Apple Q3 FY9/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Recession Has Yet To Hit Cupertino

by Alex King, CEO, Cestrian Capital Research, Inc

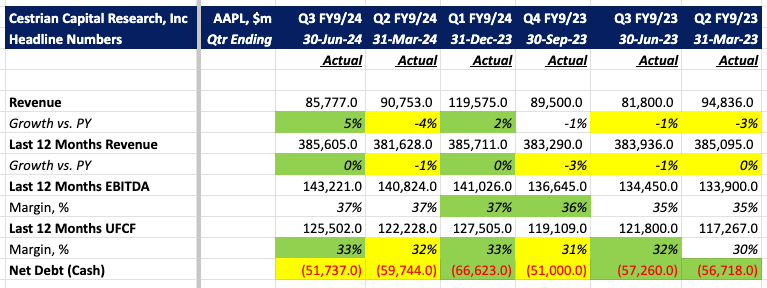

Apple printed its Q3 yesterday, and a very good Q3 it was too. Everywhere you look at present there is talk of the weak consumer, recession, and so on and so forth. Well, Apple - a consumer-driven business - just delivered an acceleration in revenue growth to +5% for the quarter vs. prior year quarter, at a time when most other stocks we cover - in the main whose issuers sell to enterprise customers ergo you would expect are more resilient - are seeing deceleration in growth rates.

We remain at Hold rating on Apple - below we run through detailed fundamentals, valuation analysis, technical analysis and our price targets.

Headline Numbers

Everything good there.