CrowdStrike (No Paywall)

Moving To Distribute Rating; Removing From Our High Beta Model Portfolio

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Could Go Either Way - Why Wait To Find Out?

by Alex King

Every piece of analysis one could conduct as regards Crowdstrike's business, its stock price, and the ramifications of last week's calamitous product failure, can be summed up in this meme:

It is possible that the company prospers after a period in purgatory; possible that the stock moons after a selloff; but it's also possible that the opposite happens. And from a securities analysis perspective my own view is, why take the risk? There are so many other places to put money to work, why wait to find out how the company and its stock makes it through - particularly since the stock is already at an extended price, way above where we rated it at Accumulate?

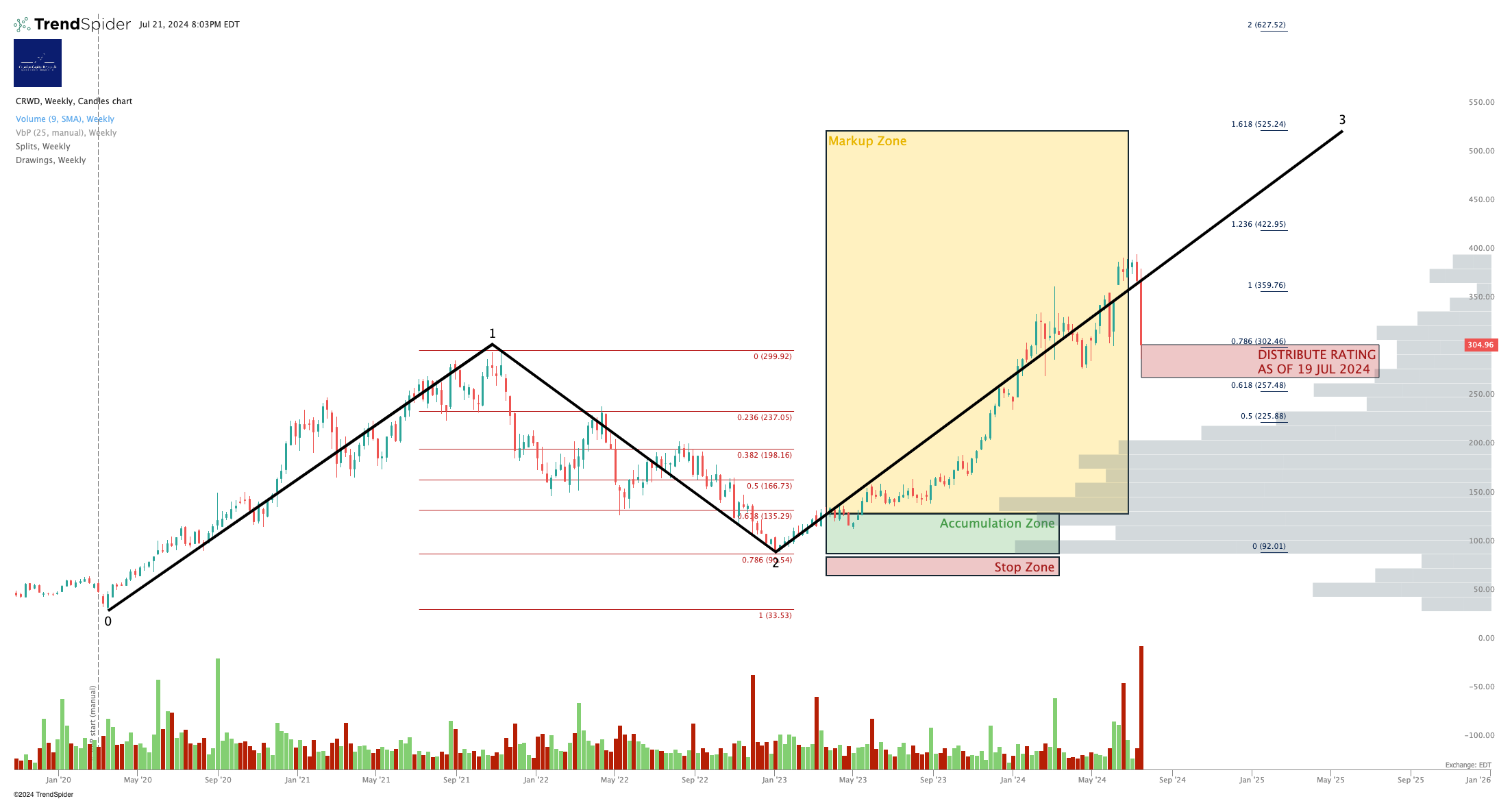

We had rated $CRWD at Accumulate between $90-135/share so anyone buying at the top of our Accumulation Zone may as of Friday be around 125% in profit, and if buying at the low end of our Accumulation Zone, may be at around 235% in profit. We had thought the stock could reach $525 in time but now see that as a very long haul and perhaps unachievable.

So we take the following actions:

- Move from "Hold" to "Distribute" rating

- Remove the stock from our High Beta Model Portfolio (our model portfolios are available to Inner Circle and RIA - Insight Pro susbcribers).

Numbers are as per our most recent earnings report (here).

Chart is as follows - you can open a full page version, here:

Any questions, reach out in comments to this note, in Slack Chat (Inner Circle subscribers only), or using the contact form on our website (here: https://www.cestriancapitalresearch.com/contact/ ).

Cestrian Capital Research, Inc - 21 July 2024

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold no positions in $CRWD.