Disney Q3 FY12/23 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Fundamentals Improving, Stock Remains All Beat Up

by Alex King

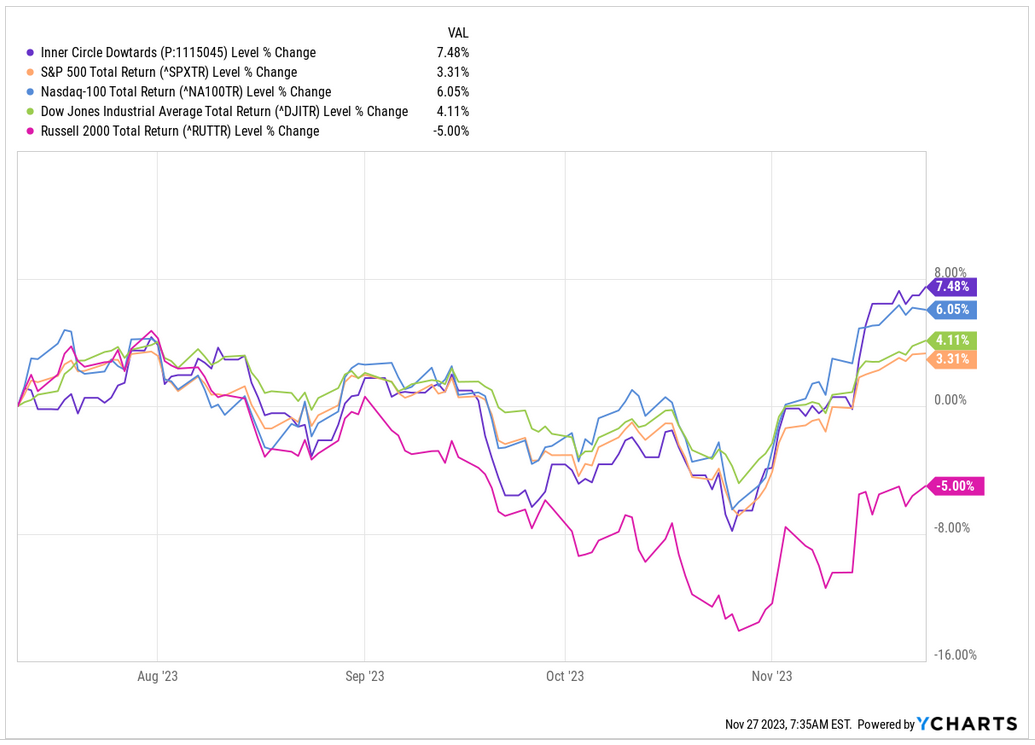

Disney ($DIS) is a component of our 'Dowtards' Dow-laggard stock portfolio which we established on 11 July this year. The notion with this basket was to be buying value names when everyone was very focused on buying only growth. After a slow start when the portfolio just meandered along a little below market performance, it now looks to be putting in a solid performance. +7.5% since inception on a total return basis, vs. 6% for the Nasdaq, 4% for the Dow, +3.3% for the S&P500 and -5% for the Russell 2000.

In that mix, Intel ($INTC) has performed exceptionally well, but Disney has continued to lag.

Disney printed its Q4 of FY9/23 on 8 November. Below we review the numbers, valuation and stock price outlook.