CrowdStrike Q3 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Work in Progress

By HermitWarrior a.k.a Richard Iacuelli

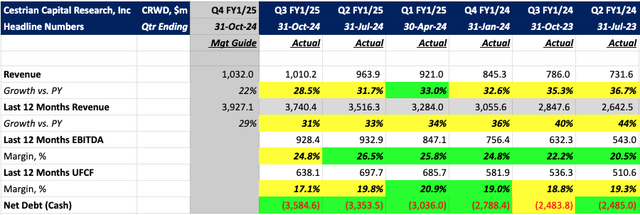

At first glance, CrowdStrike ($CRWD) seems to have weathered the fall-out from the July 19th 'Blue Screen of Death' incident quite well. Q3 revenue came in a little above guidance, the share price has recovered most of the post-incident losses, and management called out a new $4B Annual Recurring Revenue (ARR) milestone, while touting one $multi-million win after another on the recent earnings call.

Under the surface however, it's probably more accurate to describe the process of digging themselves out of the hole that was July 19th as a 'work in progress'. Here are the headlines.

Revenue growth continued to slow, and Q4 guidance suggests it will decelerate further, if anything at a sharper pace, from 28% to 22% in Q4 at the midpoint. This is in contrast to 32.5% year on year revenue growth in Q4 of last year. Yes, it's normal to see growth rates slow as an organization scales however the pace and trajectory of the slowdown speaks to something else going on. Should growth continue to slow, questions will be asked around CRWD's ability to hit its $10B ARR target for FY31. Note that ARR is not a GAAP measure; it's a way for management to illustrate a trend-line for revenue growth: ARR up, revenue growth should follow.