Defense Stocks Continue To Play Offense (LMT Q1 FY12/24 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Lockheed Martin Q1 FY12/24 Earnings Review

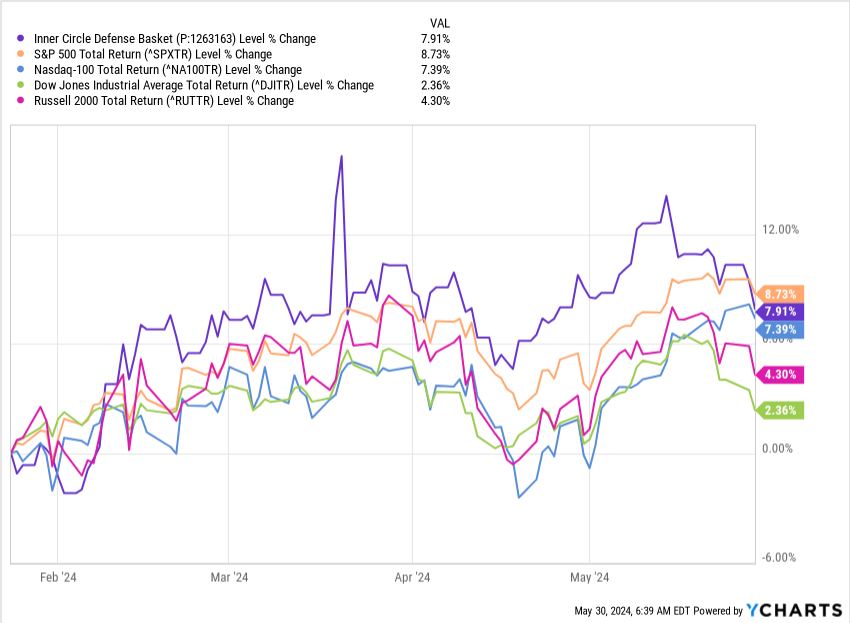

Lockheed Martin ($LMT) printed a good quarter. Fundamentals improved somewhat with a modest acceleration in revenue growth (to +5% on a TTM basis), backlog up some 10% on prior year albeit down a touch sequentially, and leverage holding steady at 1.6x TTM EBITDA. None of this is the reason for the stock’s recent rise in my view. At present, defense stocks are undergoing an ascendancy en masse, a consequence of capital rotation into the sector since late 2023. Here’s how our Inner Circle Defense Model Portfolio has performed since inception on 24 January this year:

Despite all the good news in semiconductor … a handful of six defense names is ahead of the Nasdaq, the Dow and the Russell 2000 and only a touch behind the S&P in what has been a scorching year to date for the S&P. This for a model portfolio which was designed to protect capital rather than particularly to generate outsized returns.

Let’s now take a detailed look at LMT financials, valuation metrics, our stock rating and price targets.