DataDog Q2 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

What Recession?

by Alex King, CEO, Cestrian Capital Research, Inc

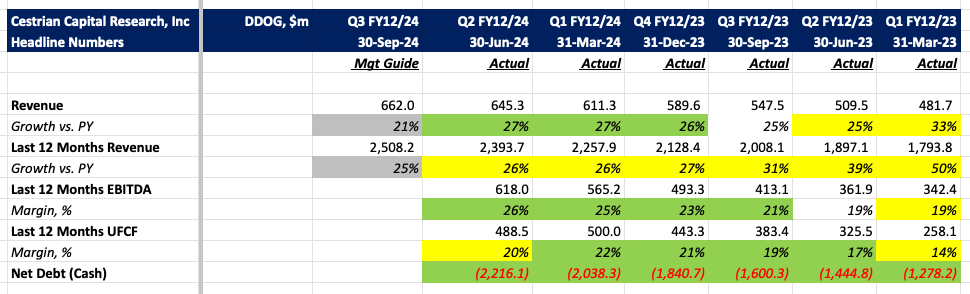

DataDog revenue growth has held steady at around 25-27% p.a. now for the last four quarters. The company is clocking in around $2.4bn of TTM revenue so the growth rate is solid for the size of company. The Q3 guide is for a drop to the 21% level; and growth in the order book as measured by Remaining Performance Obligation (RPO) fell to +43% this quarter (from +52% last quarter), so there may be some clouds on the horizon, but so far all looks healthy. Generally speaking with niche infrastructure vendors like this you have to look for slowing growth across the board - eg. at Dynatrace ($DT) and other competitors - to see if the category is reaching saturation point amongst target customers. Whilst the headline numbers and order book slowing suggest this may be an issue, a nugget in the company’s earnings release to the contrary caught my eye. The company stated that amongst their customers using GPU-based servers in their datacenters, the spend per instance was 40% higher (the comparator was unsaid but I presume this means GPU drives +40% spend on monitoring compared to CPU). I would expect that the number and complexity of GPU-based systems being monitored by DataDog will continue to increase at speed, so I believe this to be bullish for the revenue line.

Here’s the headlines:

Below - available to paying subscribers of all tiers here - we review the fundamentals, the valuation, the stock chart, our rating and price target. Read on folks.