Cloudflare Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Best Foot Forward

By Hermit Warrior, aka Richard Iacuelli

"Lead with that next time" is the cliched line in a typical movie scene when the most important information should have been said first, not last. I think Cloudflare ($NET) got the message - and pushed it loud and clear this quarter.

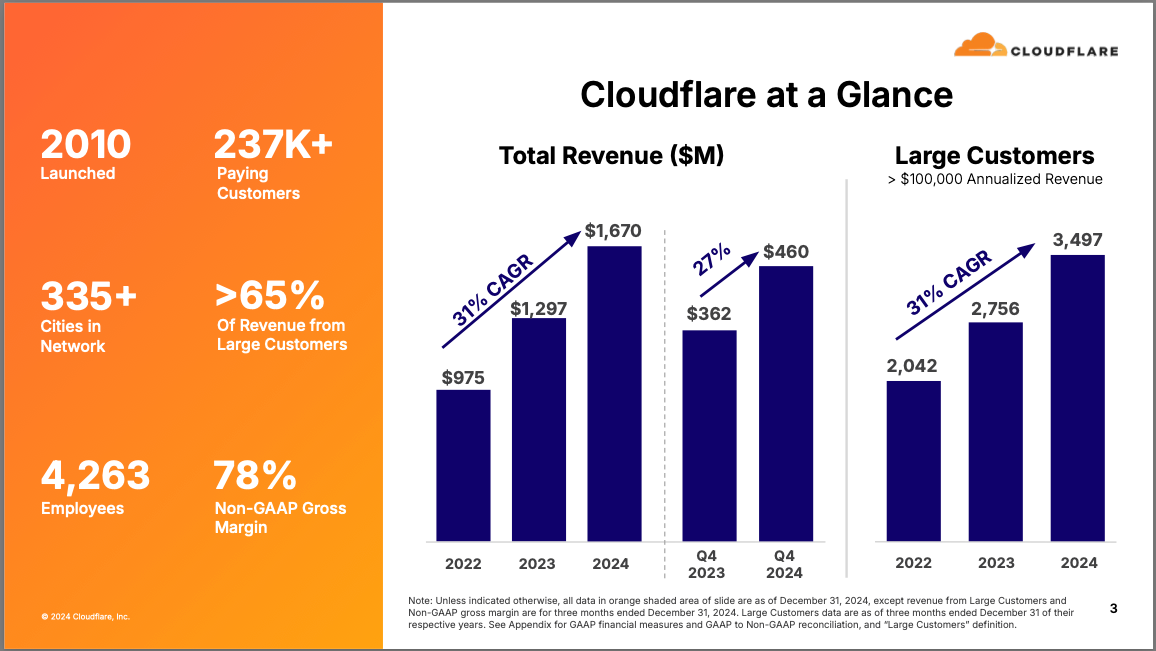

That most important piece of information - the growth in Large Customers with >$100K Revenue - featured prominently in their earnings presentation, starting with the first slide.

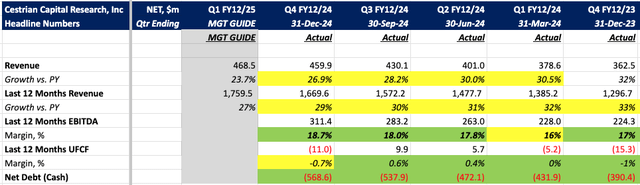

The earnings print was not bad, but not exceptional either. Here's the Headlines.

Revenue growth came in a little above the guide at 27% but was down from 28% the previous quarter. The guide for Q1 is for 24% growth QoQ, a step down from the 27% QoQ growth in Q3.