Dynatrace Q3 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

What He Said

by Alex King, CEO, Cestrian Capital Research, Inc

I don’t wish to be seen to be lazy, uninterested or lacking analytical insight. But everything in today’s note about DataDog (DDOG) being an expensive and somewhat orphaned point-solution stock at a stage of its life where normally it would be getting hoovered up by suite vendors is also true of its cheaper cousin Dynatrace ($DT). The fundamentals at DT remain strong subject to the usual growth slowing / margins rising story in a maturing software company. The multiples are less painful than for DDOG. But still.

If you didn’t catch that note on DataDog yet, you can read it here:

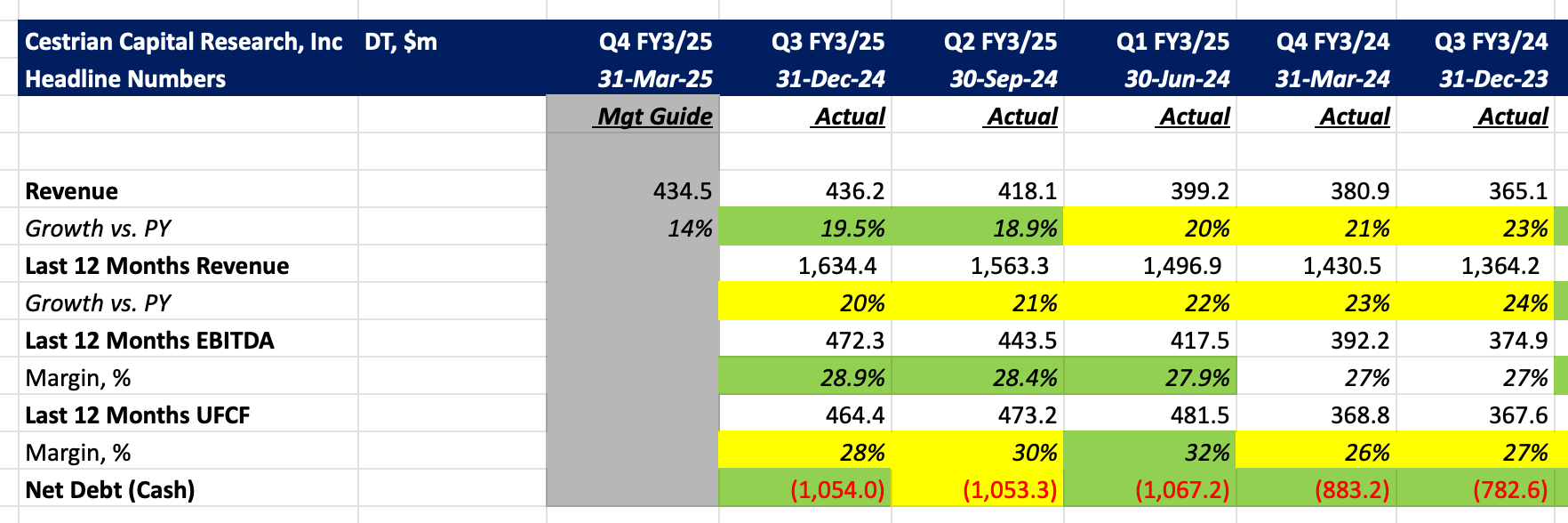

Here's the DT headline numbers.

Now the detail: