EQT Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Choose Your Own Ending

We rated $EQT at ‘Accumulate’ between $28-44/share; the stock closed Friday at $53/share, up some 20% from the top of our ‘Accumulate’ range and up over 80% from the bottom of that range.

You can open a full page version of this chart, here.

You can see that the stock has broken out. With a fair wind behind it I believe the name could hit around $57, that being the 1.618 extension of the Wave 1 up placed at the Wave 2 low of the timeframe shown.

Whether you choose to hold from here is a riskier bet, in my view, than when the stock was trending sideways, rangebound, in the Accumulation Zone. Breakouts like this can be played to the long side by skilled momentum traders, using stops or other risk management techniques, but if you have followed Wyckoff principles, been patiently building a position in that rangebound Accumulation zone, risk is now on your side; you can take gains and relax, then rotate the capital into some other opportunity which remains under accumulation.

Personally I tend to sell names like this whilst they are still in the Markup Zone ie. during the momentum breakout. It means I often miss the highs, but it means I can harvest gains with regularity in order to then rotate the capital back into something more boring instead, then sit back and wait for the boring thing to break out, rinse and repeat.

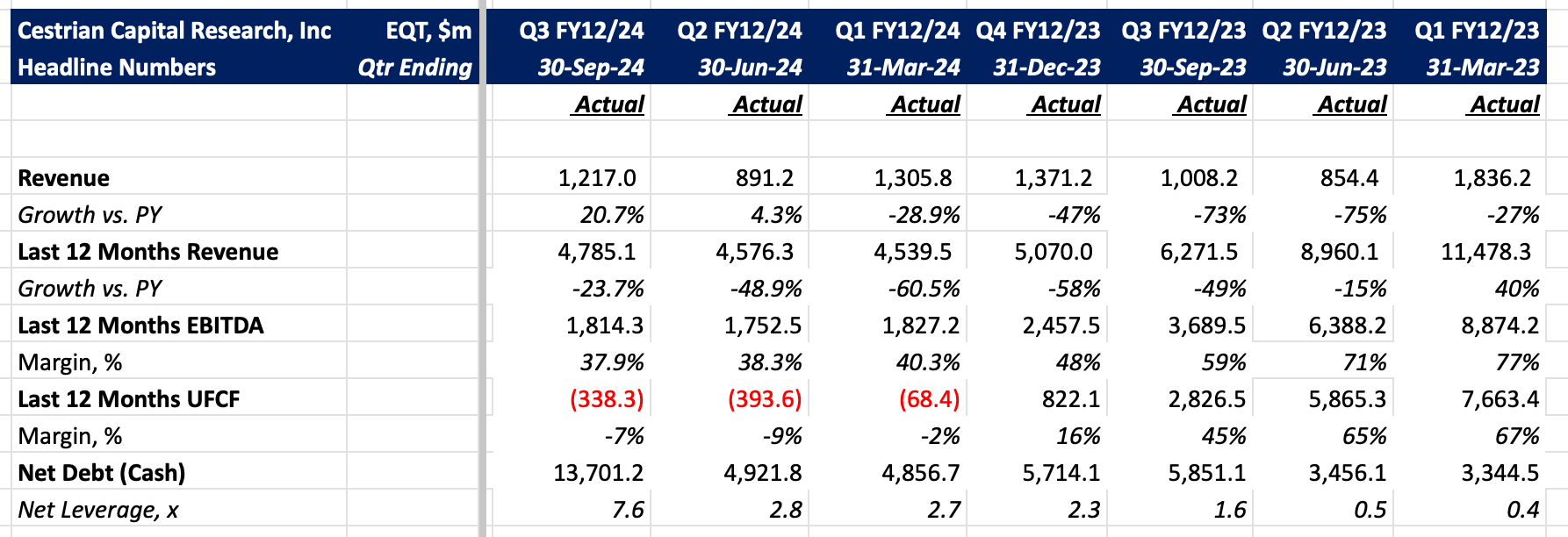

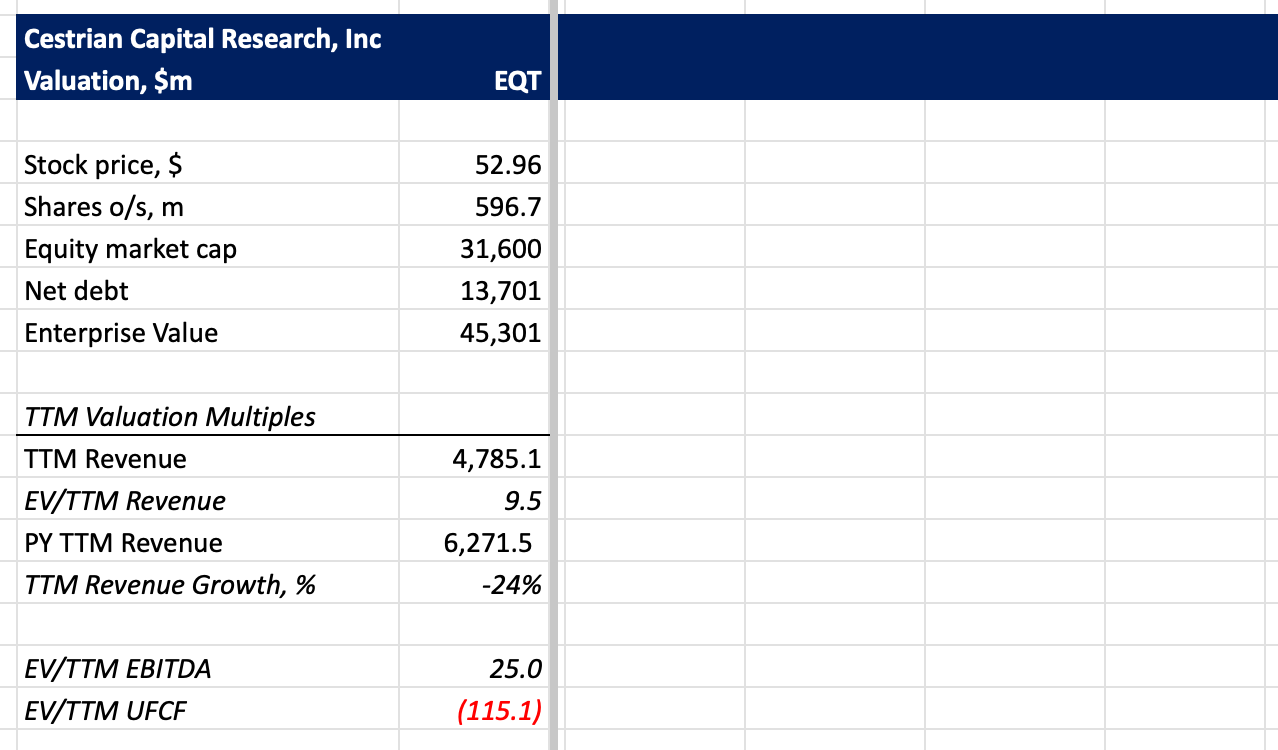

Here’s the numbers and valuation.

