Dynatrace Q2 FY3/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Ageing Gracefully

By Alex King, CEO, Cestrian Capital Research, Inc.

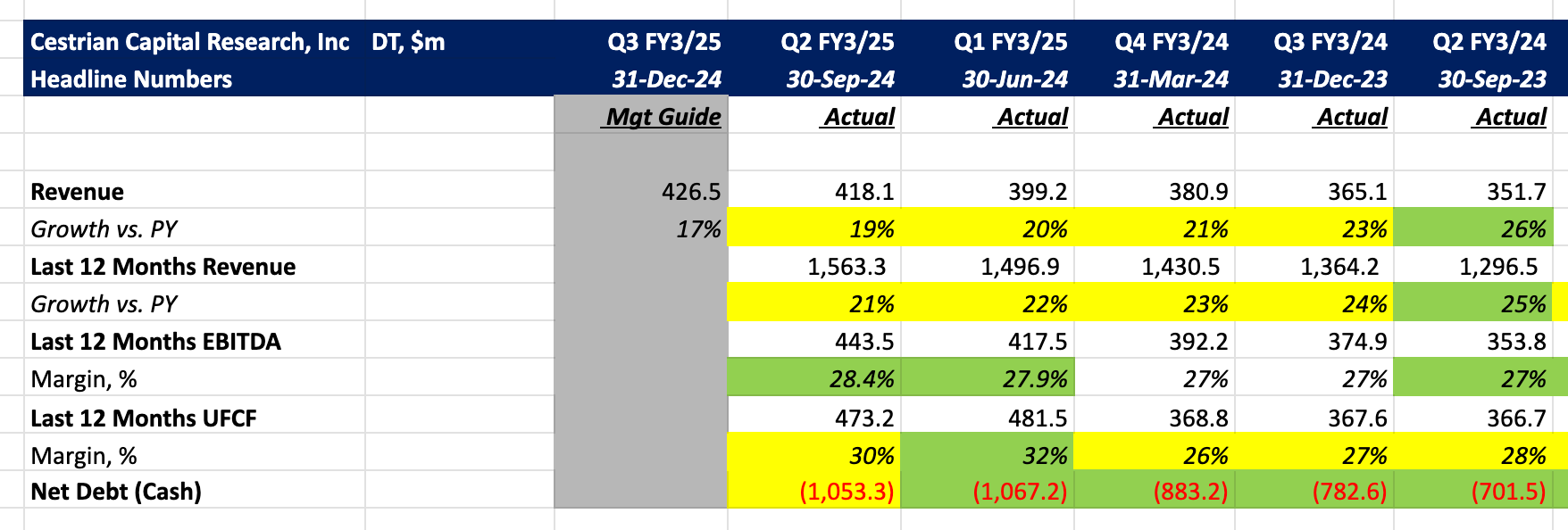

Dynatrace, like DataDog, is maturing but remains a very well managed enterprise software company. If you were the sole owner of this company and your retirement depended upon it, you would sleep easy. This thing now comes with >$1bn in net cash and an order book worth 1.5x the prior twelve months' revenue. Growth is holding in the 20% zone for now and cashflow margins in the 30% zone. This business was designed and created in a leveraged buyout shop's boardroom, and it shows. (I am somewhat surprised it wasn't bought back into private hands during the bear market - perhaps that opportunity lies ahead for DT shareholders).

Let's take a look at the Q2 report and Q3 guide, together with our chart analysis, valuation analysis, and stock rating.

Financial Summary

Here's the headlines.

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.