Autodesk Q1 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

If (Recession =0), Then (ADSK =Up). Probably.

by Alex King, CEO, Cestrian Capital Research, Inc.

In my mind, even if not in anyone else's, the Autodesk revenue growth rate isn't a bad indicator of the health of the US economy. At its most basic level, if companies are committing to capex projects, be they buildings or new electronic systems designs, then producer confidence is high, and if producer confidence is high, probably the economy is OK. You're welcome.

For a boring old software v1.0 company, Autodesk has more than its fair share of drama. In recent years we've seen revenue model shifts, activist shareholder involvement, late SEC filings, all that. It's almost as if the management team are so bored by going to work to do exactly the same thing all day for the last 30 years that they have to think up things to do to liven up the day. In any event this has thus far provided some buyable dips.

The quarter just printed was good, solid, fine. Not exciting. Fine. Just like the company itself. But since not everything can be Nvidia, sometimes boring is good and has a place in one's portfolio.

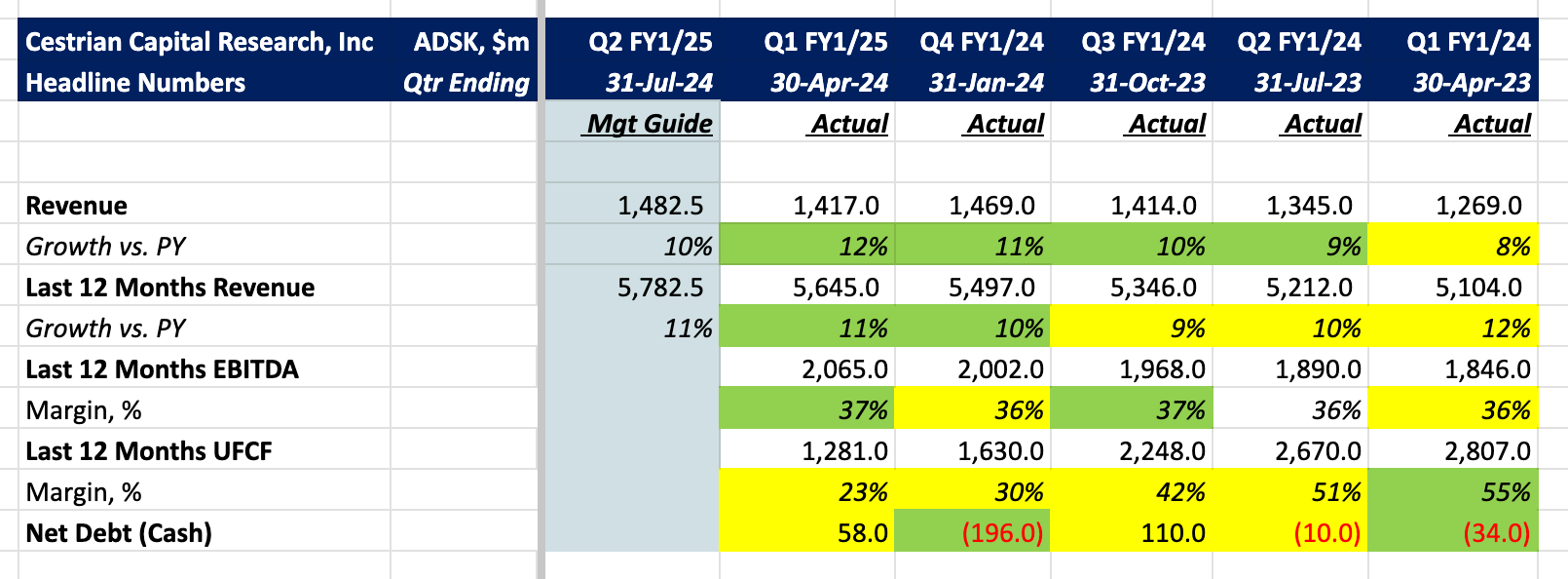

Here's the headline numbers just printed.

Below - available to paying subscribers of all tiers here - we review the fundamentals, the valuation, the stock chart, our rating and price target. Read on folks.