Apple Q4 FY9/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Products Are Not The Stock And Vice Versa

I bought a new iPhone recently. It is a bit better than the one it replaced, which is several years old. The screen is bigger, the battery lasts longer, and because I bought a new case to go with the phone, it looks less scruffy than the old battered and threadbare one. I know it has some innovations but so far I don't know what they are. The photos aren't much better than the old one. The photos app is harder to use. Oh, it has 5G, which is good, my old one didn't.

Does any of the above stuff on the iPhone influence my desire to own, or not own, Apple stock? It does not.

I also bought a MacBook Pro a year or so ago, with as much memory and as fat an ARM processor as I could find. It is a wondrous machine that has transformed my productivity. The only downside I can think of is that the power adapter is poorly shaped for most hotel room power outlets. I don't plan on buying a Windows machine ever again, despite having been a Wintel zealot for some decades since older Macs seemed targeted at kindergarten users who liked pretty colors, not self-satisfied "I used to build my own PCs" Road Warrior Types like myself.

Does any of the above stuff on the MacBook influence my desire to own, or not own, Apple stock? It does not.

A lot of people confuse stocks with the products made by the companies that issue those stocks. I think there may be a connection somewhere but for the life of me I don't know how to derive a stock price from a battery half-life curve.

For me I look to Apple company fundamentals, which are OK, so-so, good-enough, and I look at the Apple stock chart. Oh, and I look at the amount of retail cash on the sidelines. When retail cash comes off the sidelines, having been scared to commit ever since the Grand Rug Pull Of Q1 2022, it likes to buy $AAPL, because nobody ever got hurt buying AAPL. Well unless you bought and sold it when Gil Amelio ran it.

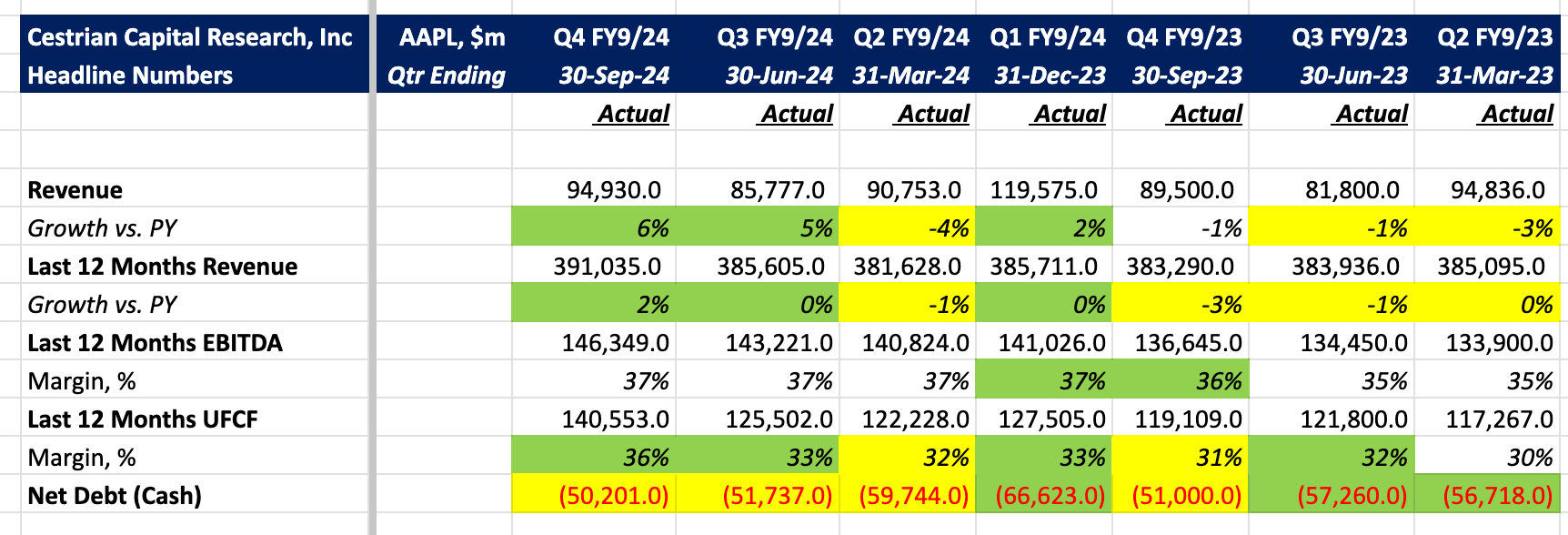

AAPL right now has sold off down to a potential support level of $220 and is once again widely trashed as having no innovation &c. Here's the numbers as printed last quarter.

Pretty good right? Growth accelerating, cashflow margins up and although net cash is down (buybacks being the reason), there's still $50bn to keep staff a/c running on warm days.

Let's take a look at the full numbers, valuation, and where the stock may be heading.