Boeing Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

In The End, Leverage Bites Everyone

by Alex King, CEO, Cestrian Capital Research, Inc

Want to know why Boeing just sold $10bn-worth of software assets to a private equity firm?

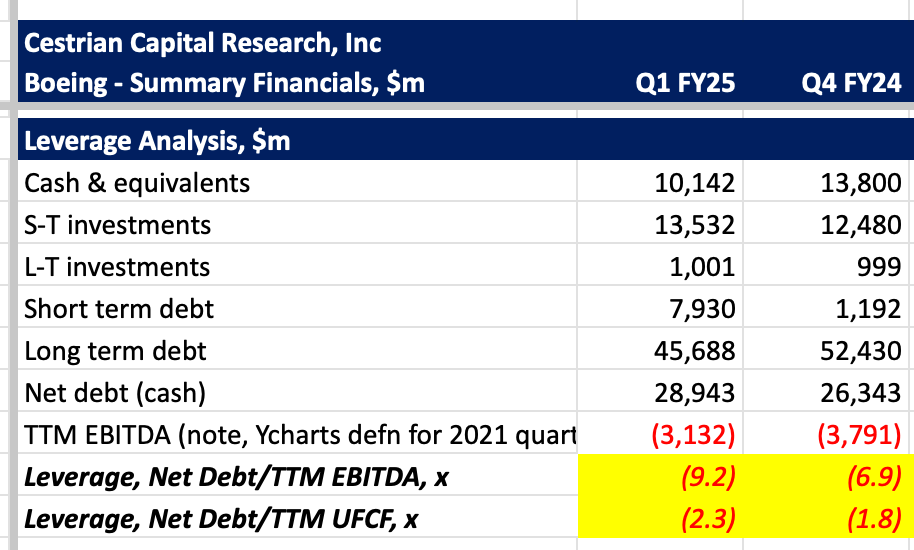

This is why:

You see that line labeled “short term debt”? The full title of which should be, "short-term and short-term portion of long-term debt”? As you can see it jumps up by a little shy of $7bn from Q4 last year, meaning that an additional $7bn-ish of debt just fell due to be paid during 2025. With $10bn in cash on the balance sheet and heavily negative cashflow, there are only two ways Boeing can reliably make that payment. One, issue new equity, to the consternation of all; or two, sell some stuff to free up cash. So they did the second thing. You can read the details here but in essence this is a $10.6bn all-cash sale due to close in 2025 which I would expect to encounter few if any anti-trust roadblocks. Assuming it closes, this will kick the “solvency” question down the road for year or so.

Let’s take a look at the rest of Boeing’s numbers, its valuation and stock charts.