AT&T Q2 FY12/24 Earningzzzzz Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Reminder - Pays You 6% Yield For No Work

by Alex King

This quarter, $T delivered:

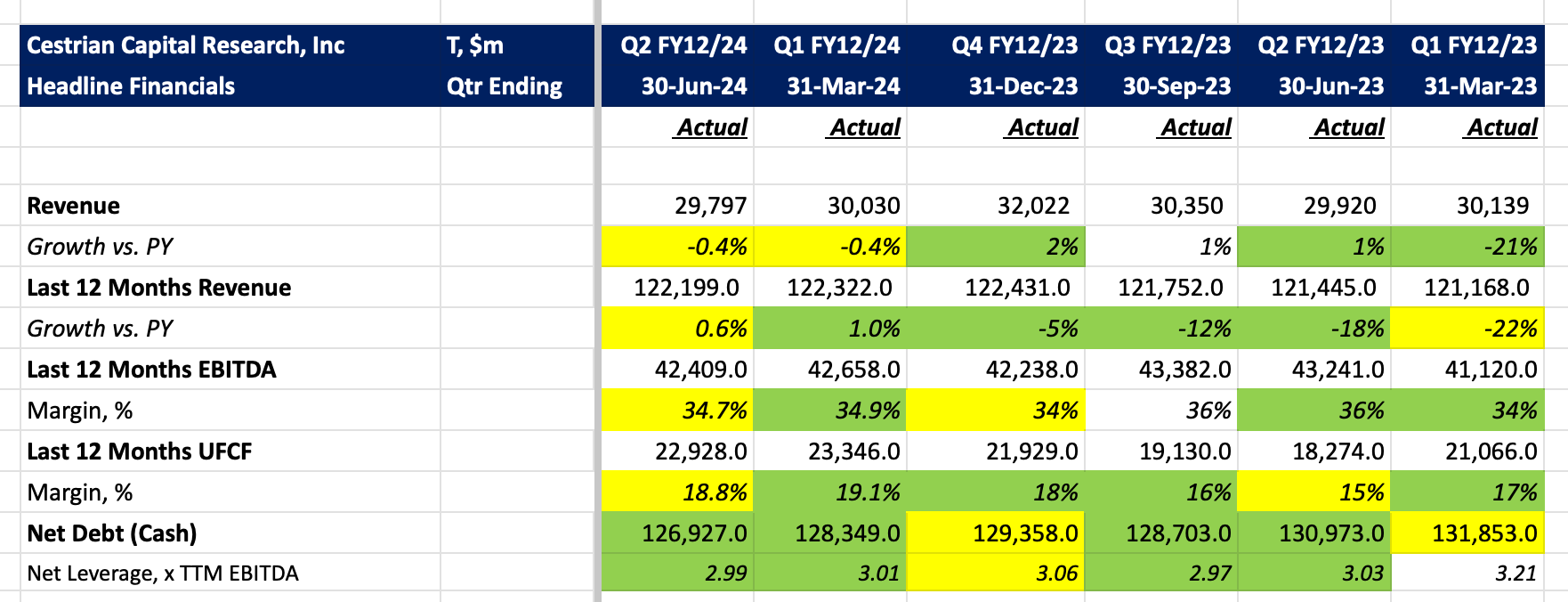

- Revenue down a touch in the quarter vs. the same quarter last year; and more or less flat vs. prior year on a TTM basis.

- Gross margins ticked up to 60% on a TTM basis - that’s a recent high - as far back as 2018 this has not been matched.

- TTM EBITDA and TTM unlevered pretax free cashflow margins both down a little to 34.7% and 18.8% respectively; nothing to worry about at this stage.

- Net debt down to $127bn or 2.99x net debt / TTM EBITDA leverage.

In short - meh. Nothing to see here, move along.

Here’s the headline numbers as of this quarter.

Paying subscribers, scroll down for our price target, rating, fundamental and technical analysis. Yet to join us as a paying subscriber? Choose your tier from the links below. If it's Inner Circle you're interested in, join up in July - prices rise 1 August.