ARM Q1 FY3/25 Earnings Review (No Paywall)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Choose Your Own Timeframe

by Alex King, CEO, Cestrian Capital Research, Inc

In the long term, meaning looking out over years and decades, there is one simple reason to want to own ARM Holdings ($ARM) stock in my view, and that reason is, power.

As AI and other compute loads rise, power demands in the datacenter, in the wide-area and local-area network, and on client devices, will rise inexorably. Of all the major semiconductor vendors, only ARM was built ground-up with low power in mind. This is why ARM got its first real break in mobile devices; the only at-scale CPU alternative when cellular phones started becoming more like computers (in the Stone Age, around 2000-2002!) was Intel. America’s finest tripped over its own shoelaces on cellular, because at that time smartphones and high speed radio networks were a predominantly European thing ergo unimportant; ARM, being a European company, stepped into the breach, and cemented its let’s-not-call-it-a-monopoly-let’s-call-it-compelling-market-share in mobile. By the time US cellular networks settled on wideband CDMA and its evolutions (4G, 5G), coupled with the Second Coming Of Steve Jobs courtesy of the iPhone, $INTC had wiffed comprehensively and couldn’t catch up. (Which it then did in 7nm and then in AI too!).

ARM’s opportunity and challenge is to build on its dominance in client devices and to make the leap into increasing levels of market share in server and hyperscale datacenter. Prior to the current generation of AI, this looked like a distant hope, because if you can plug your server into the mains and run old-school loads, you don’t really care that much whether you’re running an Intel or AMD CPU or an Nvidia GPU, because power costs aren’t all that silly. Cue more intensive loads and rising power costs and problems with power density and all of a sudden, if you design datacenters you are thinking about processor power requirements in some detail.

So there’s the long term opportunity. The company will make it happen or not, there is no way of knowing for sure. If you like to pick long run winners, this might be one.

Short term? There’s a reason to own ARM too, and that’s the stock chart. Depending on where it holds support post earnings. But before we get there, let’s do some numbers.

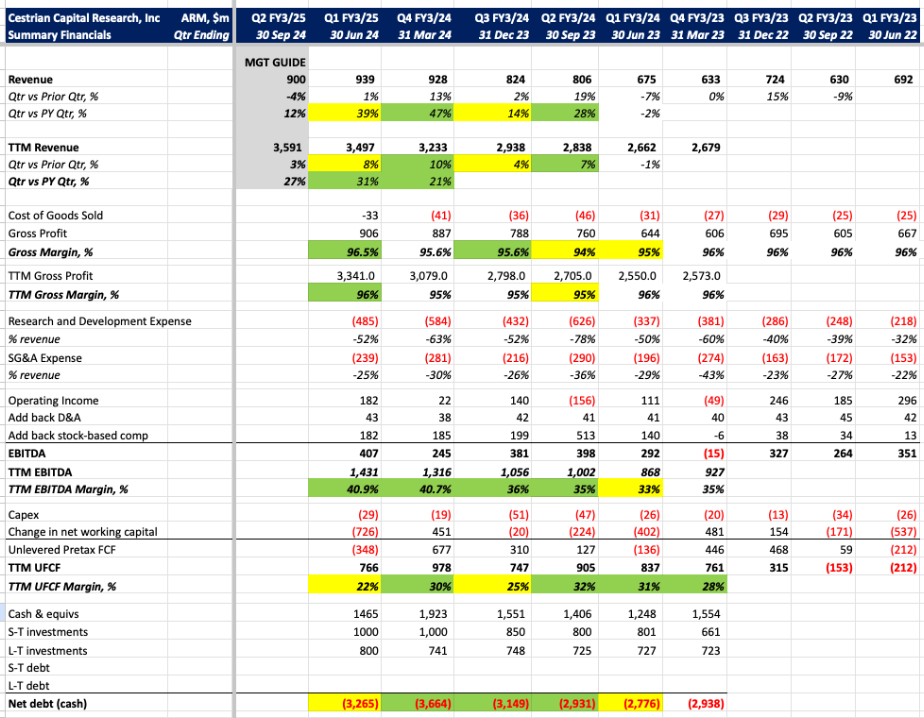

Fundamental Analysis

Here's our detailed take on ARM fundamentals. In short - growth slowed this quarter and cashflow margins took a hit. The adverse move in cashflow margins look to be a function of seasonal working capital flows - the same happened this quarter a year ago and two years ago - so that’s not a particular concern to me personally at this stage. Quarterly revenue growth is all over the place as you can see - the company has yet to establish a nice smooth quarterly pattern, likely because it’s not a US business and hasn’t yet learned how to play the US capital markets beat-and-raise game.

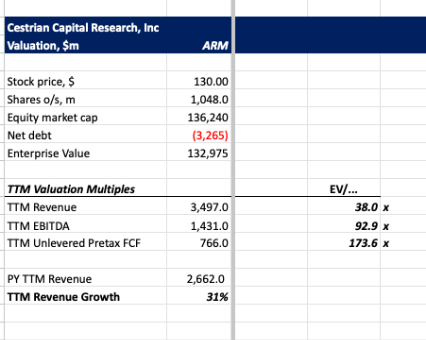

Valuation

The valuation is nuts on all multiples. It may not matter, but it is. Nuts. No two ways about it.

Technical Analysis And Rating

Righto. The main problem here is that there’s insufficient history as a traded stock for technical analysis to be much use. But we’ll try anyway. Here’s the long term chart to our eyes. You can open a full page version, here.

Now that is a beauty up to the Wave 5 top. A shallow 38.2% Wave 2 retrace, a big ole 300% Wave 3 up, a deep 61.8% Wave 4 retrace and a very bullish, outsize Wave 5 top before a substantial a-b-c correction.

If ARM holds 124 or above then the stock is likely poised for a move up. Breaks 124 from above and moves down with any gusto, the correction isn’t done in my view. Breaks 131 from below and holds over 131? Bullish in my view. Short-term (5 minute interval) chart here:

Questions?

If you have questions about any of the numbers, charts, anything, reach out in comments to this note or on social media (Twitter here, StockTwits here, LinkedIn here).

Cestrian Capital Research, Inc - 1 August 2024

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold no positions in $ARM save via Nasdaq ETFs, and hold long positions in $INTC.