Autodesk Q4 FY1/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Technicals Made Me Sell, Fundamentals Made Me Glad I Did

by Alex King

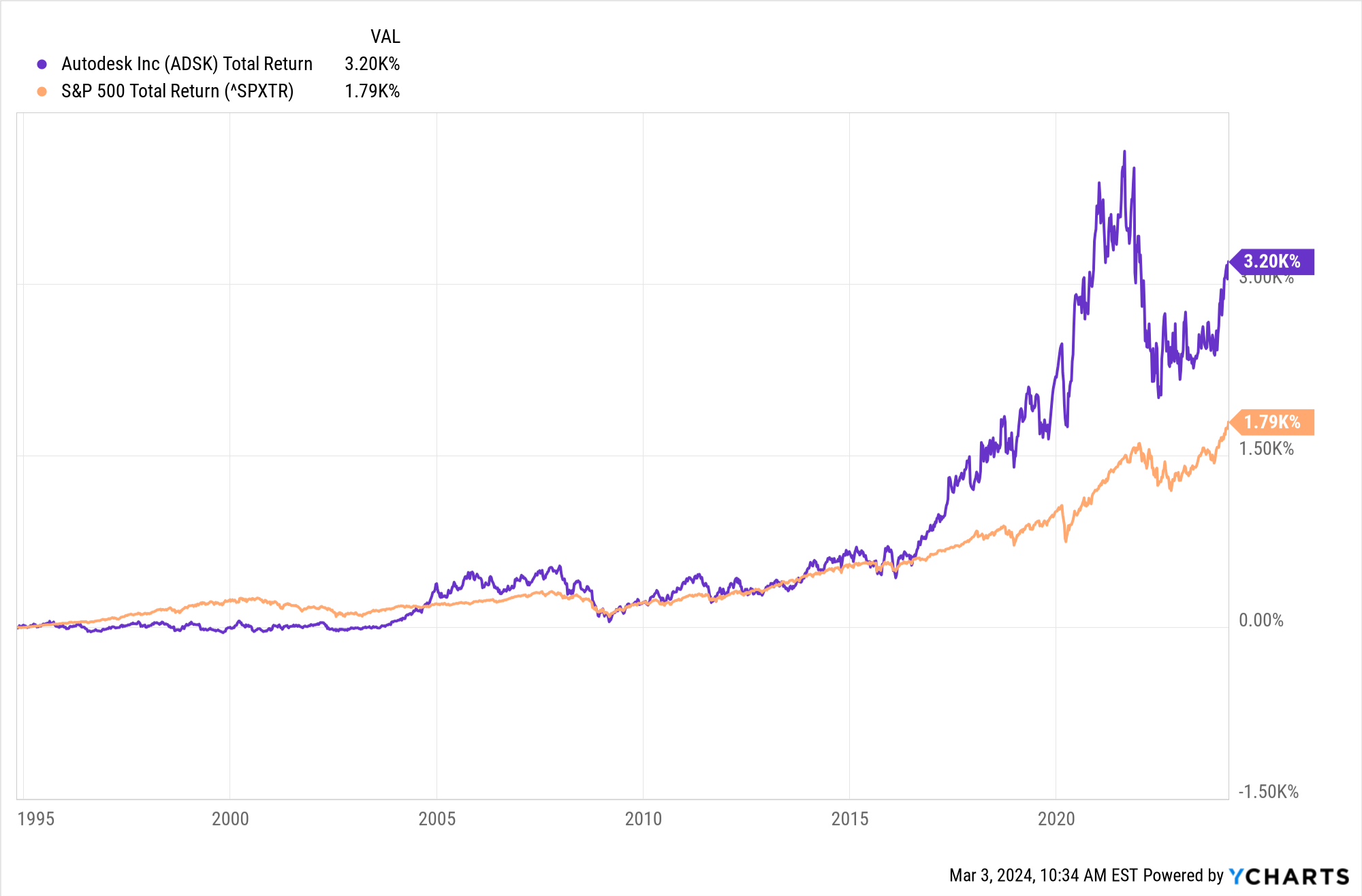

Autodesk (ADSK) is a long-established software business, founded in San Francisco, CA in 1982 and now based in San Rafael, CA. The company sells computer-aided design software to multiple vertical markets, from construction to movies. The company is a long-run grower, and the stock has followed suit. Here's the stock vs. the S&P500 in the last thirty years, on a total return basis (ie. dividends re-invested).

