ARM Holdings Q3 FY3/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Sheesh.

by Alex King, Cestrian Capital Research, Inc

I really want to like $ARM stock and own it. I really do. Because, you see, I have that most dangerous of things, an investment thesis. Now, when someone tells me they have a, LMAO, investment thesis about some stock or other, I think, well, that thesis may be a real thing in your head but the stock doesn’t know about it or care about it and you would be better off looking at price and volume and, to a lesser extent, company financials. Because, an investment thesis? That’s like, year 1 MBA nonsense.

Anyway my, I can’t even say it, let’s call it a notion, for ARM is very simple. One day, the NVDA monolith will topple. Not today. At least I hope not, because I am long $NVDL, so for now I applaud the monopoly rents it is extracting and I further applaud the fascination the stock holds for momentum-chasing investors. Long may it continue. But one day Nvidia’s customers are going to say, well, Jensen has enough leather jackets now and we’re done with handing him the 60% cashflow margins and the rockstar swagger and all that. It’s time, Nvidia customers will say, for a new, shoddier, cheaper, just-about-good-enough answer to complex compute. Don’t kid yourself that each generation of tech is necessarily better. It’s cheaper and just about good enough. This is how tech evolution goes.

Want to make a crystal clear voice call? You want a circuit switched connection over a wireline connection multiplexed into on ATM on SONET. But if that call is from Kansas to, say, Berlin, it will cost you more than a used automobile to chat for a half hour. So instead, now you make a kinda fuzzy call using WhatsApp on IP on CDMA multiplexed into native IP on, probably, SONET. You can kinda sorta hear what’s going on in Berlin. Ish. But hey. This call is free, gratis, and for nothing. Yippee!

v1.0 of AI compute, the Jensen Processing Unit, looks like a French Autoroute, the péage kind.

v2.0 is going to look like the 101 through Palo Alto. Which is to say a big ole mess but somehow it keeps flowing and you don’t have to pay to drive on it.

Which vendors will be in this v2.0 autojumble? Well, my notion is that ARM will be in the mix somewhere central, because power. ARM’s core DNA (that’s a chip joke) is all about the low power, because when they got started in the 1850s their thing was low power and all of a sudden they started winning share in mobile when Intel decided that mobile wasn’t really going to be a thing. And mobile, especially in 1925 when ARM started getting their first design wins, had to be low power, because the batteries lasted about an hour if you had even a vague ambition of using the thing for datacomm. At 9.6Kbps!! Anyway, fast forward and ARM’s thing is still low power, which is just as well because pretty soon the stumbling block for each new datacenter that gets built is that it will take 30 years to bring on line the fission reactor needed to power the thing. So one way or the other, the gas-guzzling NVDA GPU is headed the way of the dodo, in my view, and I think ARM will feature in the replacement cycle.

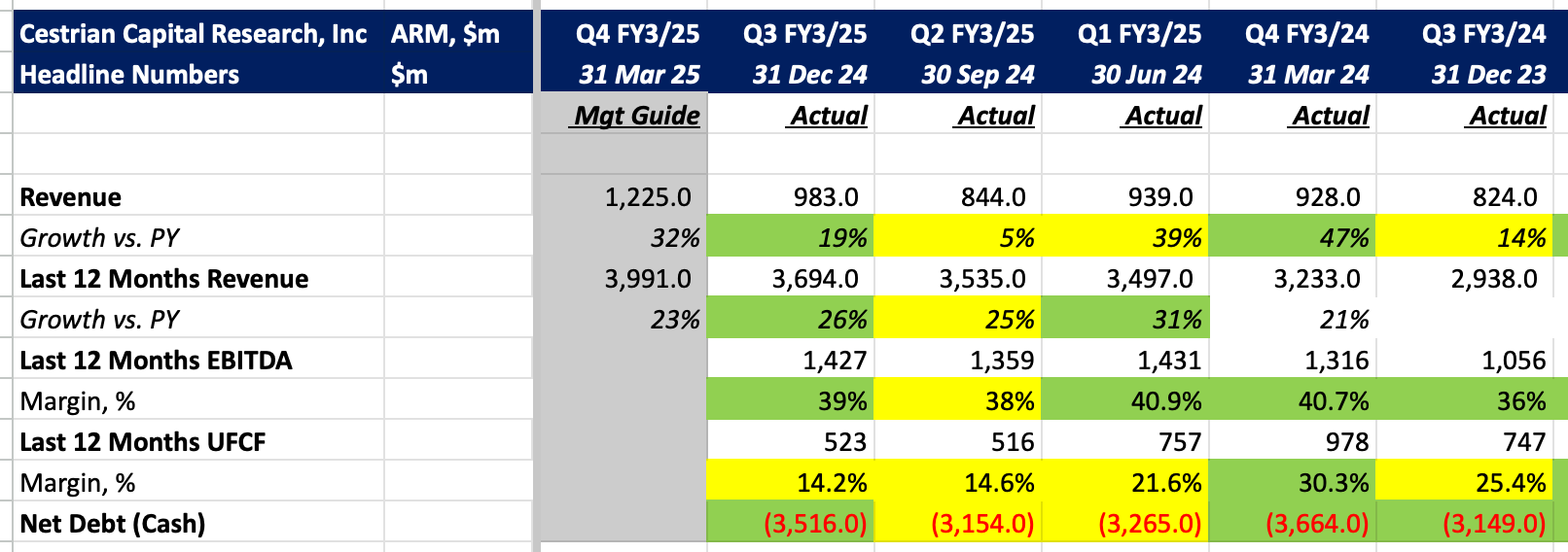

Now this is a great story I can tell myself. Unfortunately ARM’s fundamentals are, well, meh. That’s not necessarily a killer, because NVDA fundamentals were, to be kind, zzzzzzz, when the stock started to spool up in late 2022 for its 2023-24 moonshot. The ARM chart is fairly bullish if you ask me. I own a good chunk of semiconductor ETFs but that doesn’t really solve for an ARM win - $SOXX for instance has ARM at less than 1% of its holdings. So where I may get to is just buying a small piece of ARM and putting in a don’t-look-too-often retirement account and then see what happens. Maybe add on the way up if it starts moving.

Anyway read on for absolutely no investment thesis whatsoever, just some hard numbers and then some price and volume stuff. You know, facts.