Apple Q1 FY9/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Look Below The Waterline

by Alex King, CEO, Cestrian Capital Research, Inc

100 years ago when I was a pure fundamentalist, my view on Apple the company was, meh, without Steve Jobs they are nothing special. My view on the stock valuation was, that’s expensive considering it’s margin-maxed and doesn’t grow much. At this time I also shunned Apple computers as being ‘for creatives’ as opposed to being for people who did, you know, real work.

Anyway, then I learned how to do technical analysis, and I learned about the fact that large swathes of investors view Apple stock as the safest game in town (so many buybacks). Since which time I have been able to make good money with Apple stock, either indirectly through index holdings, slightly less indirectly with the single-stock levered ETFs like $AAPB or $AAPU, and also directly with good ole $AAPL itself.

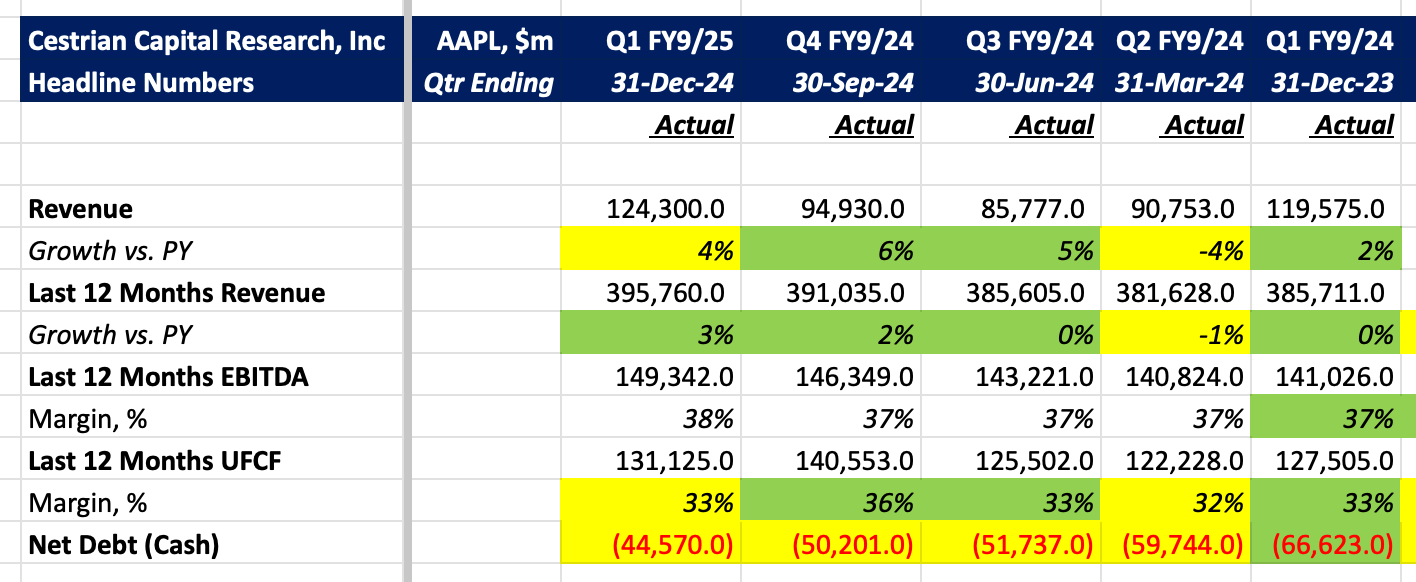

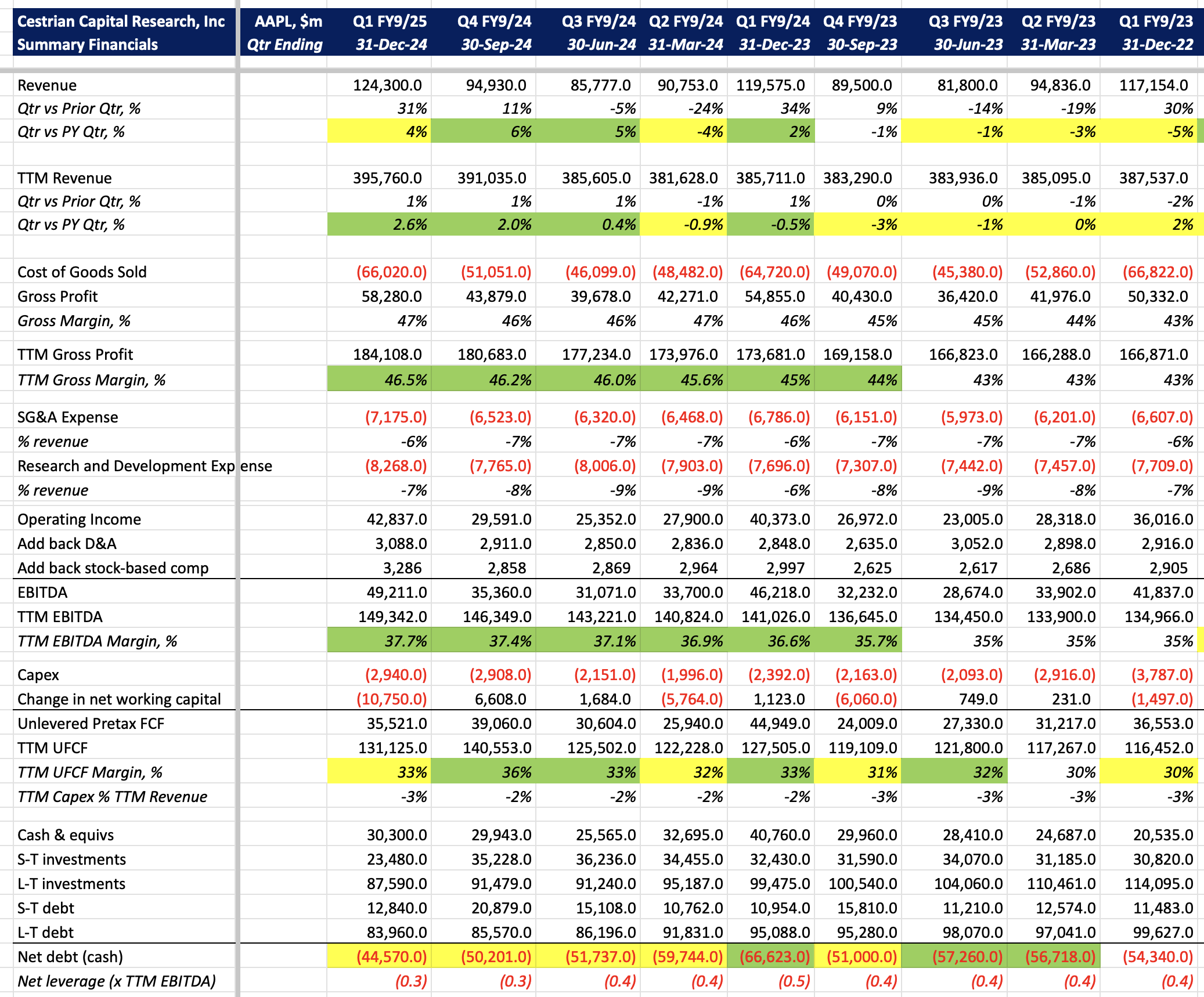

Earnings this quarter (ending 31 Dec 2024) were fine. Growth slowed, cash balances dropped, EBITDA margins were up but cashflow margins were down. A ‘meh’ kind of quarter warranting an unenthusiastic ‘Hold’ rating.

But then today this happened:

If you don’t know much about modem chips, I envy you. You likely have a rich and fulfilled life. I, however, know more about modem chips than I ever wanted to. And I can say this - they are fiendishly difficult things to design and manufacture at scale. Because modem chips have to deal with a very tricky thing, being the outside world, the analog world beyond the digital domain; and they also have to deal with the inside world of 1s and 0s that runs the machine. 5G modems have to do all this at high bit rates in terrible radio conditions. Not easy at all. Apple tried to bin off Qualcomm some time ago, failed, had to crawl back to San Diego to say how they didn’t mean it, it was me not you, and all that. But now I think Apple’s designers have been to therapy, achieved some self-realization and are about to break free to be the best versions of themselves.

This means boring ole Apple which is essentially a headphone and phone leasing company now has (1) a very very difficult chipset up and running which takes a big chunk of money out of their bill of materials (2) a set of blazing fast CPUs that also don’t eat batteries - thankyou ARM Holdings for the core designs of the latest Apple CPUs. And all this means that …. I think Apple might be becoming a very serious hardware company indeed. With Tim Sweater at the helm. Who woulda thunk it?

OK so let’s get into it. Here’s the headlines.

Now for the good stuff. No paywall today.

