Crowdstrike Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Plenty Of Other Stocks To Be Had

by Alex King, CEO, Cestrian Capital Research, Inc.

When a company hits material problems - as Crowdstrike did recently with its Blue Screen Of Death event that made it a household name - you have two choices I think. One, form a view as to “how much of a big deal is this” and then take a view on what that means for prices at which you might buy or sell. Or two, declare “this one is too much trouble” and go looking for another thing in which to invest or to trade. Personally I tend to the latter. In times of trouble, the stocks you own aren’t your family or friends. They don’t know who you are, and if they did, they wouldn’t care, because they are just stocks. If George Kurtz is a buddy of yours and you want to show solidarity? Sure, buy up the stock at the lows. If CRWD is just another ticker - why take the risk? My assumption is that there will be dues to pay from their BSOD moment, either in the form of customer compensation or in the form of a materially reduced rate of growth in their order book and therefore, over time, the revenue line. So for me I file this one under “too difficult” and go looking elsewhere.

We rated CRWD at Accumulate between $90-135/share, then at Hold above that level. We moved from Hold to Distribute rating on 19 July - the stock closed at $305 that day, then dropped to $200 during The Yen-d Of The World on Aug 5/6, and now sits at $258 in pre-market. We now move to Do Nothing rating, on the assumption that anyone reading our work would have decided what to do about that Distribute rating by now.

The stock could go up, down, or sideways, I don’t know. But there are a lot of other stocks in this world. Personally I don’t want to sit around hoping that survives Blue Screen Day intact; I would rather not care, so I have no holdings nor planning holdings in this one myself.

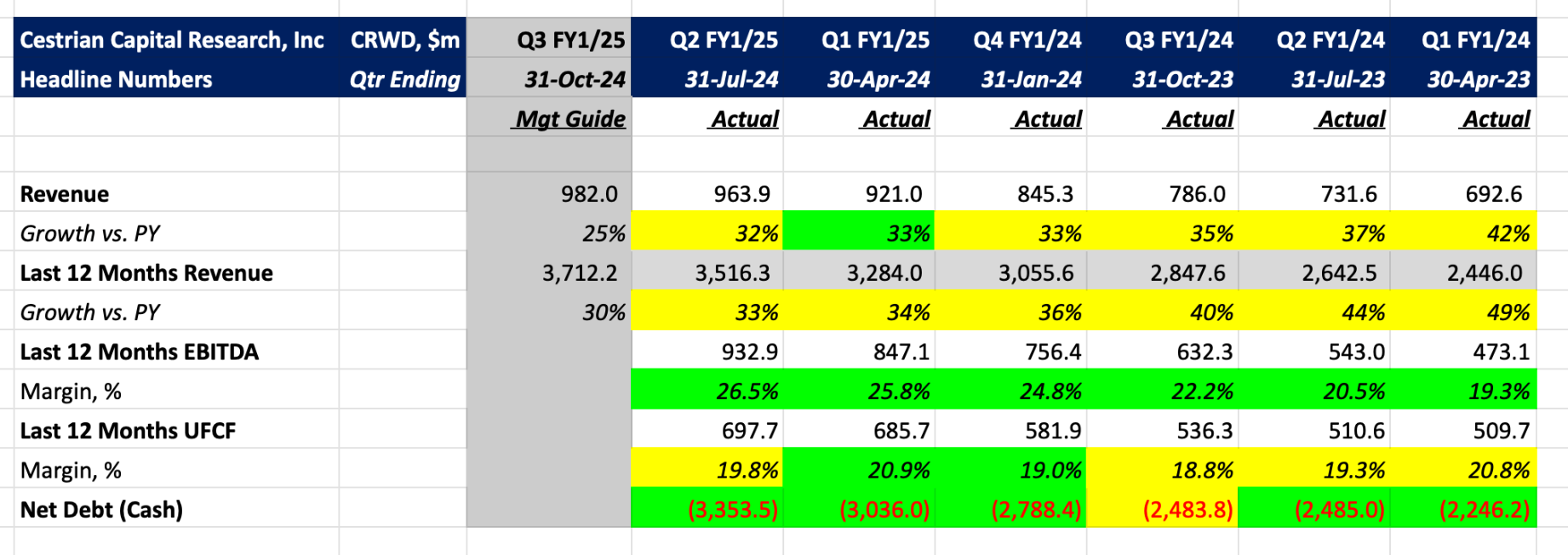

Headline Fundamentals

Now the detail. Want to dig into this? Ask us in Slack chat if you're an Inner Circle member.