Does The Source Of Alpha Matter? (No Paywall)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Structure vs. Issuer

by Alex King

This is a short note that reflects a lot of pondering. And the punchline is, I believe alpha obtained through structure is preferable to alpha obtained through the issuer - but only if the security in question can be hedged. Who says this stuff isn't exciting?

Allow me to explain.

Everyone is looking for alpha, as we know, which whatever the Investopedia definition is we could probably all agree can be defined as, how do I outperform the S&P500 over time. Yes I know you could call that beta. But I'm going to call it alpha.

Here are some ways to outperform the S&P500.

- Find stocks that are going to outperform the S&P500, and own only those stocks. This is dumb, you say, too hard. And I would agree with you. Yet almost the entire activity in stock-picking and FinTwitting is dedicated to this almost impossible task.

- Learn how to rotate in and out of sector ETFs so that you generally own the sectors that are on the rise and don't own those that are declining, or at least, be heavily weighted at all times towards those in the ascendant. This is possible. Difficult - if it wasn't, anyone could do it - but possible. (It is also, by the way, going to be a feature of our forthcoming RIA service).

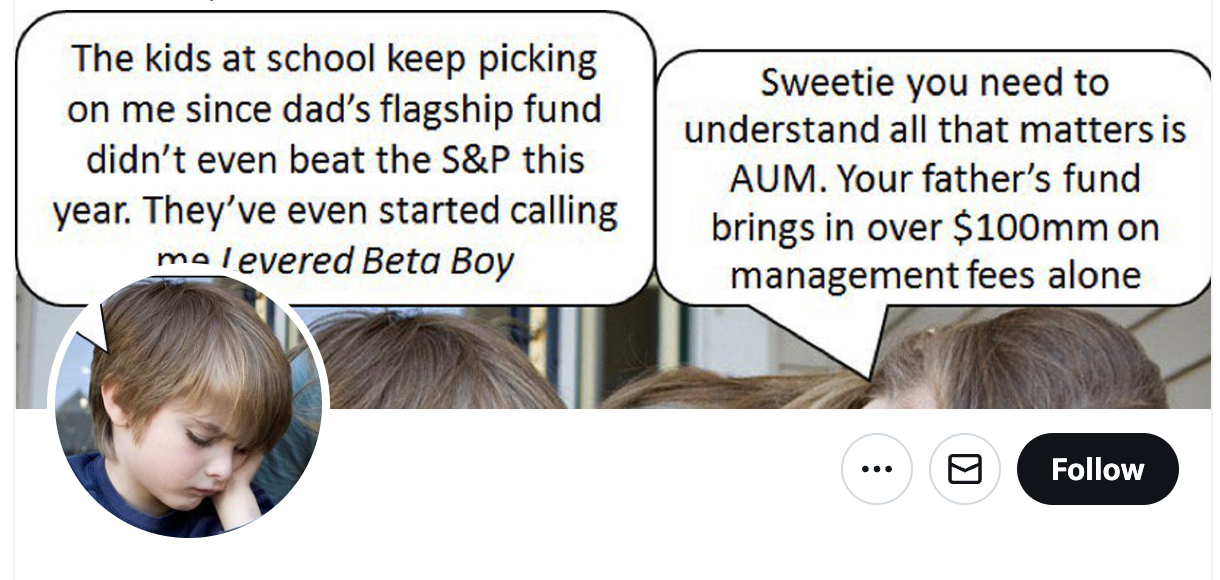

- Own the S&P500 via structured products designed to amplify the S&P500's moves. We can call this levered beta if you like. This is great (options! yay!), until it isn't.

To me, trying to stock-pick your way to beating the S&P year in, year out, is a fool's errand. If you like to stock-pick because it's fun, or you are just playing at it and you don't mind not beating the S&P500, that's great, all good reasons to do it. But if this is a serious endeavor you are committed to, then you have to ask yourself - why not just do what Mr. Buffett says and just dollar-cost-average your way into SPY for a lifetime? Since that is not only a great strategy from the dawn of the S&P500 until today, it is also, well, no work at all.

How about sector rotation using the sector ETFs? This is a good method if you don't like to own weird stuff that you can't explain to the kid at the bus stop. Do you know how it is that $TQQQ delivers 3x the QQQ daily? No? Well, neither do most other people including, I would wager, some people who work at the fund manager that runs it. But can you understand that energy stocks might be rising when tech is dumping, and that it's easier to own XLE than stock-picking energy names and easier to own XLK than stock-picking tech names? Sure. So does the kid at the bus stop. And what's more, it works, but it does require some work and you probably will have some off-periods that may be time-consuming from which to recover.

Finally, structuring your way to success. Personally I don't care for futures or options because the y-axis is hard enough to get right, I don't need the mind-boggling complexity that the x-axis brings and that's even before we get into things like greeks and contango and all manner of brain-frying material. I do like structured ETFs though; specifically levered equity index ETFs. These names - TQQQ, UPRO, that kind of thing - are intended to deliver daily amplification of the underlying move of, in those cases, QQQ and SPY respectively. These days you can also find single-name levered ETFs like NVDL, AAPB and so on (NVDA and AAPL being the respective underlying common stocks).

I keep reading that "retail loves levered ETFs" - NVDL being a particular favorite as it's a 2x amplified daily NVDA instrument. This is a sign we are in the second half of a bull market, when everyone is a genius and all these genius ideas work out great. You know what comes next. Even genius fails, and when not-genius fails, look out below. My belief is that the best way to prepare for what comes next - when down is the new up, and everyone believes it's a dip when it isn't (until very recently, nobody believed in this bull market by the way, and thought it was a rip that would fade!), is to learn to use structure to your advantage. Learn how to use the inverse ETFs - SQQQ, SPXU, NVDS, AAPD, those sorts of things. (We teach this all day long in our Inner Circle service by the way). Because this way, when times are good, you can get your outperformance through structured amplification to the upside, whilst owning America's finest issuers - Apple, Microsoft, McDonalds, JPMorgan etc - and then when the work turns you can rely on those same issuers, using amplification to the downside, to help you beat the S&P500 in a bear market just as you did in the bull.

The more I do this myself the less I care to stock-pick. Sometimes along comes a very winning single stock name like NVDA (now) or TSLA (in 2018/19), and those names are great to load up on. But owning a generally diversified basket of stocks? I don't think so. The S&P500 and the Nasdaq-100 and the Dow Jones already offer that without anyone having to work for it.

In answer to the question, I do not think the source of alpha matters. I do think the S&P500 can be beaten, regularly, and I don't think you have to work at Renaissance Technologies to do it.

Want to learn more? Join us.

Disclosure - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, UPRO, NVDL, NVDA.