Dell Q3 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Probably Not All Over.

By Alex King, CEO, Cestrian Capital Research, Inc.

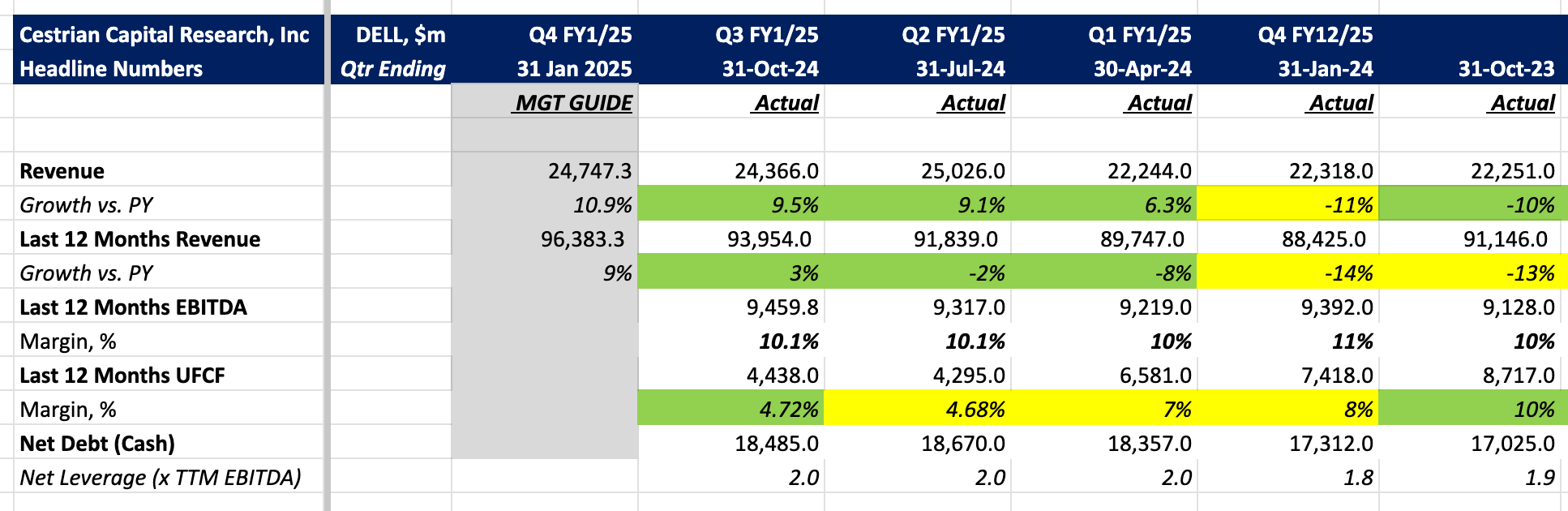

From the stock price reaction today you could be forgiven for thinking something terrible has happened to Texas' finest. A glance at the numbers, however, may disabuse you of such a notion. Revenue growth accelerated a little, gross margins are unchanged, cashflow margins are weak vs. last year but unchanged from last quarter. The balance sheet remains 2x levered which is unstressful.

Dell ought to be an ongoing spending beneficiary of the rush to re-arm the datacenter and, later, of the capex refresh that I expect to roll through workgroup servers and client-side devices as the current generation proves inadequate to handle next-generation software with its growing element of AI processing requirements. This spending will slow in the end, yes; and there are many competitors, yes. But I think the company and the stock can live with these risks for now.

Here's the headlines.

Financial Summary

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.