Citigroup (C) Q1 FY24 Earnings Review - Coverage Initiation

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Yimin Xu, Jun 03 2024

Citigroup’s Overall Business Model and Activities

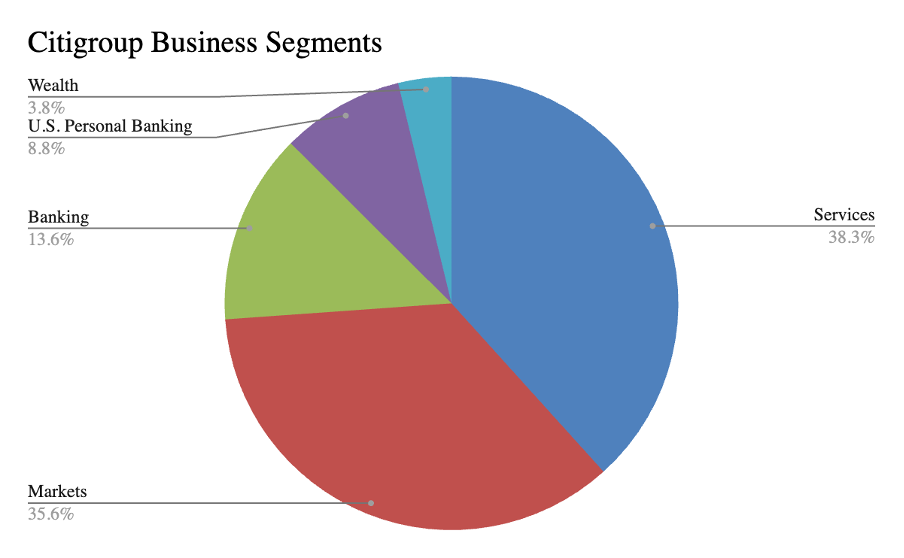

Citigroup (“Citi”) operates five main business segments: banking, markets, services, wealth, and US Personal banking.

Banking provides investment banking, corporate lending, and advisory services.

Markets engage in fixed income, equities, and spread products trading.

Services include Treasury and Trade Solutions (TTS) and Securities Services.

Wealth focuses on wealth management services, including investment fee revenues.

US Personal Banking (USPB) comprises branded cards, retail services, and retail banking.

For those who are curious about the insider life on Citi’s trading floor, I recommend Gary Stevenson’s latest book, “The Trading Game: A Confession”. Several years older than me, Gary and I share incredibly similar career backgrounds – we both went to the London School of Economics and traded FX swaps and Short-Term Interest Rate Swaps (STIR) in London, before quitting “the game”. Recognising almost every detail of his version of life on London’s trading floor (as well as LSE), I assure you nothing was of exaggeration.