Broadcom Q3 FY10/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Grab Bag Of Tech Remnants Keeps On Truckin

by Alex King, CEO, Cestrian Capital Research, Inc.

We can call Broadcom $AVGO a major player in AI if we like (because the name harks back to the original $BRCM, a white-hot chip stock when the Internet was young), or we can think of it as a grab-bag of stuff including virtualization software and other ageing cashflow streams. You choose.

For me I think there is no point trying to analyze fundamentals on a trend basis - there are too many weird and wonderful acquisitions for that, unless you have the ability to craft pro-forma accounts - and since nobody that doesn’t live in the bowels of the CFO’s office can do that, we won’t try.

This is in essence a large leveraged buyout with a tradable ticker. Nothing wrong with that as long as you know it if you own it or are thinking of owning it.

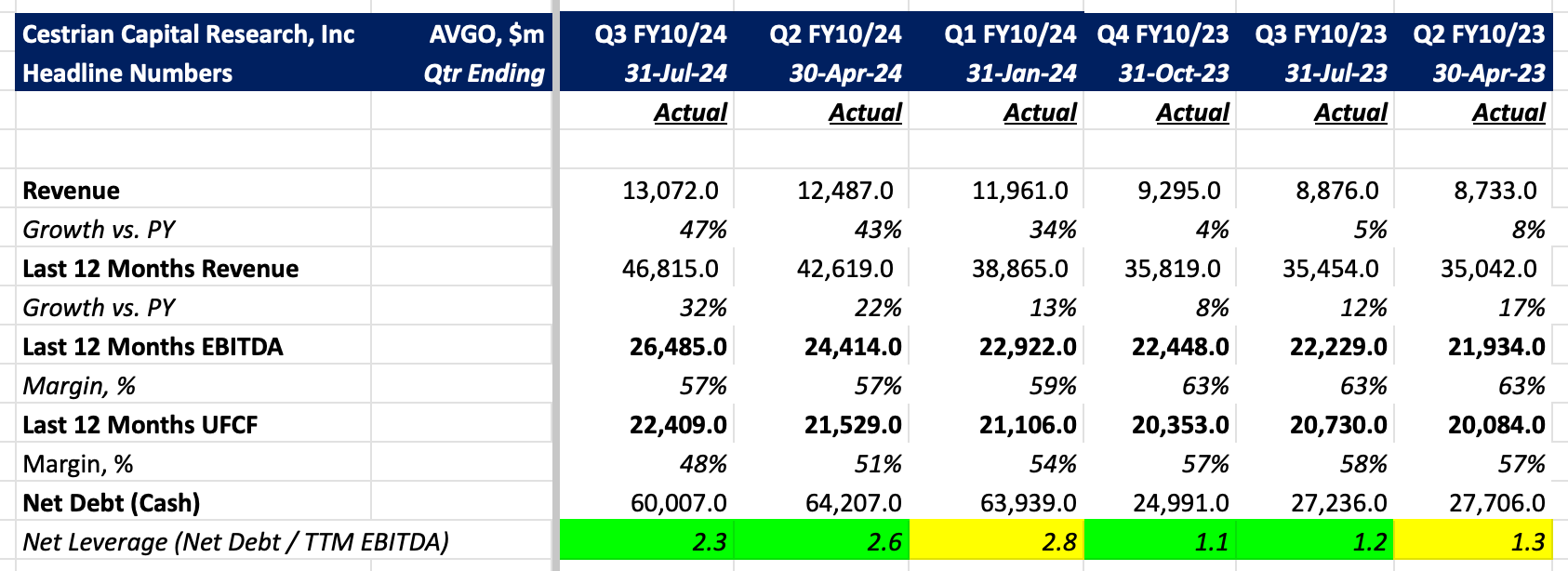

The easiest way I can think of to analyze an LBO from the outside is to watch (1) the total revenue line - up is good (2) the EBITDA and in particular unlevered pretax FCF margins - up is good (3) the net leverage (ie. Net Debt / TTM EBITDA) - down is good and (4) the share count - down is good.

Here’s $AVGO headlines.

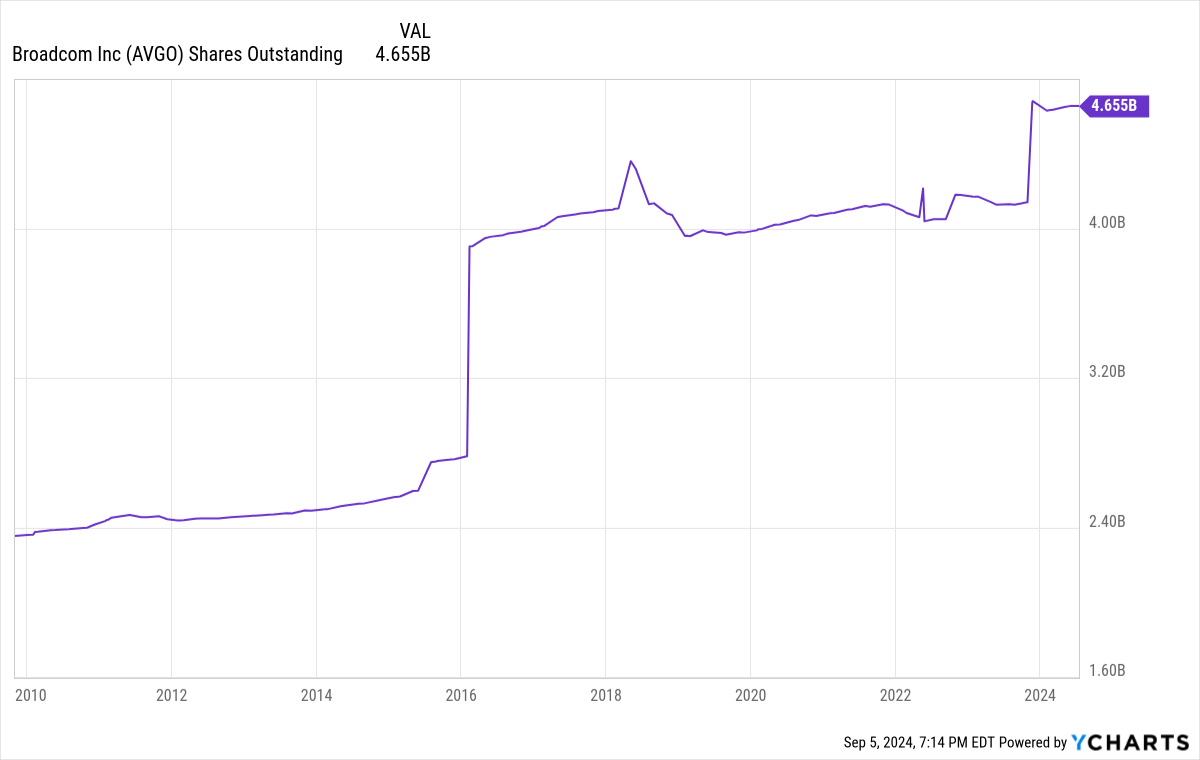

And here’s the share count. What you want to see is that after each acquisition involving stock (which will cause a big jump up in the share count), the number ticks down due to buybacks or at least trends somewhat sideways whilst leverage falls and the balance sheet strengthens. So far this has more or less happened.

So, read on!