Chevron Corp Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Yawn

By Alex King, CEO, Cestrian Capital Research, Inc.

The reason that so few people follow the Wyckoff Rotation system (here) is that it takes tooooooo long to generate results for most folks. But if you have multiple stocks - or indeed multiple sectors - that you invest in, each of which are at different phases in the cycle, then you can be generating positive returns at an account level most of the time, even when certain sectors and/or stocks are doing nothing much. Here's an illustration which I asked Gemini to draw for me.

Prompt: "draw a stock chart illustrating Wyckoff rotation with two stocks"

Energy, I think, is under accumulation. I say I think because an accumulation pattern (sideways, rangebound, high volume) looks a lot like a distribution pattern (sideways, rangebound, high volume) and you have to guess which it is. When I say guess, I mean apply some judicious analysis, of course.

You can see this in CVX, in XLE, in USO. OXY breaks the mold somewhat as I noted yesterday.

So, let's check in on CVX.

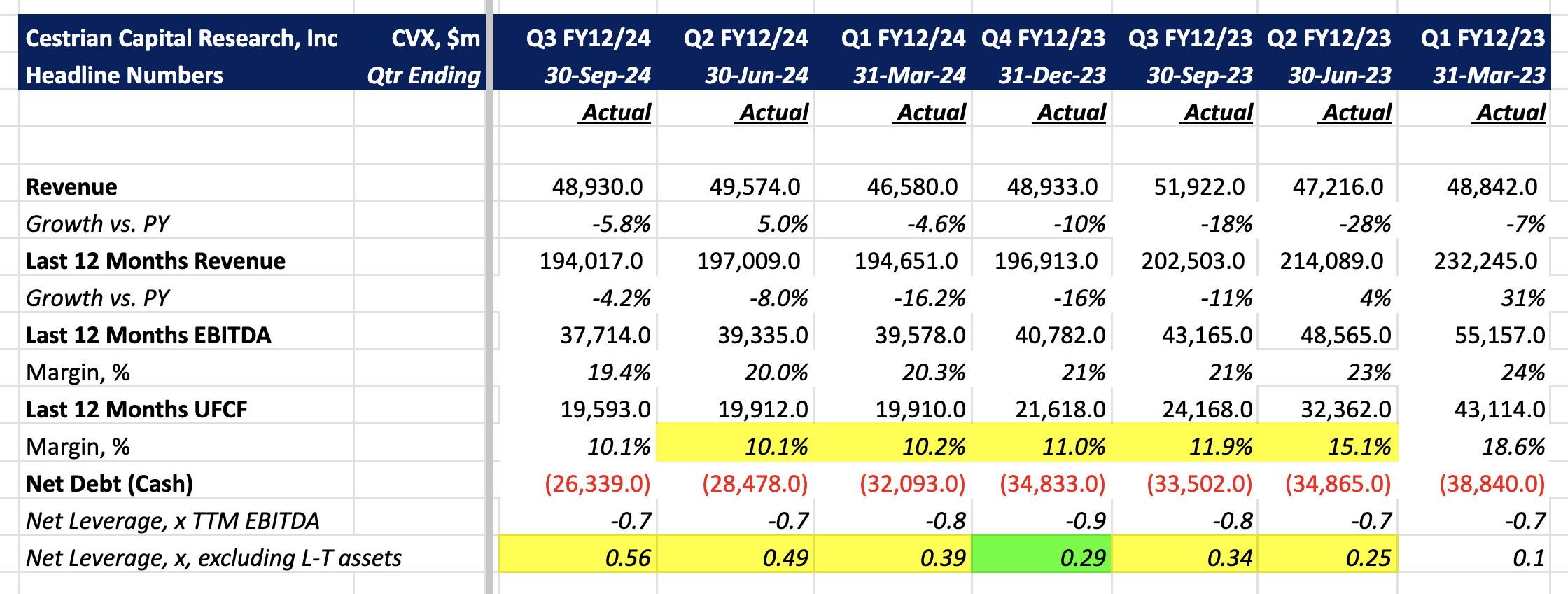

Financial Summary

Here’s the headlines.

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.