Dell Corporation Q4 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

I Don’t Make The Rules

by Alex King, CEO, Cestrian Capital Research, Inc.

As everyone knows, you can’t buy tech stocks right now because tariffs. Said tech companies don’t know (1) the cost of their componentry, much of which originates in China, and (2) the revenue opportunity before them, all because tariffs. This makes absolute sense of course. Entirely logical.

It’s just that nobody told DELL stock. The chart looks for all the world as if it has an actual shot at an all time high (meaning up and over $178 from the current $83). And it looks like in pursuit of that $90/share gain, there might be a logical stop-loss level some $20 or so below here. So, $90 up, $20 down, those odds look OK to us.

Let’s check in on earnings, the current valuation and that chart outlook.

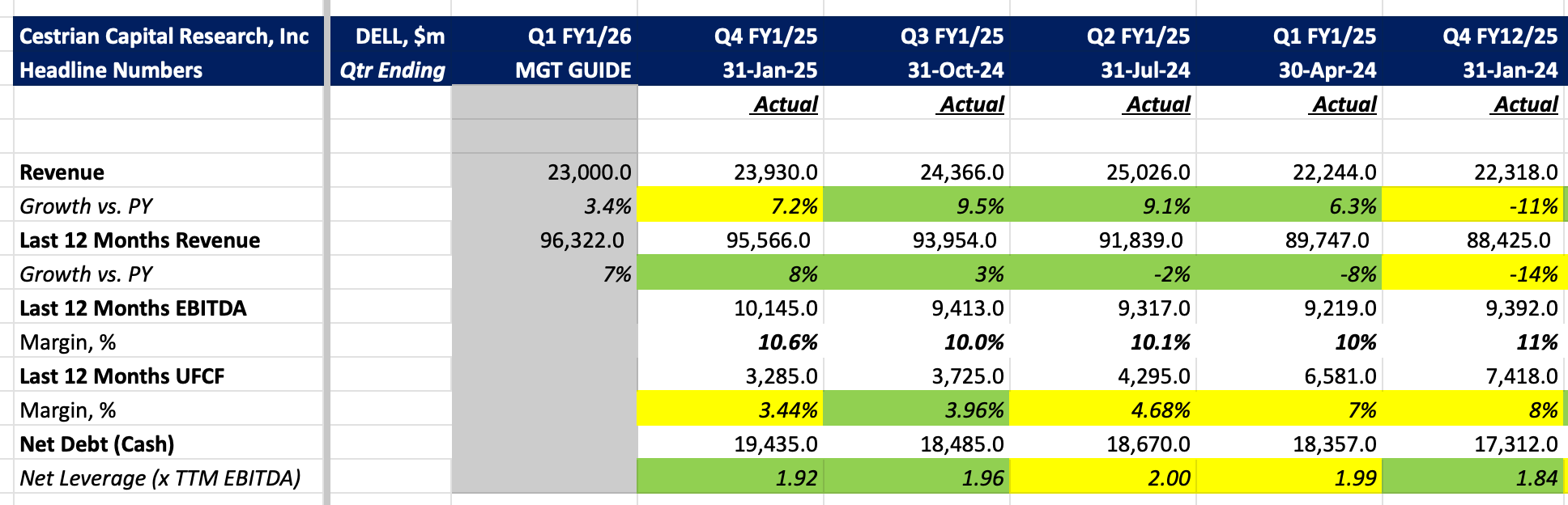

Here’s the headlines.

Now for the details.