Personally, I opened a new position in Autodesk stock in July 2023 - the stock was in our Accumulation Zone at the time - and I sold last week right after earnings. That may prove to have been too cautious, we shall see. I sold without having looked at the earnings print - the stock reached a typical Wave 3 high in the post-market session - but having seen the fundamentals I am happy to have taken profits.

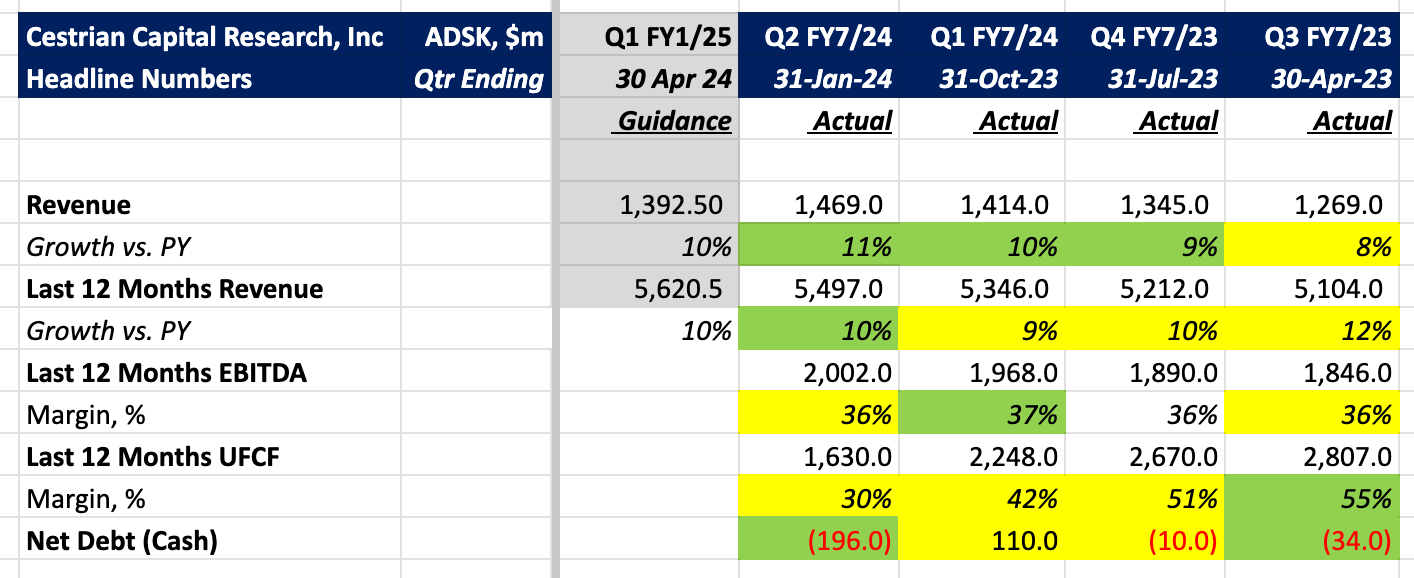

We'll get to those charts below, but for now, here’s the headline numbers as of this quarter.

In short:

- Revenue growth ticked up a little this quarter, 11% vs PY for the quarter and +10% vs PY on a trailing twelve month basis.

- TTM EBITDA margins have been stable at 36-37% for a year or so.

- TTM unlevered pretax free cashflow declined quite a bit, from +55% margins in the April 2023 quarter (that's unusually high for a company of this type by the way) to +30% in this quarter (which is unusually low).

Let's turn to the stock price outlook, more detailed financials, valuation analysis, and our rating.

Read on!