Autodesk Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Lesson Two

by Alex King, CEO, Cestrian Capital Research, Inc.

There are, when it comes down to it, only three things you have to do when running a company. Assuming some bright spark already thought of a viable product or two.

1 - Sell more stuff

2 - Spend less money

3 - Collect cash faster

Everything else is just the McKinsey'd-up version thereof.

In that light, let's look at Autodesk ($ADSK). If you're unfamiliar with this old-timer, it's the design software company whose software is used to design about half of the things in the world, more or less. Established in 1982, the company has innovated and acquired its way to stay ahead and remain relevant as the world has changed. When the world moved to subscription revenue, for instance, so too did $ADSK, with a little help in the shape of activist investors.

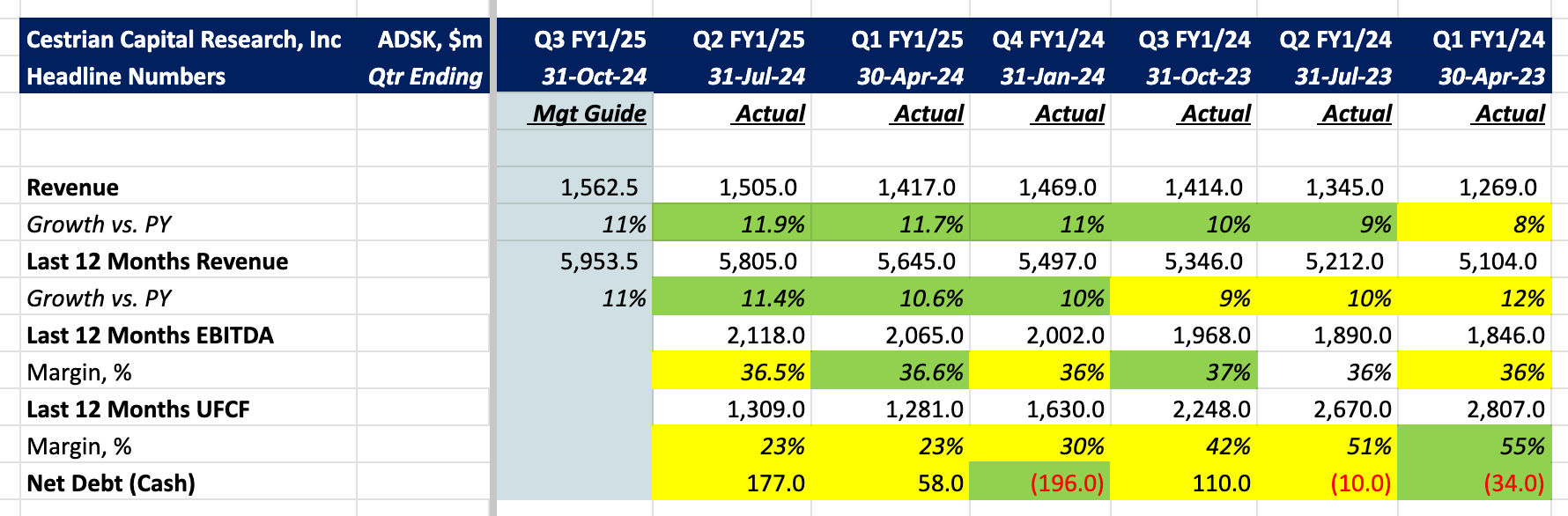

I don't think any economist would support my view that if Autodesk revenue growth is accelerating, probably nothing much is wrong with the US economy, but it's a view I stick to. In 2022 when there was a lot of belt-tightening due to inflation that remained persistent and base rates that only went up, growth rates at ADSK fell from 18% in the October 2021 quarter to just 8% in the April 2023 quarter. Since then, growth rates have accelerated each quarter, including the 31 July 2024 quarter just printed. That is bullish for ADSK and it's bullish for the market I think.

Here’s $ADSK headlines.

Read on for the financial detail, valuation, our stock chart and rating! Any paid subscription here gets you the full note.