Financial Fundamentals

The drop in cashflow margins is due to the outflow of working capital - this is likely in part the sale of a lot of iPhones around quarter end for which Apple has yet to be paid; I would expect the working capital swing to come back in the company’s favor in Q2 (the March 2025 quarter).

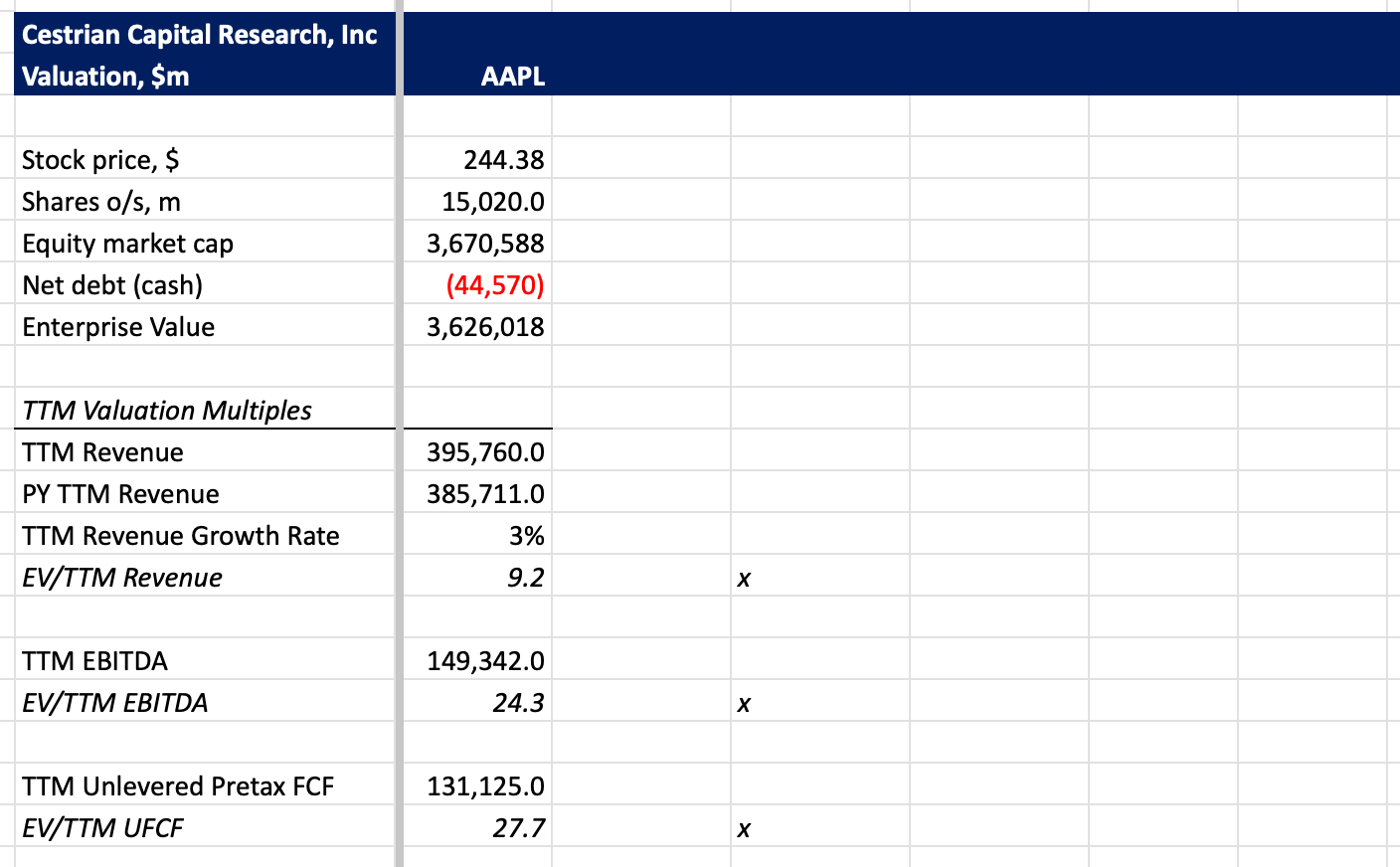

Valuation Analysis

Expensive given the growth rate; but that’s the premium to be a sort of safe harbor in times of trouble.

Stock Chart

Here’s how the chart looks long-term to me. You can open a full page version of this chart, here.

We rate the stock at Hold. Below $220 something is amiss; consider risk management in that light. You can see our serial upside targets in the chart above.

Cestrian Capital Research, Inc - 19 February 2025.