As Easy As … Oh, Wait. Market On Close, Friday 26 July

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Was That It? Is It Safe Now?

by Alex King

Well, that was a tough week to navigate. Speaking personally I came out ahead but it took about a month’s worth of work crammed into about a week! What I like about the long/short hedged ETF model we use in our Inner Circle service is that you can be wrong, a lot, and still come out on top.

Here’s an extract from the real-time trade disclosure alerts we post in the service, before any Cestrian staff personal account places trades in any stock or ETFs that we cover. Coupled with our extensive teaching on the hedged trading model - some from us but a lot from skilled members of our community - Inner Circle is a great resource that anyone can use to raise their game - whether you run $10bn of other peoples’ money or $10k of your own.

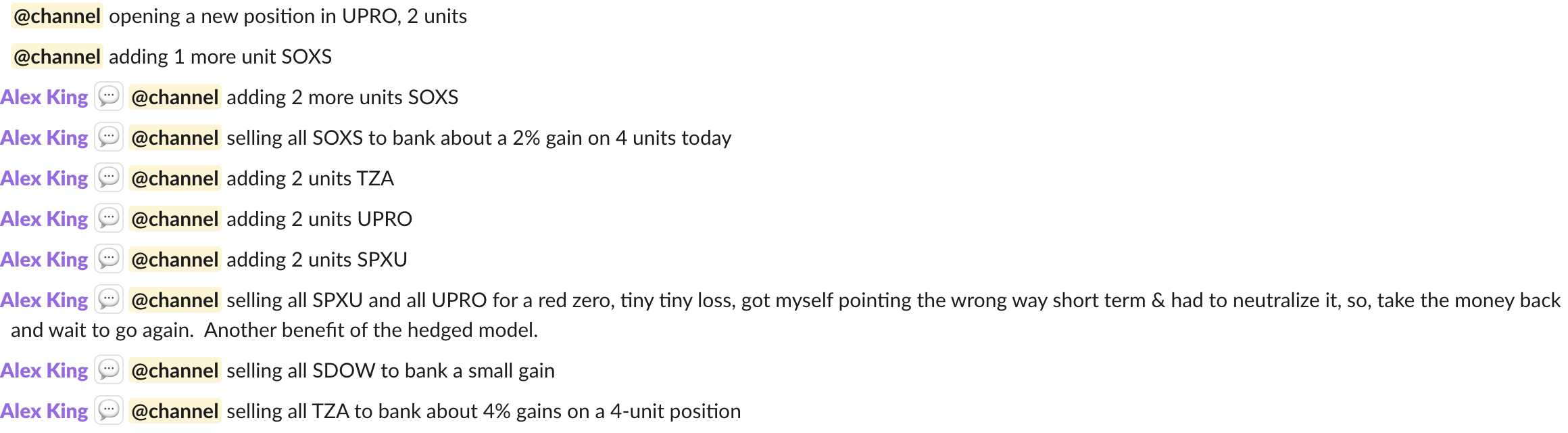

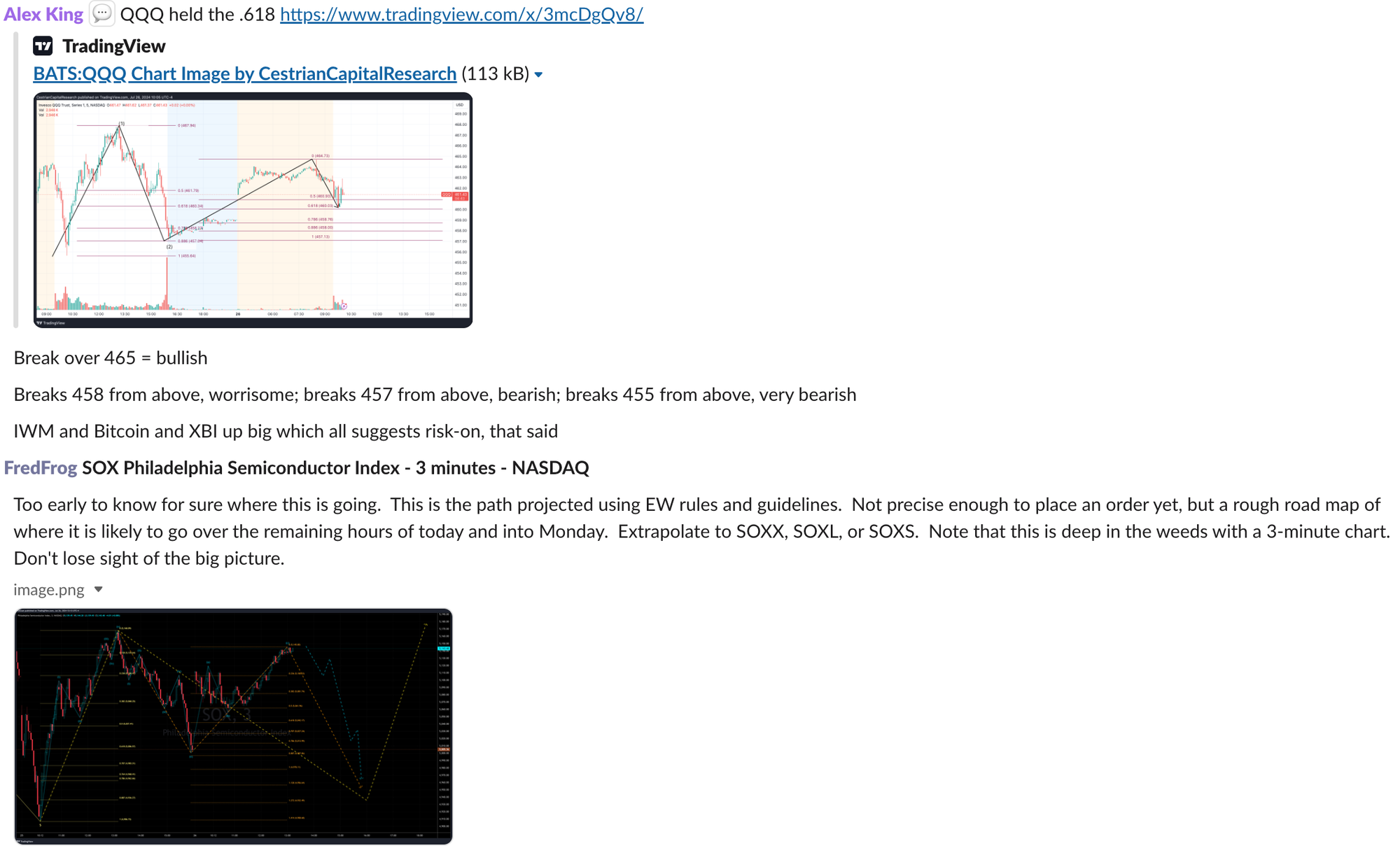

Every day we post our Market On Open notes showing how we think the key indices and other instruments are setting up that day. As the day progresses we often post short-term updates, like this:

You can use this work for real-time trading; and you can use it to set your course in longer-term investing.

If you’d like to join our Inner Circle service, consider doing so in what remains of July; prices rise 1 August. You can sign up right here:

Remember, just a few days to go before prices rise.

So Let’s Get To Work

As always in our market notes, we deal with long- and short-term charts covering the main US equity indices - that’s the S&P500, Nasdaq-100, Dow Jones-30, and the Russell 2000 - plus bonds, volatility, oil, and key sector ETFs. You can use these daily notes to help you navigate long-term investments, and/or to help you action short-term trading. Any paid-tier subscription here gets you these notes every trading day.