But We’re Ohana! Stop Selling! (CRM Q1 FY1/25 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Salesforce Q1 FY1/25 Earnings Review

Salesforce is Oracle is IBM. Everybody knows this, including Marc Benioff, since he is no-one’s fool. To keep the plates spinning atop the Eye of Sauron down there at 415 Mission, what CRM needs is acquisitions, and a series of them. That keeps the optics of growth up and as long as the management team can continue their tradition of being able to integrate the new units whilst continuing to grow margins over time, all should be well. That’s what Oracle is these days, a kind of old folks’ home where software companies go to stay when independent living becomes too difficult. And that has worked out just fine for ORCL stock.

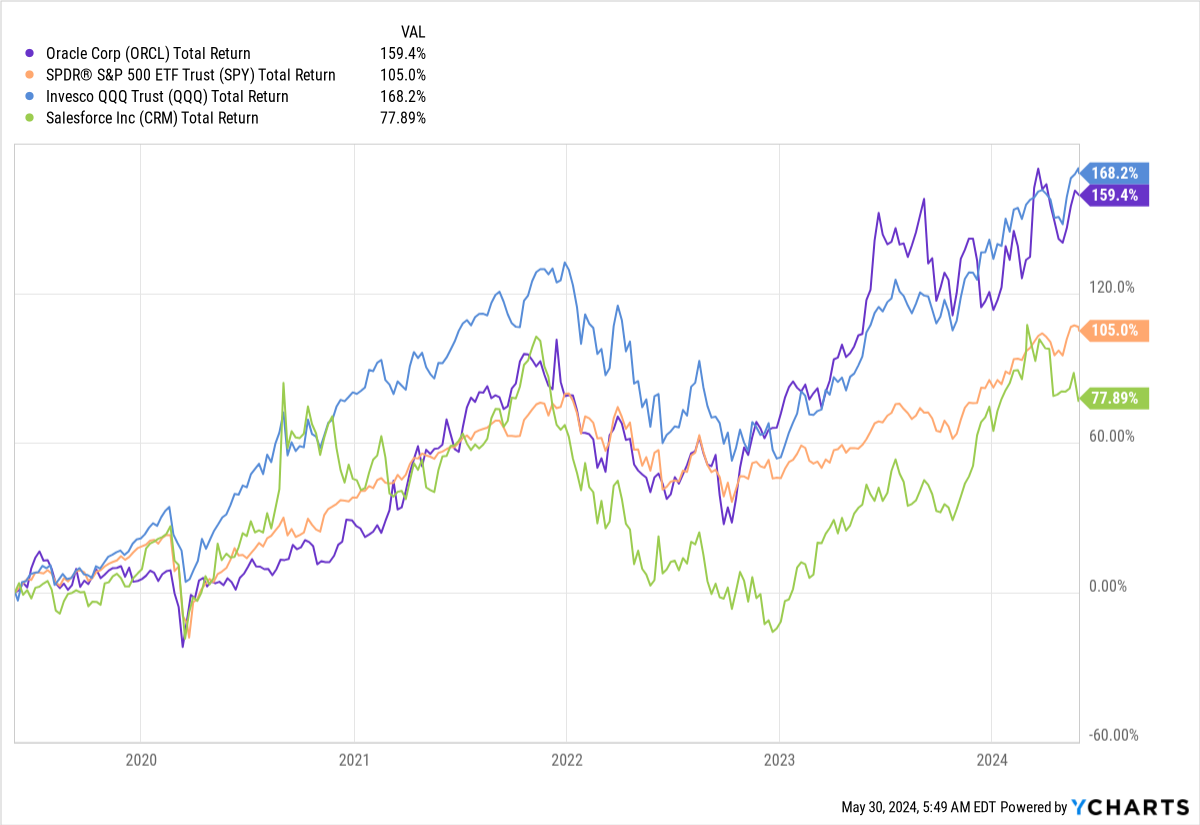

Sporadic acquisitions with declining organic growth at CRM though has meant the stock has underperformed the S&P these last five years - this is primarily a result of a colossal selloff in 2022 (overdone in my view, but who am I to say?).

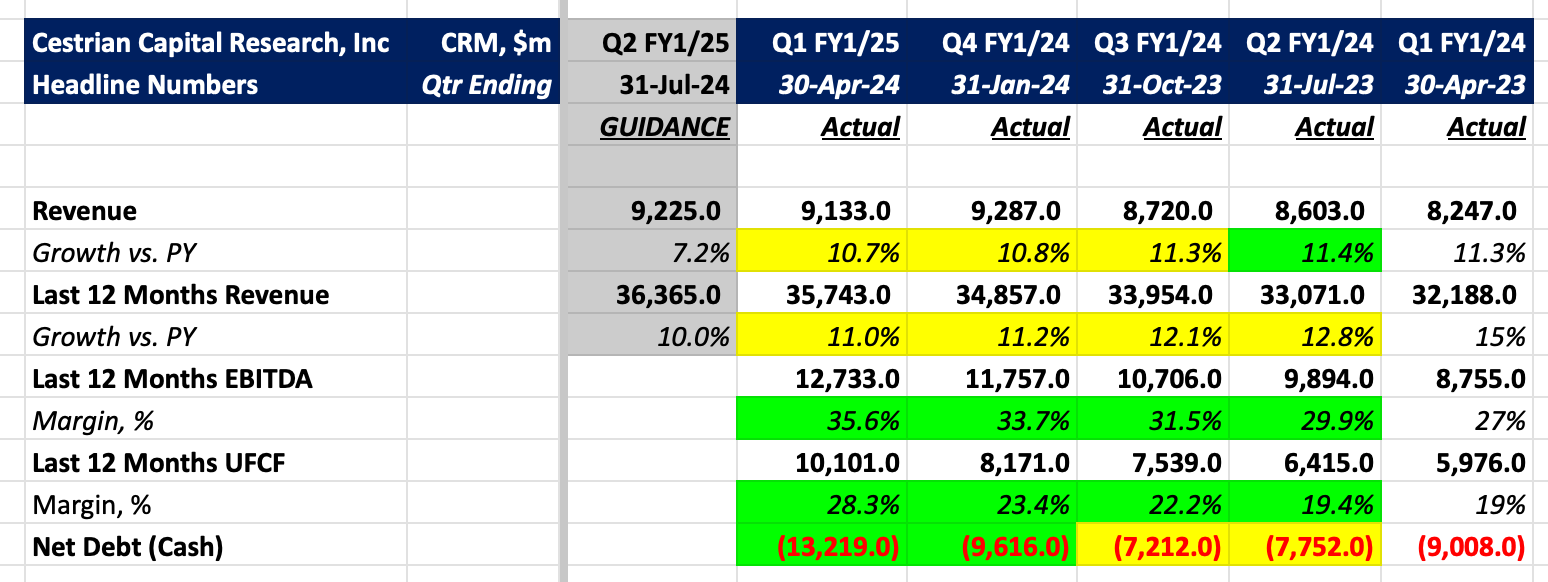

Nothing in the CRM earnings report yesterday is likely to change this picture near term. The quarter was fine, good even - a modest slowdown in revenue growth but we are talking 0.1% change on the YoY growth rate achieved last quarter here, barely noticeable. EBITDA and particularly cashflow margins were very strong and net cash moved up materially. Yet the stock dumped some 16% on the print. That the company missed its own revenue guide for the quarter probably didn’t help.

Below we lay out the fundamental financials, valuation metrics, our stock rating and price targets.