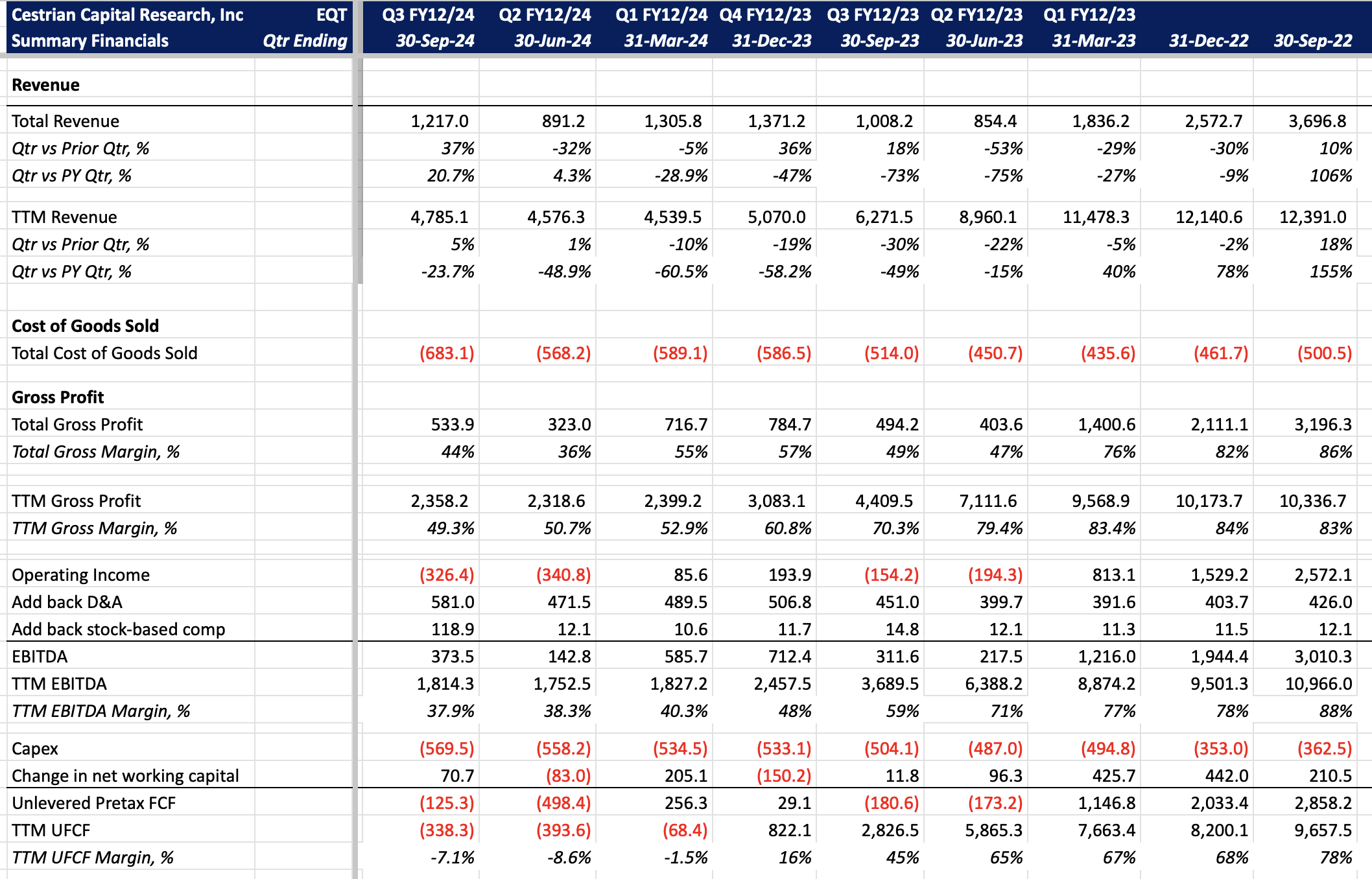

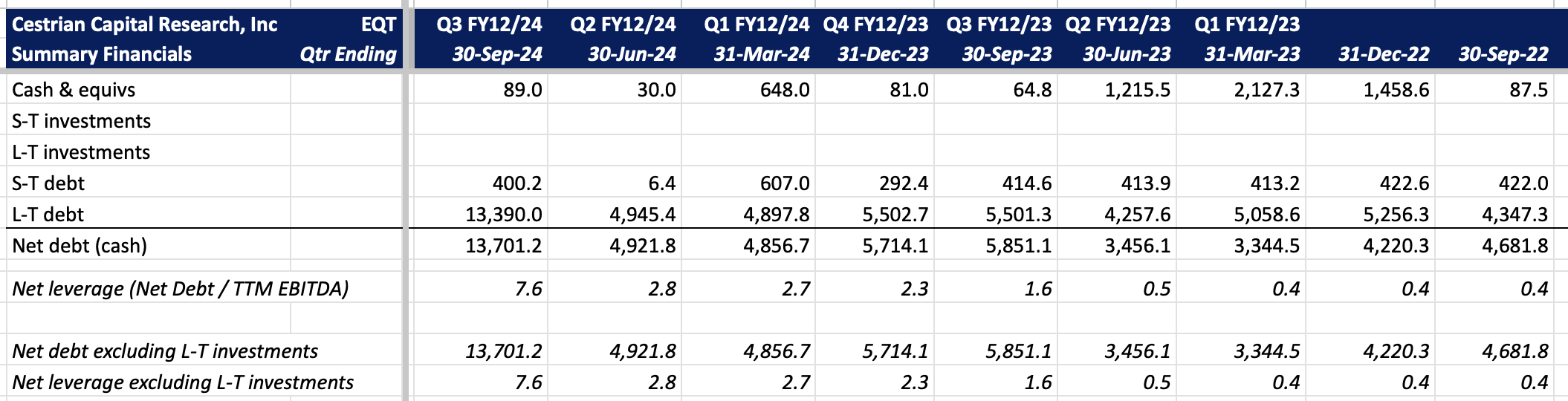

Full financials:

Formally speaking we rate the name at Hold, because the stock remains below that 1.618 extension, but again, the risk to long positions is rising not falling in my view. You will make your own decision as always.

Alex King, Cestrian Capital Research, Inc - 20 January 2025.

DISCLOSURE - Some Cestrian Capital Research, Inc staff personal accounts hold long positions in EQT at the time of publication.