with a bull market.

So far though, the sector has yet to really respond. Here's $XLE, the energy sector ETF, which continues to just trend sideways at high volume in a rangebound manner. Now, oftentimes that is what institutional accumulation looks like, so I continue to be patient here. (Remember $IWM between $160-200/share for 2+ yrs before it broke out?).

You can open a full page version of this chart, here.

For the patient investor, let's check in on XOM's Q3.

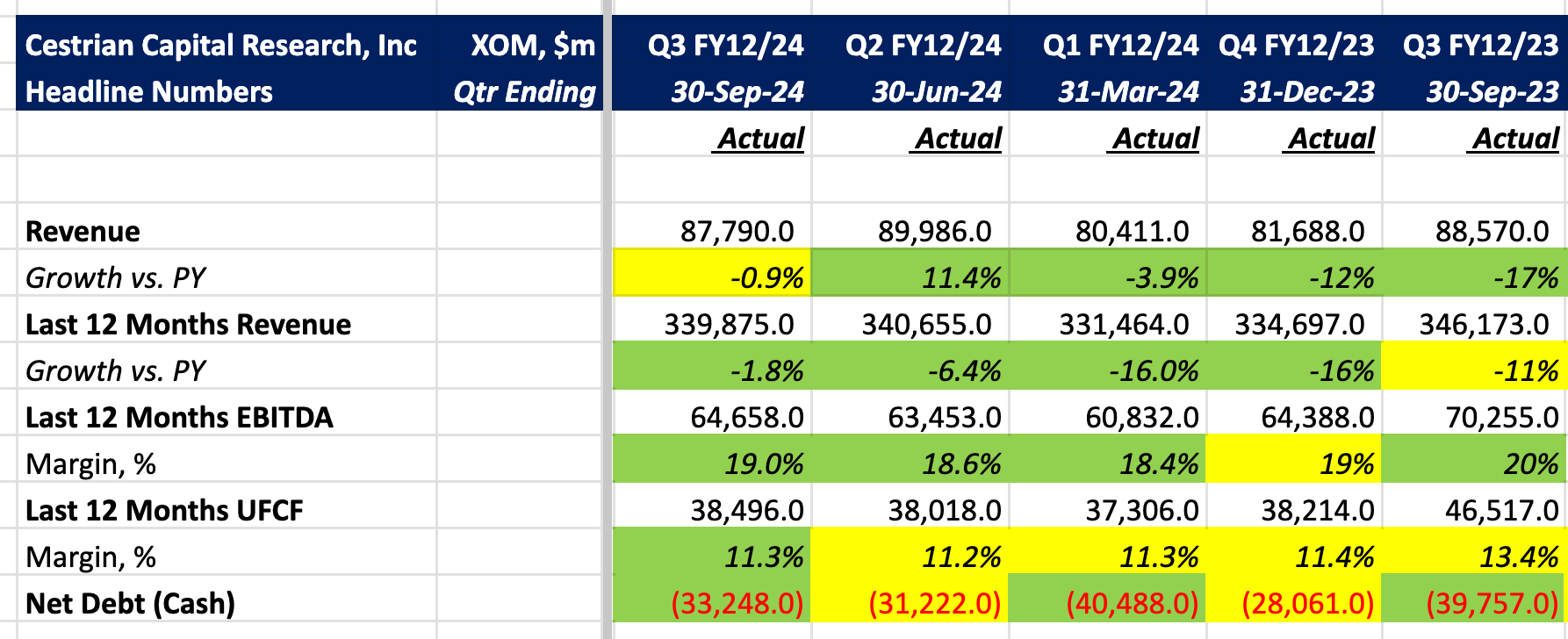

Financial Summary

Here’s the headlines.

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.