Docusign Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Sometimes Fundamentals Matter

by Alex King, CEO, Cestrian Capital Research, Inc.

For the most part the enormous amount of effort that investors and analysts and the commentariat at large put into trying to understand companies’ product strategy, competitive positioning, financial fundamentals etc, is a waste of time. Easier in my view just to learn to chart and then invest in or trade SPY or QQQ. Lower risk and, if you do it right, more upside too. (At least if you are prepared to get a little fruity with structuring, hedging and so forth).

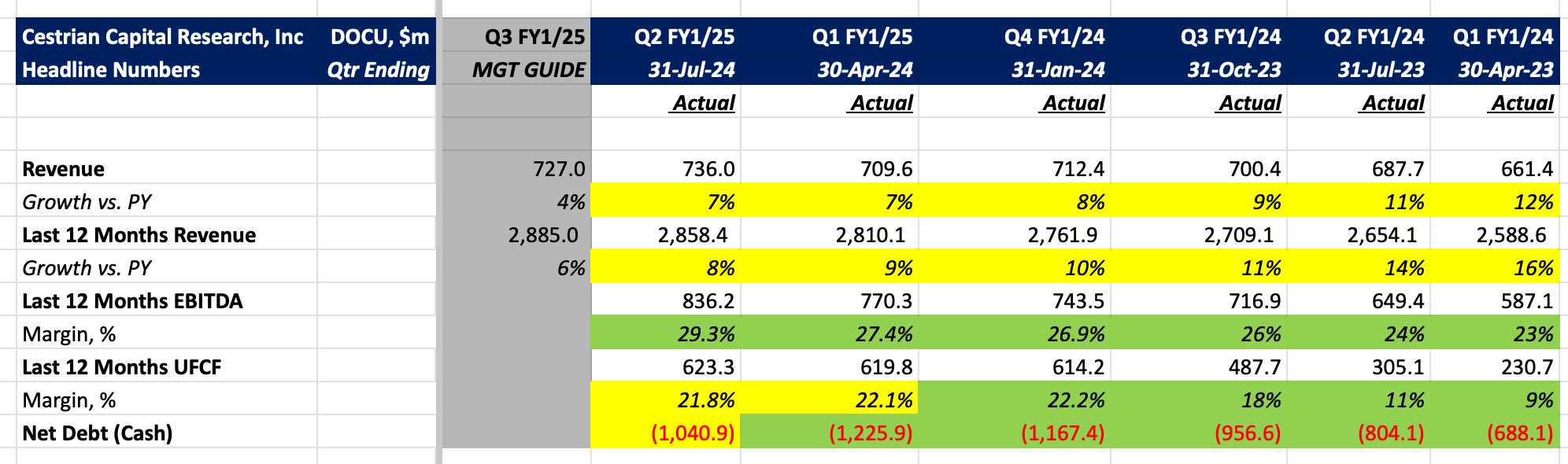

Sometimes though, fundamentals do matter. Docusign ($DOCU) is a software companies whose products …. ah that doesn’t matter. It has modest but good-enough revenue growth, rising EBITDA and cashflow margins, a perfectly strong enough balance sheet, and an order book which is large vs. its trailing twelve month revenue number. And the market is asking you to pay 4x trailing revenue, 13x trailing EBITDA, or 18x trailing unlevered pretax free cashflow, to buy the stock. In my book - and in most other grownup software investors’ books - that’s not expensive.

Here’s $DOCU headlines.

So, read on for the financial detail, valuation, our stock chart and rating! Any paid subscription here gets you the full note.