De-Cadence?

CDNS Q1 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

May Be A Canary

Cadence Design Systems ($CDNS) sells, in essence, two things. One, software that is used by engineers to design semiconductor devices or parts thereof; and two, designs for semiconductor devices or parts thereof. If you, a company in the business of producing semiconductors, think that you are going to be making more and/or different devices in the future, you’re probably buying more stuff from Cadence and/or its major competitor, Synopsys ($SNPS). And you’ll be buying it ahead of time. If on the other hand you think you are going to be making less and/or the same kind of devices in the future, you probably won’t be buying as much stuff from Cadence or Synopsys, and you’ll be putting the brakes on spending early doors - because you can see what your end-customer demand looks like a year or two out.

What this means is that CDNS can be used as something of a leading indicator for the chip sector as a whole. The company has sufficient market share in the design tools and intellectual property licensing segments for its revenue line and order book to be a reasonable read on the market. If the revenue line is accelerating, that’s likely good news for semiconductor as a whole and that is likely good news for tech as a whole and that is likely good news for the market as a whole. And the converse is also true. But don’t look only at the revenue line - look at the remaining performance obligation aka. the order book. If RPO growth is accelerating, doubleplusgood. Decelerating? Ungood. Very ungood.

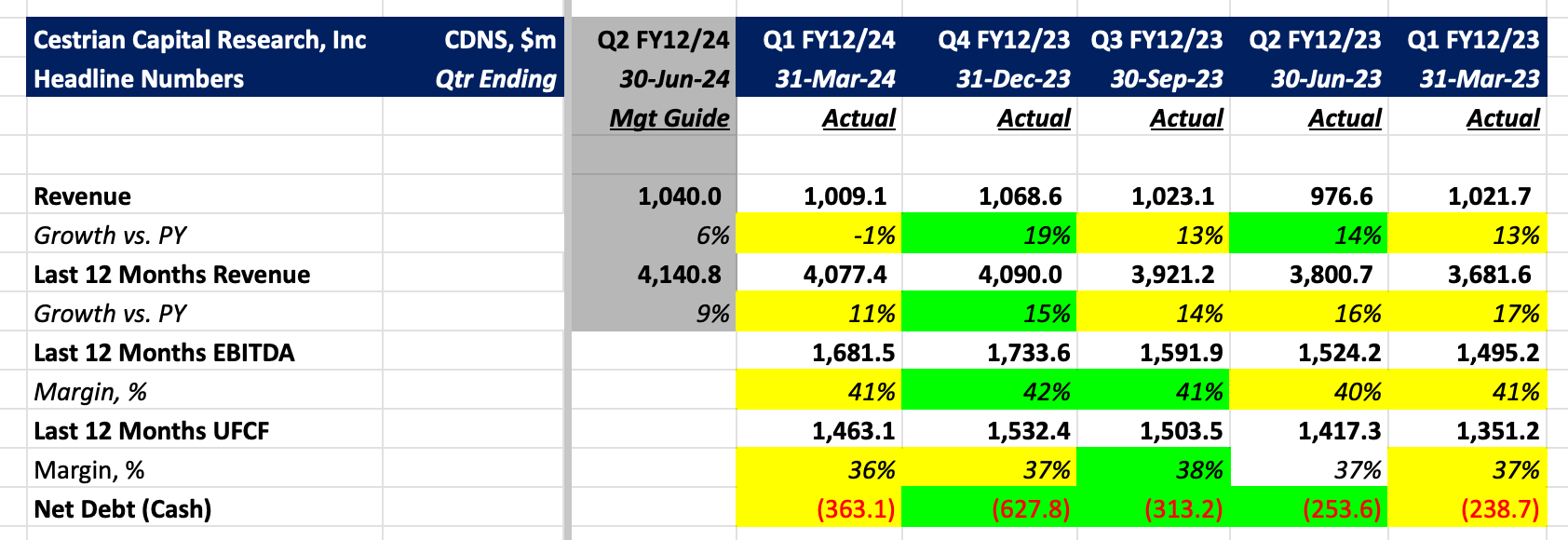

Cadence’s Q1 was somewhat ho-hum on the revenue line, more encouraging as regards the order book. Below we lay out the headline numbers (before the paywall) and then take a look at the detailed financials, valuation analysis and our stock price projection, technical analysis and rating (after the paywall).

If you’re a free reader here, and you’d like to access the post-paywall stuff, you can sign up below either for our entry-level ‘Market Insight’ tier, or our full-monty ‘Inner Circle’ service. If you have any problems doing so, or you’d like to know more about what the pay services offer, you can reach us anytime using the contact form on this site, here.

CDNS Headline Financials