DocuSign Q4 FY1/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Too Boring, Nobody Is Paying Attention

DocuSign ($DOCU) is a busted flush, as everybody knows. Adobe is eating its lunch from above and myriad low-cost point-solution vendors are nipping at its heels from below. The company just failed in its quest to be acquired by a deep-pocketed friend, and all in all it’s not looking good for this washed-up has-been coulda-been software company.

Well, maybe.

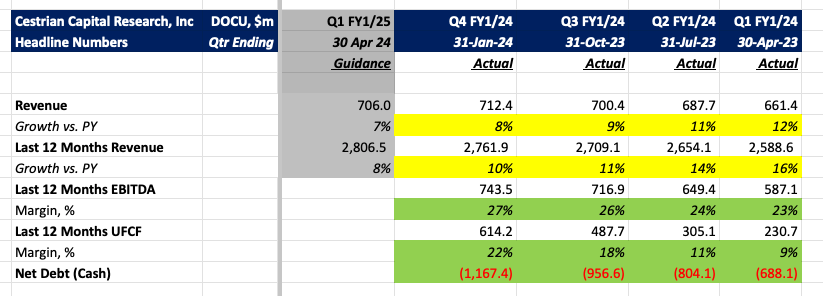

The quarter just printed was pretty good. Here’s the headline numbers.

- Revenue growth slowed a little, to +8% on the quarter and +10% on a TTM vs PY basis. The rate of decline in growth seems to be slowing, but we’ll only know once it actually bottoms out.

- TTM EBITDA margins are climbing very nicely, from +23% to +27% in the space of four quarters.

- TTM unlevered pretax FCF margins are doing even better, from +9% in the April 2023 quarter to +22% just now.

- The balance sheet now features a little shy of $1.2bn in net cash, up from $700m in the April quarter.

Read on to get our valuation analysis, our take on the stock chart, and the full set of fundamentals. (The full text below is available to our paying Inner Circle and Stock Select Newsletter members. If you’ve yet to sign up as a paying member of any of the services here, you can do so right from the link below).